Shares of Shell plc (SHEL.L) rallied into Tuesday's close, ending the day up 1.92% despite a mixed outlook for the second quarter of 2025, and a downward revision.

Citi lowered its price target on Shell to 2,450p from 2,480p, a reflection of concerns surrounding anticipated weakness in key trading and optimization segments, particularly within Integrated Gas and Chemicals & Products.

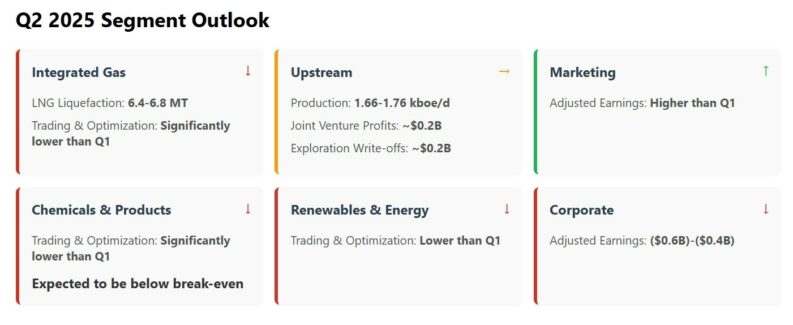

This revision comes on the heels of Shell's Q2 guidance update, which painted a nuanced picture of the company's operational landscape.

The release revealed that Shell expects LNG liquefaction volumes to land between 6.4 and 6.8 million tonnes, a figure that on its own might seem reasonable. However, the critical concern lies in the significantly lower anticipated performance of Trading & Optimization within the Integrated Gas division compared to the first quarter.

This segment is a key profit driver for Shell, and a substantial decline raises questions about market volatility, hedging strategies, and overall trading execution.

While Shell has announced a $3.5 billion share buyback program, signaling confidence in its long-term financial health, the near-term outlook remains uncertain.

The company's ability to navigate the challenges in its trading and optimization segments will be crucial in determining its performance in the coming quarters. Q2 earnings will be reported on July 31, where eyes will no doubt be glued to Shell for further insights.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY