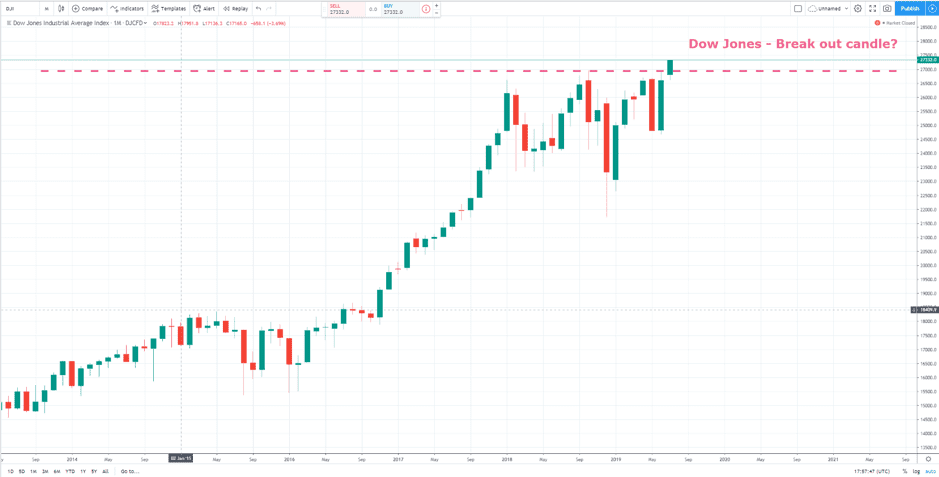

- Wall Street ended a record-breaking week

- Dow Jones Industrial Average (DJIA) up almost 1% on Friday

- DJIA posts new all-time high closing price of 27,332

- S&P 500 hits 3,000 for the first time

- Share prices rise across all sectors

- Markets continue to be supported by central banks

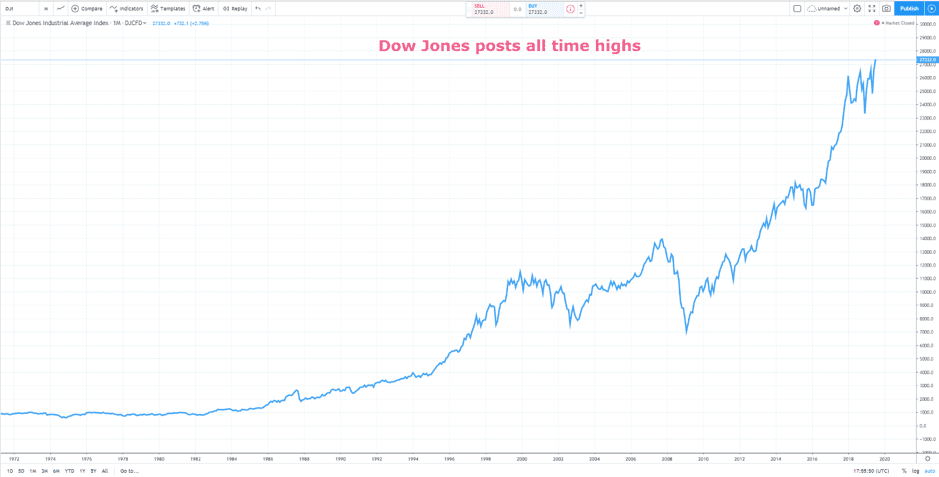

Record breakers

It was champagne all round on Friday evening on Wall Street. Stocks that make up the Dow Jones Industrial Average index rallied, meaning the index itself posted all-time highs. The S&P 500 hit the 3,000 price level for the first time. It’s not just exciting and dynamic sectors taking the markets higher. Corporations producing everyday products such as washing powder and shoes are posting exceptional returns in 2019. Procter & Gamble (PG) is up 25.10% and Nike (NKE) + 20.21%.

Last week’s news flow was punctuated by the comments of Jerome Powell, chair of the US Federal Reserve giving further signs that, in the short term at least, he will be implementing a more dovish interest rate policy. Whilst a range of geo-political threats continue to cast shadows over the global economy, at present, interest rate policy is the primary determinant of asset markets.

A lot of the analysis of Powell’s statement last Wednesday refers to him using ‘a softer tone’. Whilst a rate cut at the next opportunity looks a given, it does appear to be pretty much already priced in by the market. Those investors wondering if now might be the time to take a contrarian approach might want to consider the work of Yohay Elam.

Elam revisited the text of Powell’s speech and published his conclusions in FXStreet:

1) Dim outlook: Powell described how uncertainties since June's Fed decision have continued dimming the economic outlook. Moreover, back then, there were only ‘many’ but not ‘most’ members wanting a rate cut, and now things have deteriorated. His words imply a cut is coming.

2) Uncertainties about trade: The Fed chair seems unconvinced about the trade truce reached by president Donald Trump and his Chinese counterpart Xi Jinping. While the central-banker refrained from commenting on trade policy, he stressed that uncertainty about trade remains a critical concern – repeating trade as being one of the top factors for the upcoming decision.

3) Investment notably slower: If recent trade headwinds impact the upcoming rate decision, investment impact long-term policy and also the potential for a long cycle of rate cuts. The Fed chair said that investment had fallen notably and that may continue taking its toll for many months ahead.

4) Weak inflation more persistent: Back in May, Powell dismissed subdued inflation as ‘transitory’. In June, he dropped this wording. And now, he seems fearful that weak inflation is becoming persistent. Is he hinting about a disappointing number in Thursday's Consumer Price Index report?

5) Not hot jobs market: While the statement praises the ‘strong jobs market’, Powell stated that he could not describe the labour market as hot. People are still being drawn in. To add insult to injury, he says that the current rise in wages is insufficient to push inflation higher.

Source: FXStreet

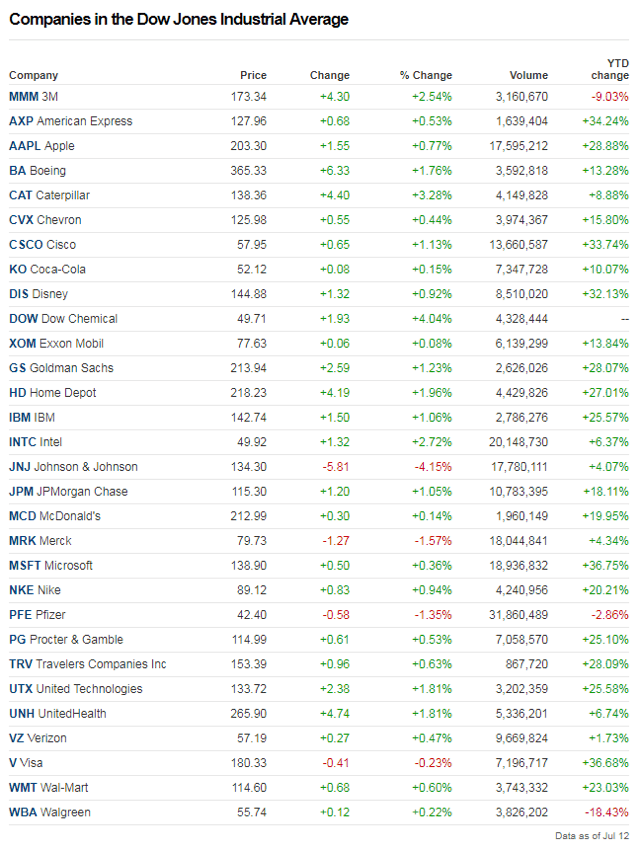

Who are the losers?

Looking at stocks that make up the Dow Jones Industrial Average index, only four stocks had down days. The kind of news that is needed to bring that about nowadays appears to be fairly fundamental.

Shares of Johnson & Johnson (NYSE: JNJ) closed down 4.15% on Friday after Bloomberg reported on the ongoing investigation by the U.S. Department of Justice (DOJ) into cancer risks from its talcum powder. The latest share price move was brought on by reports that the investigation would try to ascertain if the company lied about possible cancer risks. Looking for equities to short is something of a challenge.

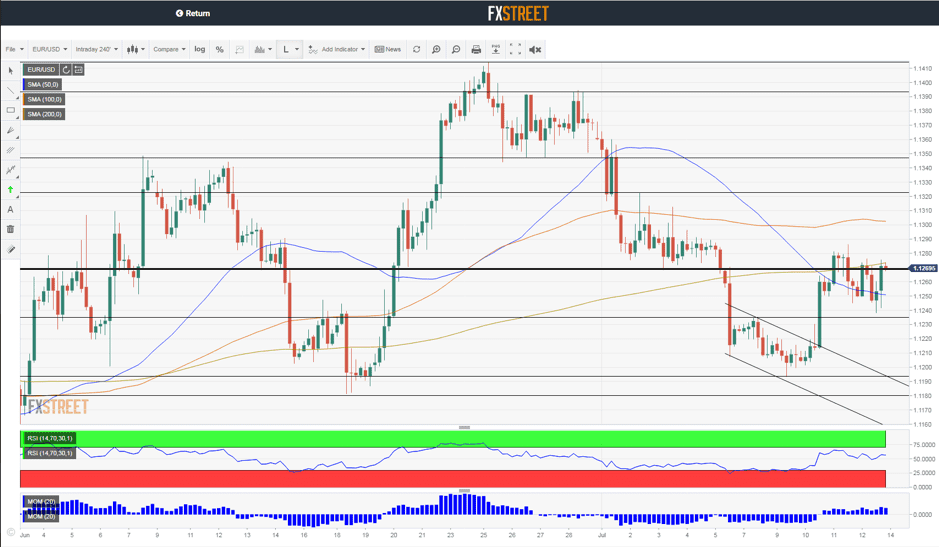

Forex

Elam considers the USD/EUR Forex market for trading ideas. Given the bi-lateral nature of Forex at least, a rising tide is not lifting all ships.

Writing in FXStreet, Yohay Elam said:

“EUR/USD has risen sharply, breaking above the short-term downtrend channel. It is now facing critical resistance at 1.1270, which is the confluence of the 50 and 200 Simple Moving Averages on the four-hour chart. The level also served as support last week.

Further up, the 100 SMA awaits at the round number of 1.1300 and 1.1320 was a temporary high last week. 1.1350 and 1.1395 are next.

Looking down, 1.1235 – which capped the pair earlier this week – now turns into support. It is followed by 1.1195, the weekly low, and 1.1180 – mid-June's low. Next, we find 1.1145 and 1.1107.”

Source: FXStreet

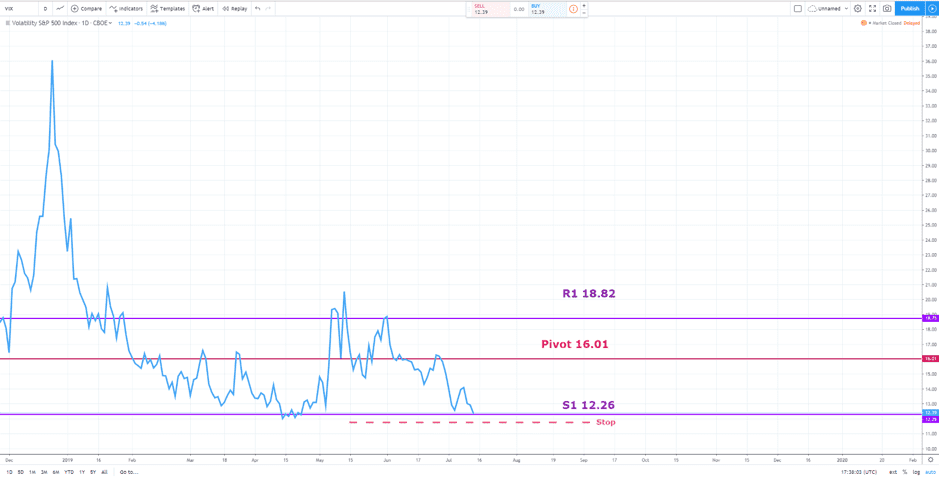

Fear index

Those wondering how to get involved in the markets might look to the CBOE VIX Index. The ‘fear index’ can provide analysts a sideways look at the state of the markets or can be traded in its own right. The index is currently trading towards the bottom end of its five year price range and just above its one day level one support of 12.26. This is a price level that would be expected considering the bullishness in the equity markets, but the index is very sensitive to the kind of geo-political events that have been thrown in from the side-lines in recent weeks.

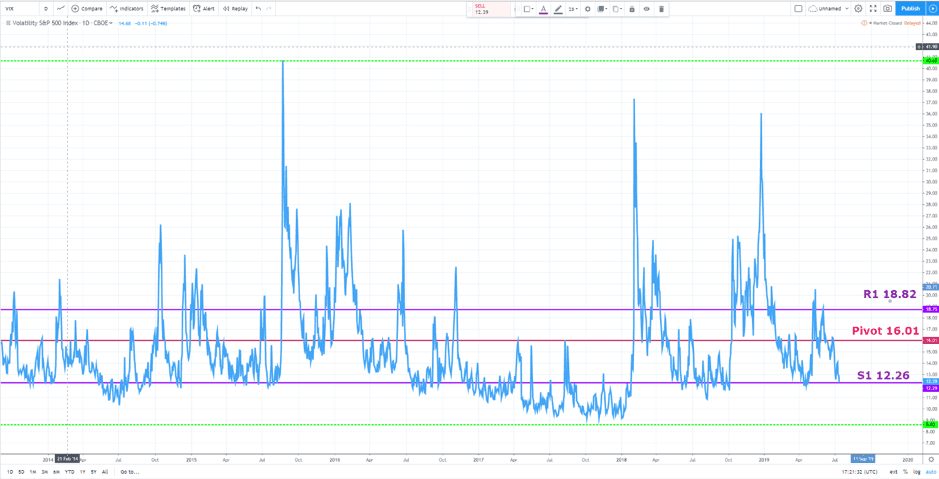

Five year timeline – VIX with Daily Support / Resistance and Pivot:

Year to date 2019 timeline – VIX with Daily Support / Resistance and Pivot:

Traders might not want to bet against a chorus of apparently in-tune central bankers. Nor might they want to invest cash into markets that are already posting new highs. The VIX index is a high-risk instrument to trade but some might be looking to take a position at these levels. Those that don’t would still do well to watch it and see if, in this instance, it acts as a leading indicator to the next market move.