Kier Group's share price (LON:KIE) is down 5.24% into the afternoon trading session following the release of its Full Year 2025 trading update. The infrastructure services, construction, and property group announced results broadly in line with expectations, but the market reacted negatively, highlighting underlying investor concerns.

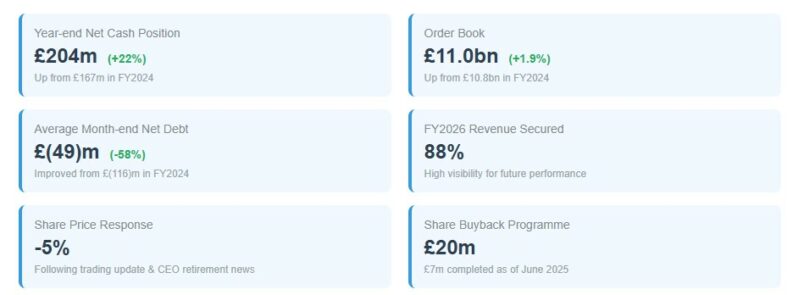

The trading update, released ahead of the full FY25 results due September 16, detailed expected revenue and profit figures in line with board projections. Kier also reported a strong year-end order book of approximately £11.0 billion, with 88% of FY26 revenue already secured.

Kier's financial performance showcased robust free cash flow generation, culminating in a net cash position of approximately £204 million as of June 30, 2025. This represents a 22% increase from the £167 million reported on June 30, 2024. The average month-end net debt also saw substantial improvement, reaching £(49) million compared to £(116) million in FY24.

The group's strong cash position has enabled the progression of an initial £20 million share buyback program, expected to be completed in the first half of FY26. To date, £7 million has been spent on the buyback.

Adding to the day’s developments, Kier announced the retirement of Chief Executive Andrew Davies. He will be succeeded by Stuart Togwell, currently Kier's Group Managing Director, Construction.

The FY25 results reflect good growth compared to the previous year, driven by strong operational execution. A ramp-up of AMP 8-related activity in the Water business offset more modest growth in the Transportation sector and a steadying of volume in Construction. The Property business also delivered significant project milestones, completing three major developments and improving ROCE towards its targeted return.

Kier has secured several notable contracts, including a £139 million Green Recovery contract for the Wanlip Sewage Treatment works and appointments for the Mayfield Community Learning Campus (£41.8m) and the Warwick University STEM Connect development (£700m first phase).

“The Group has performed strongly in FY25, and is delivering well against its long-term sustainable growth plan,” commented outgoing Chief Executive Andrew Davies. “This performance, alongside the continued growth of our high-quality order book and recapitalization of our Property business, supports the recent upgrade to our long-term margin targets and underpins the creation of strong and sustainable value for shareholders.”

Despite the seemingly positive update, the 5% share price decline suggests markets are focusing on potential headwinds, and with the stock having added 35% since the start of the year, some profit taking into a transition could also be taking place. The leadership transition, while planned, introduces an element of uncertainty. Some analysts believe the market is also discounting the impact of potential project delays or cost overruns amidst a complex economic environment.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY