Shares of Superdry PLC (LON: SDRY) soared over 20% on Monday after the retailer secured a new £70 million financing deal with its banks. A new financial injection was much needed after Superdry reported its quarterly sales declined 32.3%.

“The actions we have taken to date have greatly strengthened our cash position, which, together with our new asset-backed lending facility, give us the flexibility to execute our current plans and to secure our recovery,” Superdry’s co-founder and chief executive Julian Dunkerton said.

The retailer saw its total store sales plunged 58.1% for the quarter ending July 25, while like-for-like sales fell 32.3%. These losses were partially offset by a 93.2% surge in online sales.

“Together, we are making our way through this unprecedented period and I’m confident we can reset the brand and deliver on our transformation plans,” added Dunkerton.

Around 95% of stores reopened after a problematic period that saw Superdry furlough 88% of its staff.

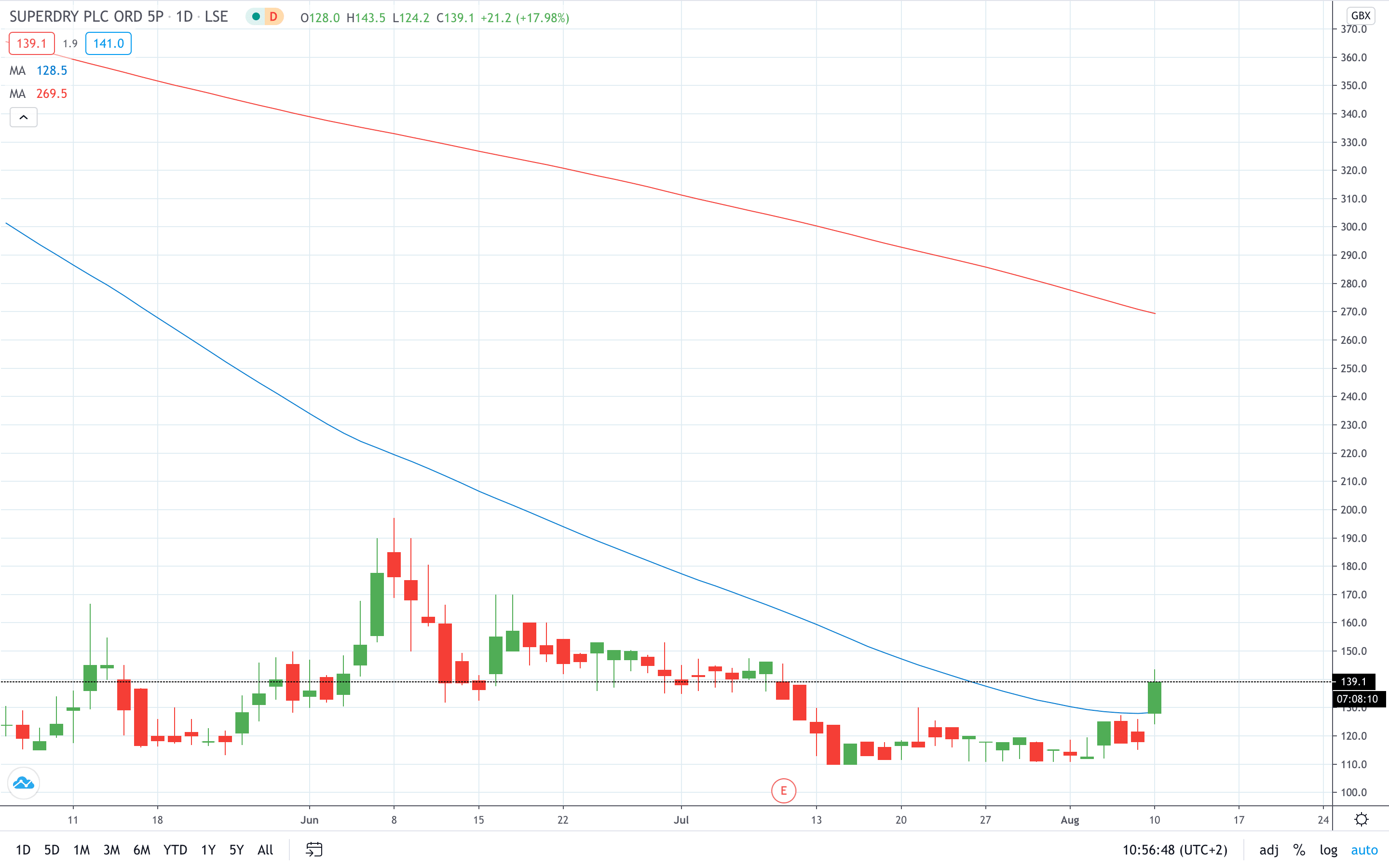

Superdry share price soared 20% to hit a 1-month high above 140p.

- Explore stock trading strategies

- Learn from experts on risk management in trading