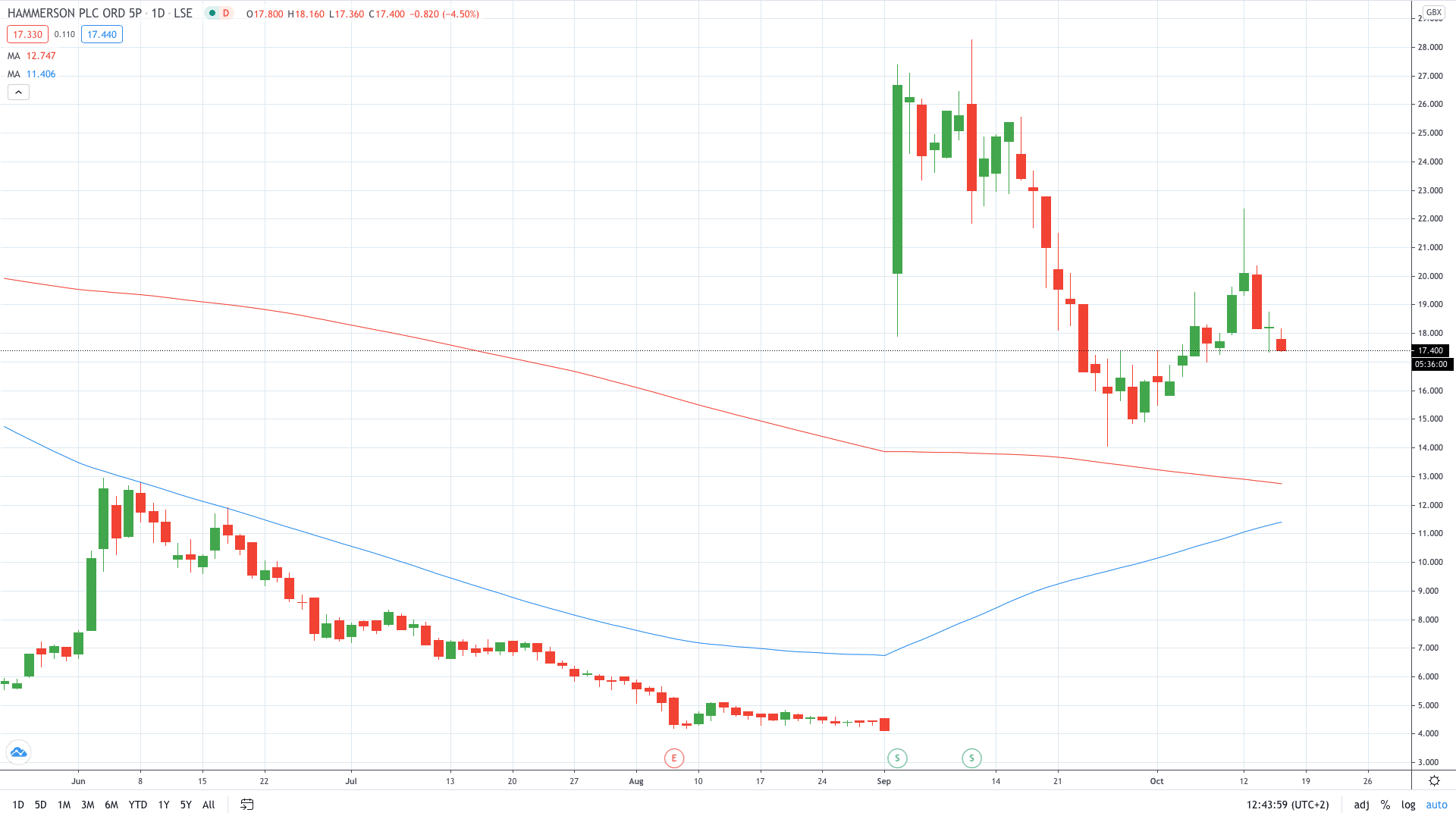

Shares of Hammerson PLC (LON: HMSO) plunged nearly 5% on Thursday after the company reported disappointing rent collection rates.

The owner of Bullring shopping centre said it collected 41% of rents due for the fourth quarter ending September 30. The collection rate was the lowest in Ireland (33%), while the UK (38%) and especially France (51%) did better.

Now that most shopping centres are open, Hammerson noted it expects an improvement in the collection rates for the last two quarters.

The troubled group said it introduced a range of supporting measures for its tenants, including monthly payments and even waivers for smaller companies.

“Since the onset of the pandemic, Hammerson has recognised the need to support brands, particularly while destinations were closed. We have worked hard to reach agreements on rent during the closure period that are fair and reasonable. This has involved a combination of rent deferrals, moving to monthly payments, and in some cases waivers, particularly for smaller and independent brands,” the company said in a statement.

In the meantime, Hammerson received the competition authority approval needed to sell its stake in European JV Via Outlets for €301million.

Hammerson share price is now trading at 17.4p, or 4.5% lower on the day.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan