- Military vessels and personnel involved in Mediterranean and Gulf

- Continued confrontation highlights divisions within Iranian regime

- Iran and UK referring to ‘international law’ but taking a more hands-on approach

- Comes hot on heels of Iran breaching terms of nuclear deal

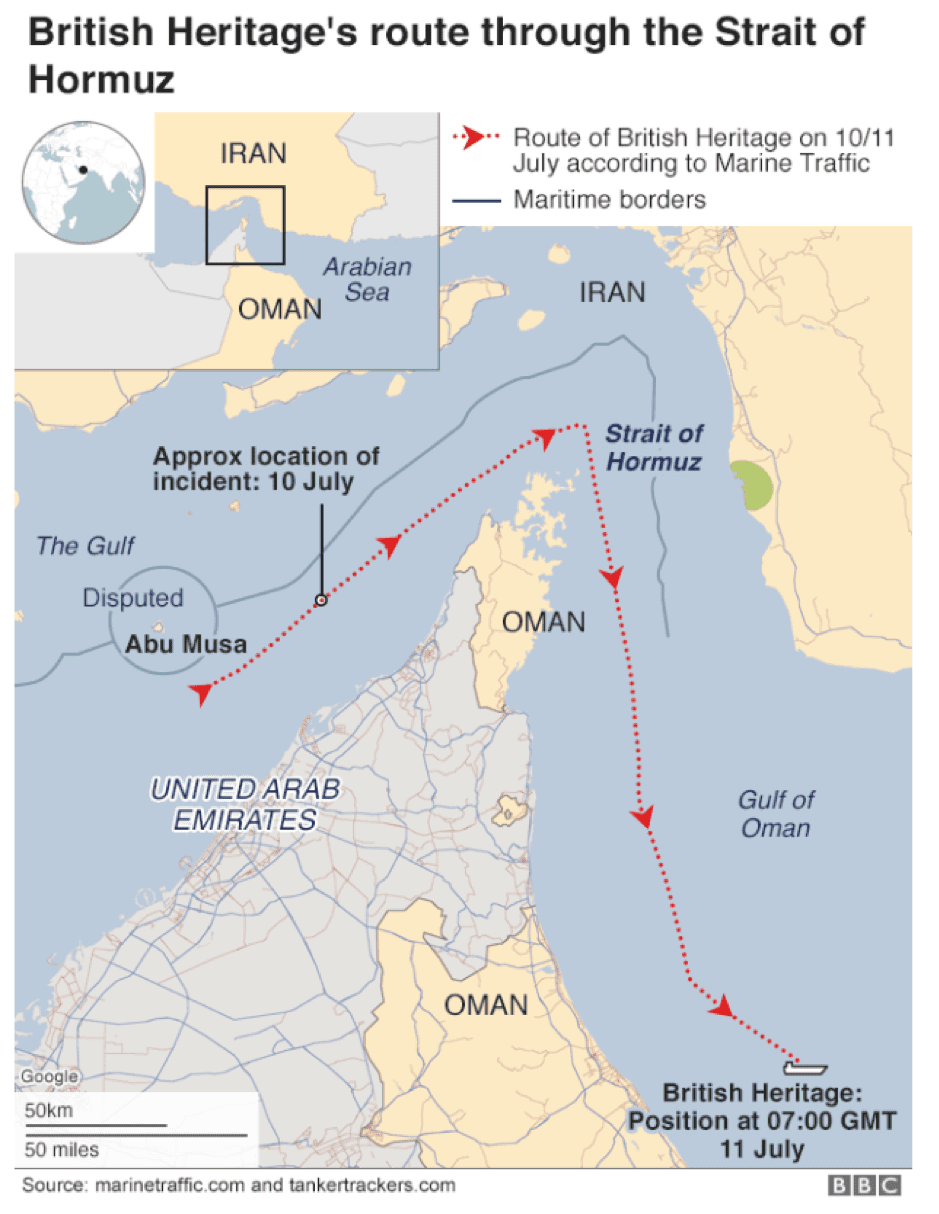

Iranian boats have on 10thJuly attempted to intercept the British oil tanker, British Heritage. Royal Navy frigate, HMS Montrose, intervened to drive off the three Iranian boats. Reports state that the Montrose, located in the Gulf of Oman did train its guns onto the Iranian vessels but no shots were fired. This incident has occurred less than one week since British Royal Marines seized Grace 1, a ‘full to capacity’ Iranian oil tanker that was holding 300,000 barrels of oil claimed to be ‘illegally’ heading to Syria.

Timeline

June 13, 2019 – Tankers Japanese ‘Kokuka’Courageous and Norwegian ‘Front Altair’ were attacked, allegedly with limpet mines.

July 4, 2019 – Tanker ‘Grace 1’impounded in Gibraltar.

July 10, 2019 – British Heritage approached by Iranian vessels

Al Jazeera has reported an alternative view from Iranian authorities. Foreign minister Mohammad Javad Zarif rejected the accusation and the Iranian Revolutionary Guard Corps also denied involvement.

Al Jazeera's Zein Basravi, reporting from Tehran, considered the suggestion that the attack may have been the work of“a rogue group of military on the ground… The fact is that while this is possible, it is unlikely,” he said. “Commanding control structures not only in the civilian government but especially in the military government and especially in the IRGC is very linear and it is unlikely that anything like this would have happened without clear directives through commanding officers, through linear lines of ranks.”

Source: Al Jazeera

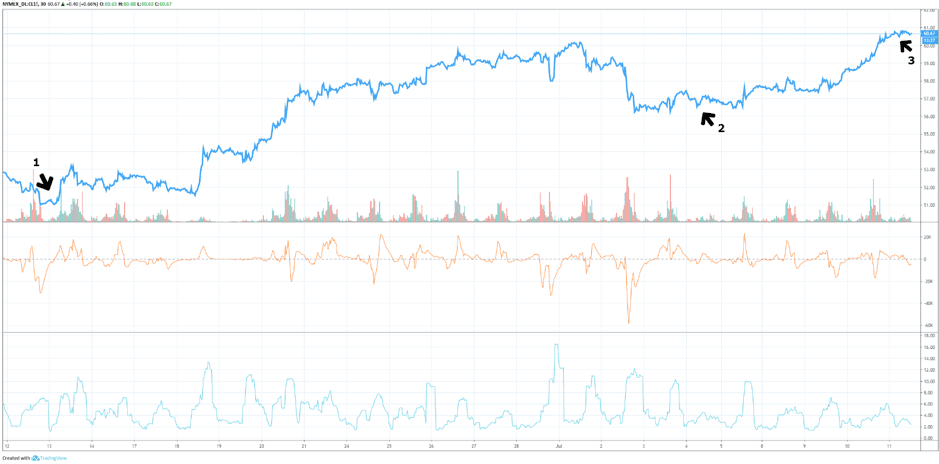

The price of crude (CL1 rolling futures) has risen 19.2% from its monthly low on 13thJune. There is now a sequence of (three) major flash-points which have helped drive prices higher.

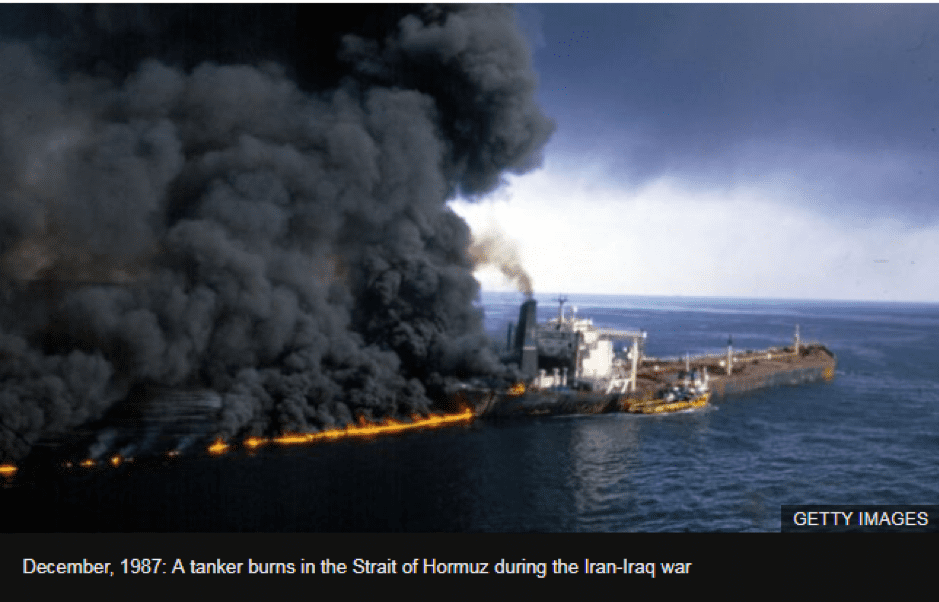

A cursory glance of the history books gives an indication of how bad ‘tanker wars’ can get. The conflict from the 1980s saw tankers blazing in the Gulf, crew members were killed and civilian aircraft were caught in the cross-fire and mistakenly shot out of the sky.

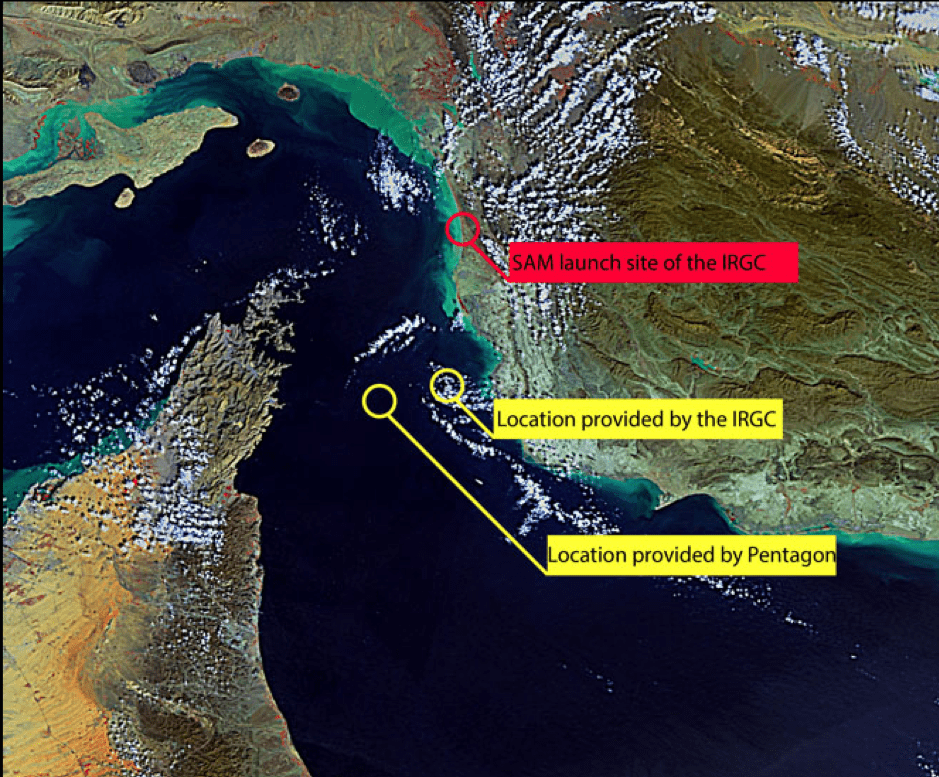

Any new conflict would have similar but exaggerated consequences. In the intervening time period, both the US and Iran have expanded their military capabilities. As a result, any conflict would now involve more technologically advanced mines, submarines and faster boats, all able to attack and damage commercial and military shipping. Analysts report that Iran has, in military terms, narrowed the gap with the US – as demonstrated by its ability to use surface to air missiles to down a US drone on 20thJune.

The stakes are further raised by the nuclear capabilities of Iran.

The Gibraltar incident occurred just as world powers and Iran were preparing to begin two months aimed at stopping Tehran from further escalating its nuclear programme.

EU foreign ministers are battling to keep the talks and treaty on track. The UK, France and Germany issued a statement voicing ‘deep concern’ that Iran has upped its uranium enrichment levels from 3.67% to 4.5% – breaching the terms of the current agreement. Calls are in place for the formation of a ‘joint commission’, as prescribed by the Joint Comprehensive Plan of Action (JCPOA), to address the disputes.

The bluff and bluster associated with recent events benefits Iranian hard-liners. Mohsen Rezaee, major-general of Islamic Revolution Guard Corps unit and secretary of Iran’s political expediency Council demanded on 5thJuly that British authorities release the Grace 1. The events of yesterday caused wide-spread concern because Rezaee is on record as suggesting a UK tanker should be seized and used as a bargaining chip. Was the British Heritage the intended target? Is this how far the dispute has travelled?

The UK and US have been the main protagonists in the recent run-ins with Tehran but the situation is not to be thought of as a bi-lateral dispute. Between 15th May and 15th June, in excess of 1,000 tankers passed through the Straits of Hormuz. Vessels passing through the Straits represent 20% of global oil supply. Alternative routes such as pipelines and alternative energy sources such as shale gas all have capacity restraints, especially in the short term. There are significant consequences for the global economy should the conflict in the Gulf escalate.

Emphasising the extent to which the Straits are important to global trade, US chairman of the Joint Chiefs of Staff Gen., Joseph Dunford, outlined plans for the US and its allies to ensure freedom of navigation. At this point, analysts must make their own call on whether scaling up the military presence in the Gulf is positive for markets, or not. Speaking after an awards ceremony for his Finnish counterpart, Dunford said:

“We are engaging now with a number of countries to see if we can put together a coalition that would ensure freedom of navigation both in the Straits of Hormuz and the Bab el Mandeb.”

Source: The Guardian

As with most situations in the Gulf, the conflict is made up of a web of complex issues and inter-twined historical relationships. The British Heritage incident does look like it falls into the good old fashioned ‘tit-for-tat’ category. The incident has occoured just hours after president Trump announced on Twitter that sanctions on Iran will “soon be increased, substantially”. The president’s comments themselves are a response to the news that Iran has been enriching uranium beyond the limits imposed by the Iran Nuclear Deal.

Following the US Fed’s statement of 10th July, equity markets are taking Jerome Powells’ comments as an instruction to load up on positions. The recent surge in oil prices will to some extent be driven by the worldwide continuation of expansionary monetary policy; but at the moment, the geo-political situation is all important for this commodity. The recent oil bull-run may need to catch its breath at some point but it would take an awful lot of peace to ‘break-out’ for prices to get back towards $50 per barrel.