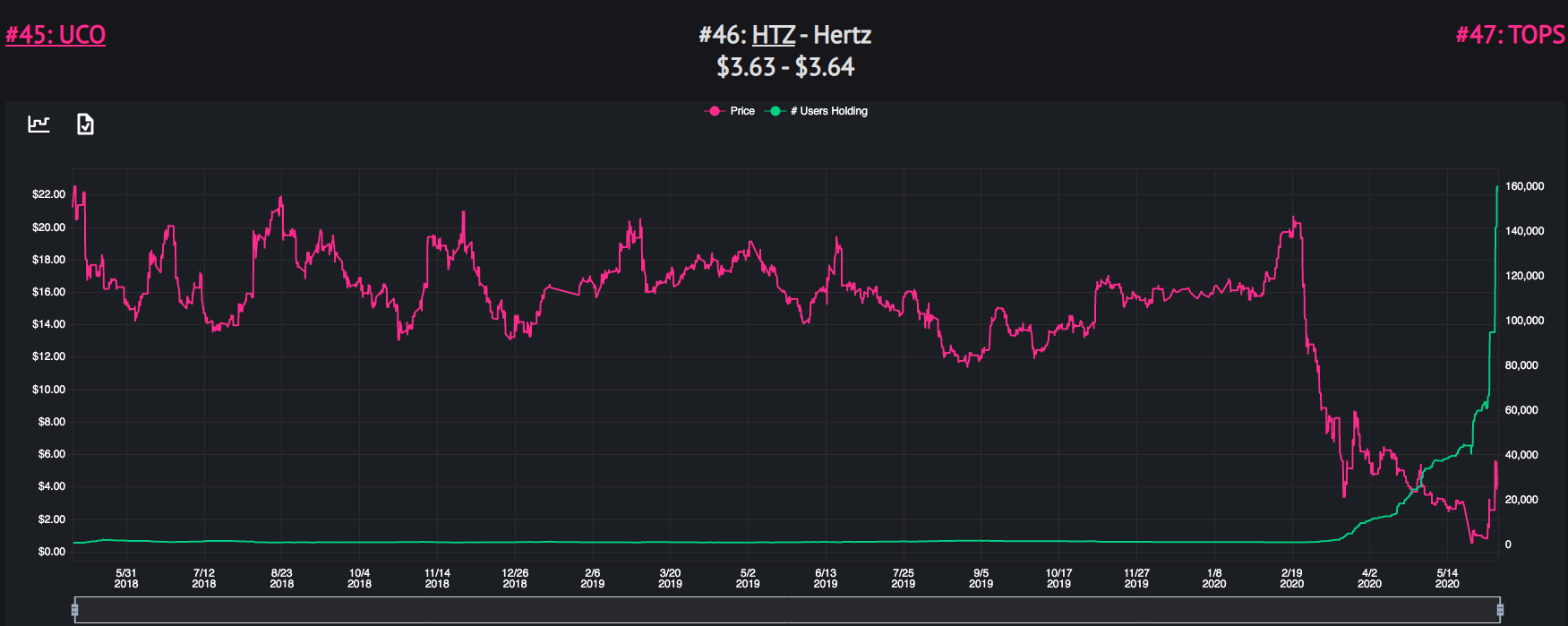

The recent euphoric rally in stock markets has seen retail investors flock to bankrupt stocks, such as Hertz and Whiting Petroleum Corp…

Last week alone saw 96,000 people, who are using the Robinhood investing app, open a position in Hertz, despite them recently filing for bankruptcy…

And, the same can be said when it comes to other companies that are potentially filing for bankruptcy…

Chesapeake Energy is preparing to file, but this now seems like a signal to buy for many investors. Just before the news of their filing, its stock rose an enormous 181%.

The stock markets so far this year have not followed the usual scripts, with the S&P 500 falling into a bear market and then seeing its fastest rebound in 90 years.

Retail traders are even calling into question legendary investor Warren Buffet's market wisdom.

So, the question is, will it last?

I added a quote from another legendary investor (John Templeton) to another article recently, and I think it definitely applies to the current market:

“Bull markets are born on pessimism, grown on scepticism, mature on optimism and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell”.

I think we are very close to maximum optimism, or “peak euphoria”…

We are now seeing the S&P 500 approaching all-time highs and quotes such as “stocks only go up” have been thrown around on Twitter.

So, while I think the rally isn't done just yet, I do believe that peak euphoria isn't far off…

When/If another crash does arrive as I am predicting, then we may see a whole heap of inexperienced traders wiped out.