Spotify Technology (NYSE: SPOT) is set to unveil its second-quarter 2025 earnings before the market opens on tomorrow, a date circled on the calendars of many analysts.

After the recent pullback of more than 10% from highs, Spotify's stock price enters earnings in correction territory, although this comes after a strong rally since the start of the year that continues to have prices 51% above where it began 2025.

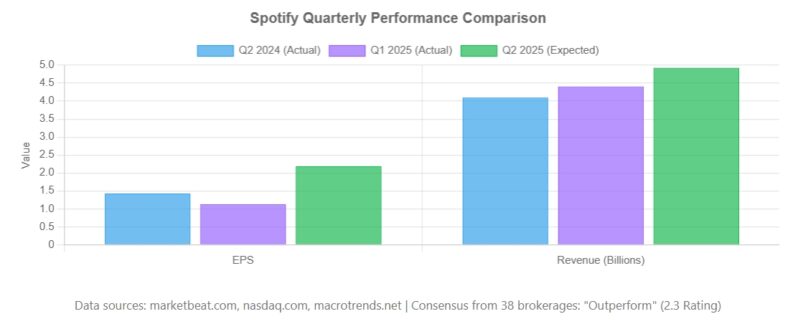

Analysts are forecasting an earnings per share (EPS) of $2.05, a significant jump from the same quarter last year when the company delivered $1.33. Revenue is projected to reach $4.27 billion, a 12.16% year-over-year increase.

These figures represent a high bar, and the pressure is on Spotify to meet, or ideally, exceed these expectations. The stakes are particularly high given the company's Q1 2025 performance, where it missed EPS estimates by a considerable margin ($1.07 actual vs. $2.33 expected), although it did manage to surpass revenue expectations.

This mixed performance has left some investors cautious, wondering if the Q1 miss was a mere blip or a sign of underlying challenges.

The stock's technical indicators present a mixed picture. The 50-day simple moving average (SMA) of $695.14 is hovering just above the current price, suggesting potential near-term resistance. However, the 200-day SMA of $608.01 paints a longer-term bullish trend, indicating sustained positive momentum.

Spotify's recent strategic initiatives offer glimpses into its growth strategy. The company achieved profitability in 2024, reporting a net profit of €1.14 billion ($1.17 billion), a landmark achievement. The addition of 15 hours of audiobook listening to its premium tier signals a push to diversify its content offerings and attract a broader audience.

Furthermore, the partnership with the Esports World Cup Foundation to become the official audio streaming partner for the Esports World Cup 2025 demonstrates a commitment to engaging with new and growing markets.

JPMorgan recently adjusted its price target for Spotify from $730 to $780, maintaining an “Overweight” rating. This adjustment reflects improved market feedback, favorable currency developments, and reduced recession concerns. The average price target of $745.20, indicates that the street continues to see upside in Spotify from here, even if the previous highs of the year may be out of reach.

The $700 level, with SPOT fast closing back in, has offered both support and resistance in recent periods, although a firm fundamental print, and outlook, could give the bulls plenty of ammo. On the other hand, anything that leaves the door open for the competition could be punished after the rally that has been seen this year.

Spotify is the dominant name in the space, despite what is growing competition, and there appear to be no reasons to doubt that, for now.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY