Vodafone's share price (LON:VOD) has jumped 3.8% early in trading, making multi-year highs in the process.

The rally has come on the back of the telecom giant releasing an encouraging Q1 FY26 trading update, highlighting revenue and EBITDA growth alongside the completion of its UK merger with Three.

The company also reiterated its full-year guidance, avoiding any surprises.

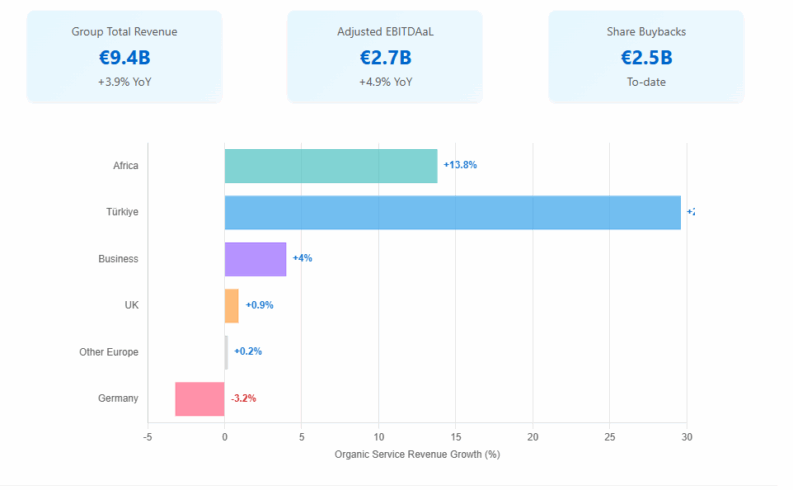

Looking into the report, and the headlines revealed a 3.9% increase in group total revenue, reaching €9.4 billion. This growth was significantly influenced by the consolidation of Three UK, although foreign exchange movements provided an offset.

Group service revenue experienced a 5.3% jump to €7.9 billion, with organic service revenue expanding by 5.5%. This broad-based growth was seen across most segments, with the notable exception of Germany.

Looking at the regional breakdown, Germany remains a challenge for the firm, and the only decliner, with service revenue declining by 3.2% due to the impact of a TV law change.

Other Europe & Türkiye presented a mixed picture. Other European markets saw a tepid 0.2% organic service revenue increase, while Türkiye shone with a 29.6% surge in service revenue in euro terms.

Africa continued its strong growth trajectory, posting a 13.8% increase in organic service revenue. This robust performance was fueled by above-inflation growth in Egypt and strong demand for data and financial services in Vodacom's international markets.

The Business segment also performed well, with organic service revenue growing by 4.0%, primarily driven by strong demand for digital services across Europe and Africa.

Group Adjusted EBITDAaL increased by 4.9% on an organic basis to €2.7 billion. The adjusted EBITDAaL margin stood at 29.3%, a 0.2 percentage point improvement year-over-year on an organic basis. However, operating profit decreased by 34.3% to €1.0 billion, largely due to a one-off gain from the sale of Vodafone's stake in Indus Towers in the prior year.

Vodafone continues to return value to shareholders, having completed €2.5 billion in share buybacks to date. A new €2.0 billion buyback program is underway, with the second €0.5 billion tranche commencing today.

A key strategic milestone was achieved with the completion of the VodafoneThree merger on June 1. The combined entity is now fully consolidated in Vodafone's results, and integration efforts are underway, with customers already beginning to see some benefits.

The company reiterated its FY26 guidance, now including the impact of the UK merger. Vodafone expects Group Adjusted EBITDAaL to be in the range of €11.3-€11.6 billion and Group Adjusted free cash flow to be between €2.4-€2.6 billion.

Margherita Della Valle, Group Chief Executive, emphasized the positive start to the year, stating, “We have had a good start to the year with strong revenue and EBITDAaL growth. Germany has started its improvement trajectory and our emerging markets are delivering strong broad-based growth…Vodafone is now well positioned for multi-year growth across both Europe and Africa.”

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY