Taiwan Semiconductor Manufacturing Company (TSMC) delivers record Q2 2025 results on AI chip demand. With the TSM stock price (NYSE:TSM) already touching new highs of $238.31 leading into the print, overnight pricing indicates further to come. Having gained 17.85%, the market's recognition of TSMC's strategic importance and its ability to consistently deliver strong financial performance is clear.

The world's leading semiconductor foundry announced a second quarter 2025 that handily surpassed expectations, with seemingly insatiable demand for its advanced chips in artificial intelligence (AI) and high-performance computing (HPC).

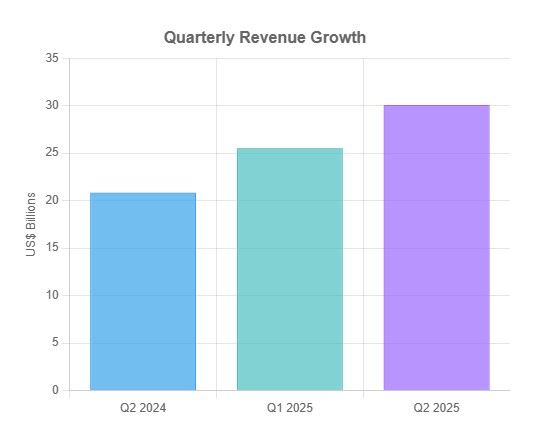

For the quarter ending June 30, 2025, TSMC reported consolidated revenue of NT$933.79 billion (approximately US$30.07 billion), a staggering 38.6% increase year-over-year and an 11.3% jump from the first quarter. Net income exploded to NT$398.27 billion, translating to a diluted earnings per share (EPS) of NT$15.36 (US$2.47 per ADR unit), representing a 60.7% year-over-year surge in both metrics. Margins remained robust, with a gross margin of 58.6%, an operating margin of 49.6%, and a net profit margin of 42.7%.

- Revenue increased by 44.4% year-over-year and 17.8% quarter-over-quarter to US$30.07 billion (NT$933.79 billion)

- Net income grew by 60.7% year-over-year to NT$398.27 billion with EPS of NT$15.36 (US$2.47 per ADR)

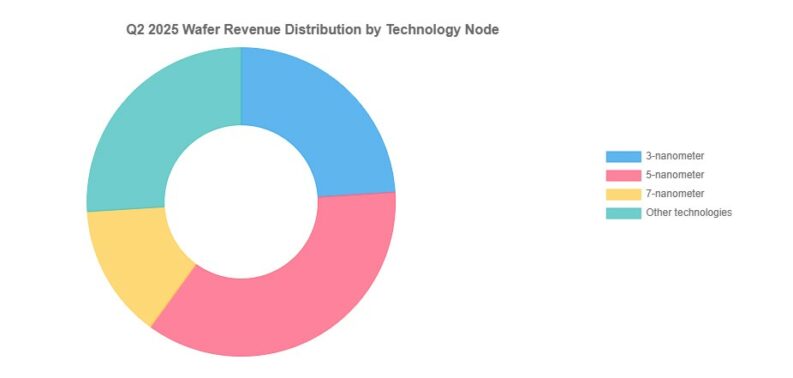

- Advanced technologies (7nm and below) account for 74% of total wafer revenue

- Strong performance driven by increasing demand for AI applications and high-performance computing

The driving force behind these impressive figures is the relentless appetite for sophisticated semiconductors powering the AI revolution. TSMC's dominance in advanced node technologies, particularly its 3nm and 5nm processes, has positioned it as the go-to foundry for leading AI chip designers like NVIDIA and AMD. In the second quarter, 3nm chips accounted for 24% of total wafer revenue, while 5nm contributed 36%, and 7nm 14%.

Notably, advanced technologies (7nm and below) comprised a commanding 74% of total wafer revenue, highlighting TSMC's technological prowess and its ability to capitalize on the most cutting-edge demands of the market. The company's advanced packaging solutions, specifically its CoWoS (Chip-on-Wafer-on-Substrate) technology, are also critical for manufacturing AI accelerators, further solidifying TSMC's role as a key enabler of the AI boom.

However, the path ahead is not without its challenges. Geopolitical tensions, particularly between China and Taiwan, remain a significant concern. Any escalation in cross-strait relations could disrupt TSMC's operations and supply chains, potentially impacting the global semiconductor industry. Currency fluctuations also present a headwind. The appreciation of the Taiwan dollar against the U.S. dollar can erode TSMC's profitability, as a significant portion of its revenue is denominated in U.S. dollars.

To mitigate these risks, TSMC is pursuing a strategy of geographical diversification. The company is investing heavily in expanding its manufacturing capacity outside of Taiwan, particularly in the United States. Its planned $100 billion investment in Arizona, including the construction of multiple fabs and an R&D center, demonstrates its commitment to establishing a more geographically balanced manufacturing footprint.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY