The UK economy has experienced consecutive monthly contractions, with GDP falling 0.3% in April and 0.1% in May 2025 according to the latest figures released by the Office for National Statistics (ONS). This follows a strong Q1 growth of 0.7%, which analysts attribute to businesses frontloading activity ahead of US tariffs.

The latest data surprised analysts who had been expecting to see a 0.1% expansion for May. The FTSE 100 has started the day with a mild dip as markets look to digest the print.

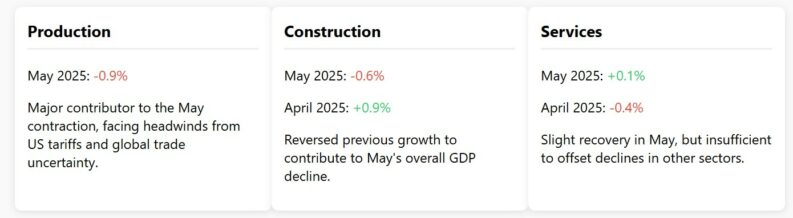

The primary drivers of the May contraction were a significant 0.9% drop in production output and a 0.6% fall in construction activity. While the services sector offered a slight reprieve with a 0.1% rebound, it was insufficient to offset the weakness in other key areas of the economy.

This marks a stark contrast to the robust 0.7% GDP growth witnessed in the first quarter of 2025, a performance largely attributed to businesses frontloading activity in anticipation of US tariff changes. That initial burst of momentum now appears to be fading rapidly.

The consecutive months of contraction are a significant setback for Reeves, who has made boosting economic growth and reducing the UK's budget deficit cornerstones of her agenda. The pressures are mounting, with recent data suggesting Reeves is slowing spending plans in the face of the slowing economy.

The unexpectedly weak figures will undoubtedly fuel criticism of the government's economic policies and raise questions about its ability to navigate the current headwinds.

A key factor contributing to the UK's economic woes is the impact of international trade tensions, particularly the imposition of tariffs by the United States under former President Donald Trump.

The UK was hit with a 10% “reciprocal tariff” despite having a relatively balanced trading relationship with the US in terms of goods, although it maintains a large surplus in services. The imposition of these tariffs in April triggered widespread business uncertainty and sent global markets into a tailspin. While the UK has since secured a trade deal with the US, becoming the first country to do so, the lingering effects of the tariff dispute and the ongoing uncertainty surrounding trade relations with other partners, including the European Union, continue to weigh on the economy.

Fears of US tariffs have also hit UK factory exports hard, further compounding the problem.

Looking ahead, the first estimate of second-quarter GDP is due on August 14. Given the disappointing results for April and May, analysts are bracing for a subdued Q2 performance, with little to no growth expected. This would represent a dramatic slowdown from the first quarter and further solidify concerns about a potential recession.

The Bank of England will be closely monitoring these developments as it assesses the need for further monetary policy interventions. The combination of domestic economic challenges and international trade uncertainties presents a complex and challenging environment for policymakers.

Reeves faces the unenviable task of stimulating growth while simultaneously addressing the budget deficit, a balancing act that requires careful calibration and decisive action.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY