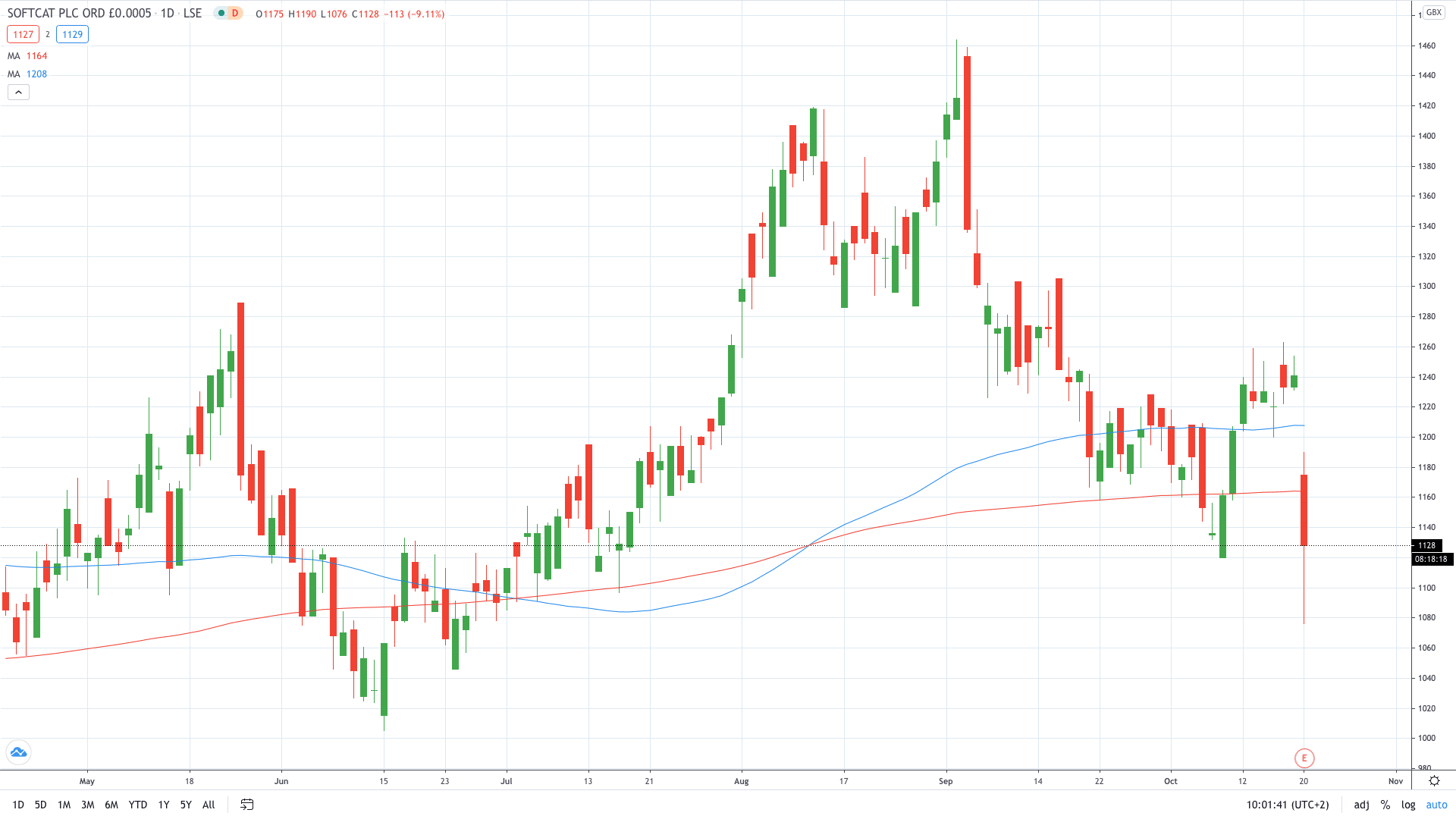

Shares of Softcat PLC (LON: SCT) crashed about 13% on Tuesday after the IT products and services provider on cautious forward-looking guidance.

Softcat reported a 10% jump in pre-tax profit to £93.6 million for the year ending July. A higher profit was possible due to rising revenue – up 8.6% to £1.08 billion.

As a result, the company declared a full-year dividend of 16.6p per share, which is 11% higher year-on-year. Moreover, a special dividend of 7.6p share will be paid to shareholders, which represents a decrease of 53% compared to last year.

“This change partly reflects the increase in the size and scale of the business since IPO and is considered prudent in light of the uncertainty created by Covid-19,” Softcat said in the statement.

Despite surging profit and revenue, Softcat said it expects its “corporate customers to continue to be circumspect with their spending over the coming months.”

“This may mean that market conditions remain challenging for a time, but we remain confident in our ability to gain market share and our view of the long-term opportunity is undiminished.”

Softcat share price plunged around 13% to a new 4-month low at 1076p.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan