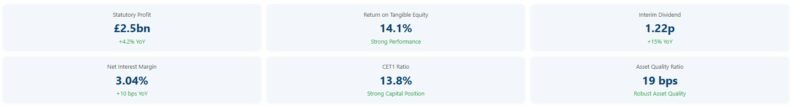

Lloyds Banking Group beat expectations today with the release of impressive half-year results. The banking giant reported a statutory profit after tax of £2.5 billion, a notable increase from £2.4 billion in the first half of 2024.

Underlying net interest income climbed 5% year-on-year to £6.7 billion, driven by a 10 basis point increase in the banking net interest margin to 3.04%. The bank also saw a 9% increase in underlying other income, reaching £3.0 billion, fueled by stronger customer activity and the impact of strategic initiatives.

CEO Charlie Nunn emphasized the bank's strong performance, noting, “income growth, cost discipline and robust asset quality, driving strong capital generation and increased shareholder distributions, with a 15% increase in the interim ordinary dividend.“

Lloyds is rewarding its shareholders with a 15% increase in the interim ordinary dividend, now at 1.22 pence per share, equivalent to £731 million. This move signals confidence in the bank's financial health and future prospects.

The bank's lending and deposit base also saw healthy growth. Loans and advances to customers increased by £11.9 billion to £471.0 billion, while customer deposits rose by £11.2 billion to £493.9 billion.

Lloyds has reaffirmed its 2025 guidance, projecting an underlying net interest income of approximately £13.5 billion, operating costs of around £9.7 billion, and a return on tangible equity of about 13.5%. The group also maintained its ambitious targets for 2026, including a cost-to-income ratio of less than 50% and a return on tangible equity exceeding 15%.

Analysts have generally reacted positively to the results. Many cite Lloyds' strong capital position, with a CET1 ratio of 13.8%, as a key strength. The bank's ability to generate capital is expected to support further shareholder distributions in the future.

Lloyds' strategic initiatives are projected to deliver over £1.5 billion in additional annualized revenues by 2026, with tangible net assets per share increasing by 2.1 pence, reaching 54.5 pence.

With Lloyds' share price (LON:LLOY) trading around 78p, and close to the freshly minted 52wk highs of 79.19p, sentiment has been firmly bullish this year. Impressive gains of 41.5% since the start of the year, and 162% over the past five, highlight what has been a really strong turnaround period for the bank.

To find resistance levels above the near term retest of highs, you will have to look back 10 years. Fortunately we have a chart for that below, with weekly candles.

For now, LLOY bulls will be eyeing the retest, and a strong hold above what had previously been resistance at 78p.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY