St. James's Place plc (LON:STJ), the UK's largest wealth manager, finds itself at an interesting juncture as its stock price continues to climb, outpacing even the revised expectations of some analysts. The firm's shares closed the most recent session at 1,227p, for a market cap of £6.56 billion.

This impressive performance, marked by a series of new 12-month highs, the latest of which at 1,230.72p to start the week has prompted a reassessment from various corners of the financial world, most recently from RBC Capital Markets.

However, the divergence between market enthusiasm and cautious analyst outlooks raises critical questions about the sustainability of the current valuation.

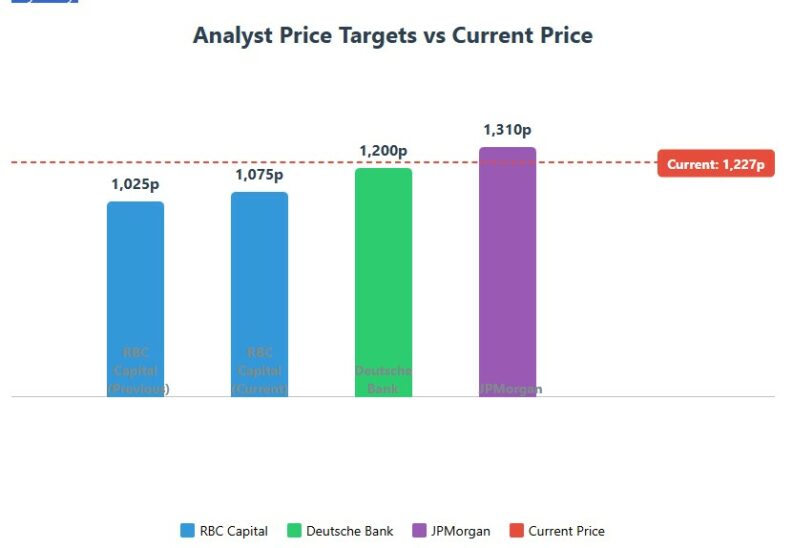

RBC Capital analyst Ben Bathurst recently increased the firm's price target for St. James's Place to 1,075 GBp, a modest uptick from the previous target of 1,025 GBp. While this reflects a recognition of the company's positive momentum, the “Sector Perform” rating remains unchanged, and crucially, the new target sits significantly below the current trading price. This suggests that, in RBC's view, the stock's recent surge may have outstripped its fundamental value and that further upside is limited.

The stock's recent performance has been nothing short of remarkable. Over the past year, St. James's Place has delivered a staggering return of 118.33%. More recently, the stock has gained 4.2% in the past week, 12.67% over the past month, and 43.76% since the start of the year. This upward trajectory has pushed the stock well above both its 50-day moving average of 1,111.65p and its 200-day moving average of 1,016.66p, signalling a strong technical uptrend.

The RBC Capital Markets' assessment stands in contrast to some of its peers.

For example, Citigroup recently raised its price target to 1,400p, while JPMorgan Chase & Co. has set a target of 1,310p with an “Overweight” rating. These more bullish perspectives likely factor in St. James's Place's strong performance metrics, including the record £181.9 billion in funds under management reported in the first half of 2024 and net inflows of £1.9 billion. The company's cost-saving initiatives, targeting £80 million in savings for 2025 and 2026, also contribute to a positive outlook for some analysts.

Other recent analyst actions further complicate the picture. Deutsche Bank, for instance, increased its price target for SJP from 1,100 GBp to 1,200 GBp, maintaining a ‘Buy' rating after reviewing the company's new charging structure, concluding the changes were unlikely to impact growth negatively.

The divergence in analyst opinions highlights the inherent uncertainty surrounding St. James's Place's future performance. While the company has demonstrated strong growth and profitability, questions remain about whether it can sustain this momentum in the face of evolving market conditions and regulatory scrutiny.

Markets will be closely watching the company's next earnings release, anticipated in late July or early August, for further clues about its financial health and future prospects. The results will provide valuable insight into whether the company can continue to justify its elevated stock price or if a correction may be looming over the horizon.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY