- Banking giant HSBC runs the risk of becoming one of the first victims of the fresh outbreak of US-China hostilities

- HSBC is listed on the London Stock Exchange but generates 55% of its pre-tax profits in Hong Kong

- The predicament the firm finds itself in could be a model of the consequences for other firms and other sectors

- With the situation worsening rather than de-escalating, identifying the winners and losers could catch price trends which have some way to run

Just as the global economy eases lockdown, it faces the new challenge of a high stakes cold-war breaking out between the US and China. Following years of underlying tensions, the parties appear emboldened by the COVID-19 pandemic. Desperate times call for desperate measures: they also call for a scapegoat. Recent events point to the issue coming to a head as politicians flex their muscles.

The developments could be unfortunate for the financial markets. The ‘whatever-it-takes’ support provided by central banks and governments in the first half of the year has left asset markets bobbing around at the levels they were before the outbreak. While the possibility is that the market may continue to trade at these levels, many firms, such as HSBC may find themselves at risk of slipping beneath the surface. The coronavirus demonstrated how easily the intricate global trade patterns could fall apart. The US-China trade war represents the opening of a new battlefront on the complex and fragile global economy.

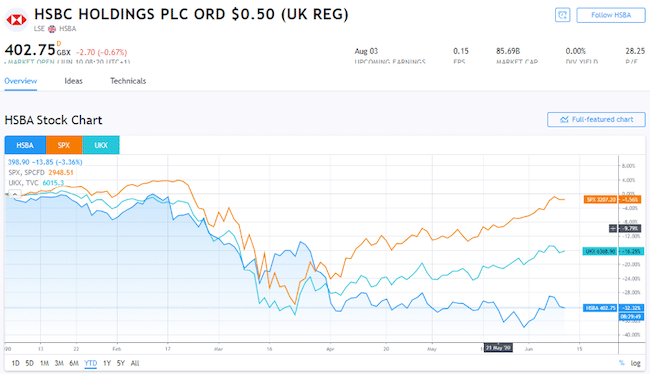

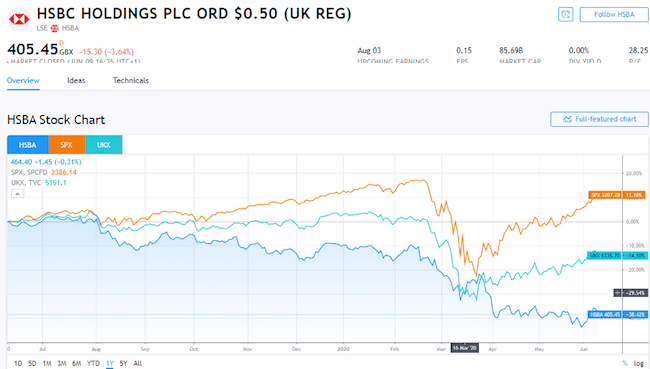

HSBC vs SPX vs UKX – Year to date price chart

HSBC’s decision to back the controversial new security laws imposed by Beijing on Hong Kong means their stock is now fully in play. US Secretary of State Mike Pompeo said on Tuesday:

“That show of fealty seems to have earned HSBC little respect in Beijing, which continues to use the bank’s business in China as political leverage against London … Free nations deal in true friendship and desire mutual prosperity, not political and corporate kowtows.”

Source: Reuters

One of the market’s biggest institutional investors also offered the bank a reality check. Aviva Investors owns £276m, or 0.34%, of HSBC’s total stock and the firm’s chief investment officer, David Cumming also stepped into the debate on Tuesday when he said:

“We are uneasy at the decisions of HSBC and Standard Chartered to publicly support the proposed new national security law in Hong Kong without knowing the details of the law or how it will operate in practice.”

Implying that each action has consequences, he continued:

“If companies make political statements, they must accept the corporate responsibilities that follow.”

Source: City Wire

HSBC has to perform a balancing act. Keeping Beijing happy is a fundamental element of its business. Pompeo’s point was that by demonstrating weakness, HSBC was now at the top of a slippery slope. Its actions would earn the bank little respect and will mark it out as a convenient political lever for Beijing to pull at their discretion. For investors in the firm, it signals more trouble ahead. This would be an issue at any time, but even before recent events, the firm’s share price was following an ‘L’ shaped pattern rather than a ‘V’ shaped one.

Looked at over an even longer time frame the share price is currently hovering at a multi-year support level in the 400p region.

Price has tested this level twice before, in 2009 and 2016. From a purely technical perspective, this may point to this pattern being a triple-bottom. Considering the fundamental issues at play, it could instead show price action having repeatedly tested support preparing to break through it. If it does head lower, there are few technical support levels in play. The London listed shares are trading beneath both the 50 and 100 SMA.

HSBC (HSBA.L) Daily price chart. March – June 2020

The 20 SMA on the weekly chart has formed a significant resistance level for more than 12 months. The test of last week falling away to not quite constitute a gravestone doji, but something not far from it.

HSBC (HSBA.L) Weekly price chart. May 2019 – June 2020

The Monthly chart shows quite how far below the SMA’s price is currently trading.

HSBC (HSBA.L) Monthly price chart. 2015 – June 2020

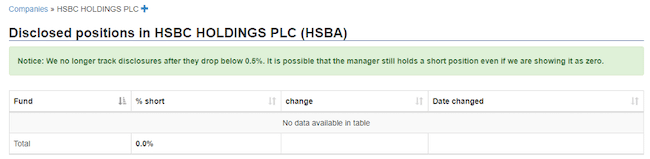

There is headroom for a relief rally but those looking to trade the retracement and a possible short-squeeze should note that despite the firm’s problems there is little interest (so far) in actively shorting it. Making a short-term rally possible but unlikely to be dramatic.

Short interest in HSBC (HSBA.L)

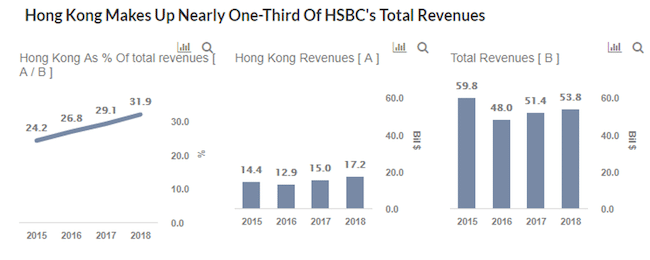

HSBC’s willingness to take a side in the political battle has caught many off-guard. In recent weeks, as tension grew, Cumming had suggested the firm would follow the tried and tested approach of keeping its head down. A passive approach pleases no one in particular but nor does it potentially offend both sides. It looks like HSBC’s move was intended to satisfy its finance director because the firm’s reliance on Hong Kong is significant. Hong Kong makes up around 30% of HSBC’s total loans and over 35% of its total deposits.

- Hong Kong has the lowest adjusted cost-efficiency ratio (ratio of expenses to revenue) among all of HSBC’s geographic divisions, with the figure being 36.3% in 2018.

- Hong Kong operations reported a pre-tax profit of $11.5 billion in 2018, which was 58% of the bank’s total pre-tax profit for the year.

- Moreover, the country’s pre-tax margin of 67% was nearly double the bank’s consolidated figure of 37%.

Hong Kong is HSBC’s growth market. Without the historical and potential future revenues, the bank’s share price would be in a much worse state. Which leads investors to consider ‘what if’s’ and as part of that logical process buyers are scared away.

One interesting feature of the situation is that despite the dispute centring on the US and China, a UK listed bank is paying the most substantial price. That could be a trend worth monitoring. It is not necessarily the case that US and China firms will be the ones which suffer collateral damage. The skill will be identifying those firms with particular exposure to the situation or which are closely aligned to one side or the other.

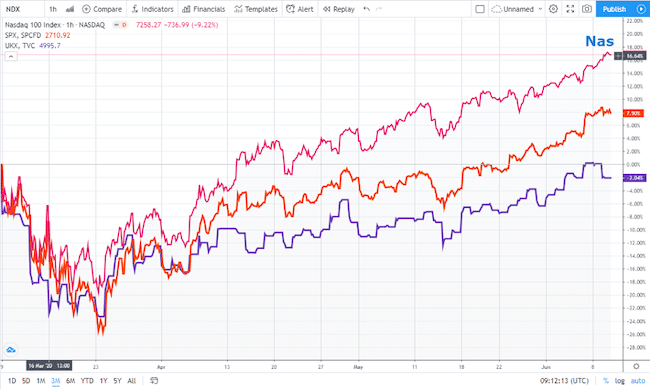

The trade in long US equities and short UK would have returned a considerable profit over the last three months. It would have incorporated a degree of market neutrality during a period of unprecedented turmoil.

UK100 vs Nasdaq 100 vs S&P 500 Three-month price chart

Long S&P500 and short UK100 would have returned a greater than nine percentage point return. The long Nasdaq 100 and short UK100 strategy would have posted a gain of over 18%.

The new trade war appears to be ramping up rather than easing off. The tech stocks and health sector firms in the US indices still attract the attention of investors looking to find a return in the COVID-19 environment. The UK index is, in comparison, overweight in miners, oil firms and banks. All with exposure to the whims of Chinese buying power.

A lot of factors are also out of the control of firms such as HSBC. Much will come down to the personalities involved and investors in UK firms would do well to heed to warnings of political commentator Fraser Nelson who wrote in The Spectator:

“It is also extraordinary how fast Boris Johnson is dumping the policy now. The Prime Minister has emerged from the COVID crisis shaken by the extent of Britain’s reliance on China and is ready to reset relations.”

He continued:

“The Prime Minister is up for the fight. He has urged China to back down, and said Britain stands ready to act. The ‘Global Britain’ agenda was his soundbite, never really given life when he was Foreign Secretary.”

Source: The Spectator

The five-year price chart reinforcing the bank is already in a weak position.

HSBC vs SPX vs UKX – Five-year price chart

Trade entry points for long US and short UK equity indices may well come from news reports. On Wednesday CNBC reported that:

“Trump wants to delist Chinese companies from US exchanges.”

Jesse Fried, a professor of law at the Harvard Law School, told CNBC’s “Street Signs” on Tuesday that “Wall Street will be lobbying to try to block” such a move. But that escalation is possible because:

“I think if it’s put to a vote, it will be very hard for people to oppose it because there’s a lot of sentiment against China.”

Source: CNBC

More bad news for the FTSE100 is that the Goldman Sachs research team posted a bearish note on oil on Tuesday. It read:

“With oil now above $40/bbl, supplies will be incentivised to return, but we believe the risks to the downside have increased substantially and are now looking for a 15-20% correction which may already be underway after Monday’s modest sell-off.”

Source: CNBC

The news is coming thick and fast, and that means so are the trading opportunities.