Online crypto trading can initially seem a little overwhelming for a beginner. One of the easiest ways of getting up to speed is to get familiar with the process by buying a small position in a cryptocurrency using a demo or live account.

YOUR CAPITAL IS AT RISK

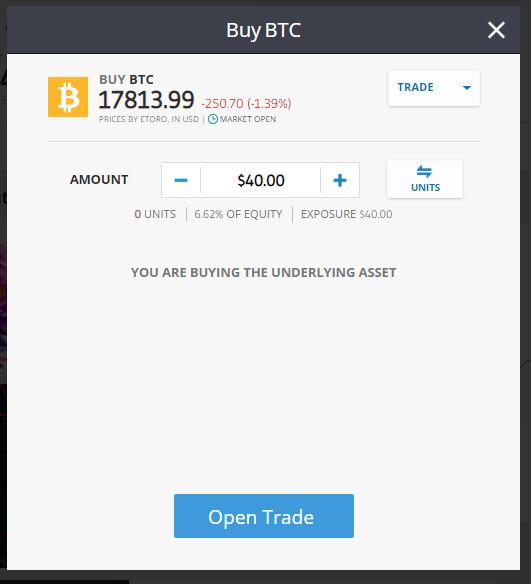

Given the risks involved and the need to get up to speed with how things work, it's essential to manage risk by limiting the size of the trade, but some brokers allow trades as small as $40 to be put on.

With that in mind, this article details the following steps to assist you when learning how to trade Bitcoin for the first time.

Table of contents

Step 1 – Onboarding

The quality end of the online broker market includes an array of regulated brokers which offer their clients the latest cutting-edge tools and a range of user-friendly security features. A modern trading account typically comes with easy-to-use functionality and feels like an online bank account, although it is far easier to set up.

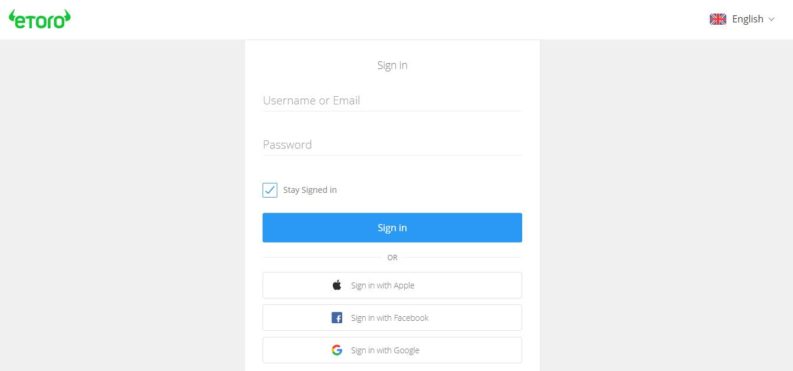

The below screenshots outline the simple steps that can be taken to set up a free-to-use demo account at the reputable broker eToro. Like other good brokers, eToro offers those who want to know more about trading Bitcoin the chance to try out trading using a risk-free Demo account which uses virtual funds. The simulated experience uses live market prices so new traders get a feel for how things work and how the life of a trade impacts total net returns.

Registering for an eToro account can be done within a few seconds. From the homepage, follow the link to the login page, where new users are invited to register for a new account. This can be done using stored information relating to existing Google, Facebook or Apple profiles. Alternatively, input your email address, create a username, enter a password, and that's it – you're ready to start trading using a demo account.

You'll be taken through to the trading platform as soon as those three pieces of information are entered. Live prices will feed into your monitors, and although the cash you trade with is virtual, the data you trade off will be the same as if you were dealing with real money.

You and only you will have access to your account, and your profile will be the starting point for moving on to the next step – setting up a live trading account and allocating real money to trades.

As the move from Demo to a Live account is a significant one, there is a need to carry out some additional form filling. It is all done online, and while the questions asked can take several minutes to answer, they are a sign that a broker is regulated and takes its compliance responsibilities seriously.

It's important to remember that cryptocurrency trading is unregulated, so there aren't the same client protection structures in place as there are for equity and bond trades. That being said, the multi-asset brokers that offer crypto, stock, commodity, derivatives, and forex trading tend to be regulated. Your crypto trades won't come into the scope of regulatory protection, but the broker is set up so that its operations in regulated markets are compliant. As such, some of the broker's good practices will carry through to all types of trading activity.

The KYC (Know Your Client) questions a broker asks new users cover topics such as previous trading experience and investment aims. They're a good double-check for newbies as they remind them that having a clear strategy is important when starting out. They also help the broker comply with ‘Client Care' protocols which are intended to provide investor protection. A final level of protection that good brokers offer is two-stage verification which provides greater security around the process of logging into your account.

Taking a more proactive approach to making sure you choose a trusted broker can include checking if your broker is licensed by a Tier-1 regulator, such as one of those detailed below. These regulators require brokers to comply with a wide range of protocols designed to protect traders.

- The Financial Conduct Authority, better known as the FCA, is a financial regulatory body in the United Kingdom that operates independently of the UK Government.

- The Australian Securities and Investments Commission, better known as ASIC, is an independent Australian government body that acts as Australia's corporate regulator.

- The Cyprus Securities and Exchange Commission, better known as CySEC.

If you're setting up a Live account, the final part of the onboarding process involves paying funds into your account. While different brokers offer a multitude of payment options, wiring funds via a debit or credit card remains popular. Such transactions tend to be instant and feel the same as any other online transaction.

With your profile complete and funds in your account, you're ready to trade.

YOUR CAPITAL IS AT RISK

Step 2 – What is Bitcoin? Analysis and Risk Management

Bitcoin is a digital currency. It can be used as a store of value or to carry out transactions, and it has certain features which distinguish it from traditional fiat currencies. These include how owners of coins benefit from a degree of anonymity. In addition, the blockchain technology the Bitcoin platform uses contains protocols designed to ensure fraudsters can't claim to have a position bigger than they do in reality.

Bitcoin was created in 2008 as part of a backlash to the financial crisis of that time and a growing lack of trust in established financial institutions. It is the original crypto and is still the largest coin in terms of market capitalisation and, for many, is synonymous with the crypto sector.

Over time, second-generation Altcoins such as Ethereum have sprung up and gained popularity. These new entrants aim to take advantage of technological advances to create coins which have the edge over Bitcoin. These might include having faster transaction times or additional functionality which supports new industries such as NFTs (Non-Fungible Tokens).

If Bitcoin does become the global currency of the future, its price will be exponentially higher than it is now. All holders of fiat currencies would have to convert their holdings of dollars, euros and pounds into BTC, and that additional demand would drive up the price. Whether that revolution in the financial system will happen is open to much debate. Regulators and institutions with vested interests in the status quo are one obstacle, but other inherent issues related to blockchain processing include the enormous carbon footprint of Bitcoin.

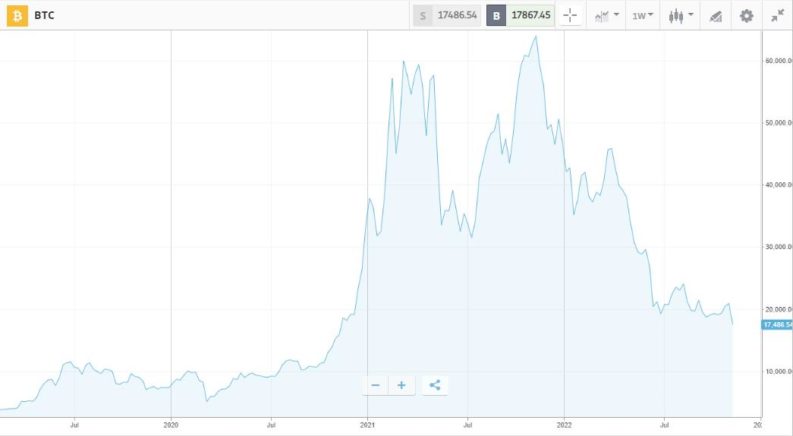

The number of unanswered questions regarding the prospects of Bitcoin results in dramatic price swings, and it is regarded as one of the most volatile assets in the financial markets. Between March 2020 and November 2021, the price of Bitcoin increased by a staggering 1,431% but then, following that all-time high, the price crashed. Twelve months later, BTC had fallen in value by 75%.

Step 3: Bitcoin Trading Strategies

The extreme price swings in Bitcoin and other cryptos make them popular with day-traders looking to make a short-term gain. At the same time, buy-and-hold investors have historically been drawn to Bitcoin as well. An investor who bought Bitcoin in March 2017 and held it for five years would have experienced an extremely bumpy ride but also posted a 4,059% return.

When looking to take a long-term position in Bitcoin, it is vital to check the reliability of your broker and its pricing schedule so that frictional costs don't eat into potential returns. Online reviews of different brokers outline their respective pros and cons so that it is possible to establish which might be the best fit. The functionality of each trading platform also varies, with some setups favouring those looking to trade from desktops while others can be a better fit for those trading using a mobile phone.

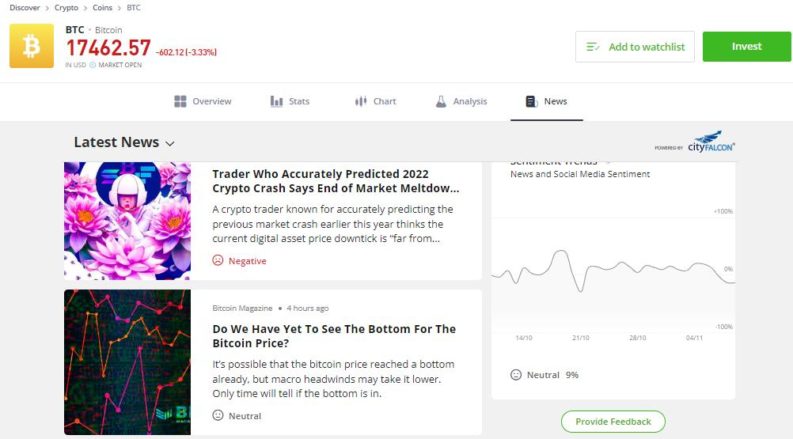

Another way brokers try to differentiate themselves from each other is through the research and analysis materials they provide to clients. These are usually free-to-access items, which range from in-depth written analysis reports on Bitcoin's long-term prospects to newswire-style updates and price alerts, which keep clients up to date with market events.

When using a trading platform, the best way to get up to date with a market such as Bitcoin is to head to that asset's dedicated page. It will have a price chart, technical indicators, news and analysis and a range of additional nice-to-have features. If your broker offers Copy Trading or Social Trading, you'll also be able to consider the views of other active investors.

YOUR CAPITAL IS AT RISK

Step 4 – Buying Bitcoin

Modern online broker platforms come packed full of tools designed to help you trade what you want when you want. The trading experience has been streamlined to make the process easy and secure for all levels of traders – from experienced investors to complete beginners.

Basic trade instructions at online brokers require you to populate a few data fields to declare your trading intention:

- Buy/sell

- Instrument — what you are trading

- Amount

It can be as easy as entering that information into the trading monitor and clicking ‘Open Trade'.

More sophisticated trade orders might include:

- Stop-loss — there are several types to consider, such as ‘trailing'. If you're taking a long-term view, you may decide not to use a stop-loss, so it isn't triggered if a slump in price is followed by a rally to above your entry level.

- Take-profit — an automated instruction to sell if your trade makes a certain amount of profit.

- Leverage — the process of scaling up your risk-return profile. Crypto markets offer plenty of price volatility, meaning many investors deem it unnecessary to use leverage. Some regulators, such as the FCA, have also taken steps to clamp down on crypto trading using margin, so buying Bitcoin using leverage in all countries is not possible.

The above tools are all designed to help you set your trade up in the way that best suits your trading strategy.

Step 5 – Managing Your Portfolio

As soon as you've booked your trade, your position in Bitcoin will be valued according to the live price in the global crypto markets. As the price of Bitcoin rises and falls, so will the value of your holding.

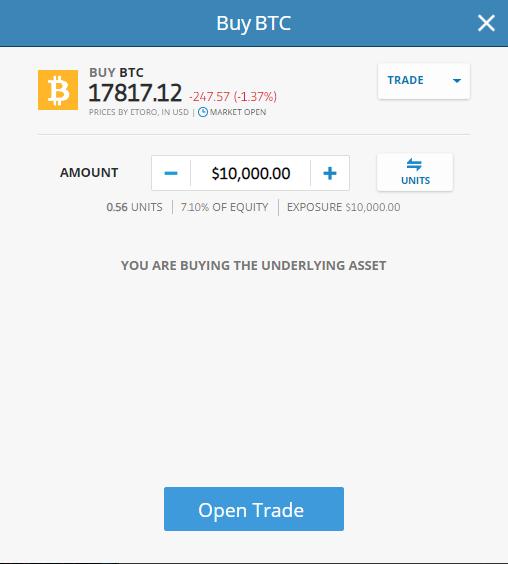

Brokers, of course, have taken into account that their clients want to keep up to date with events. In the below screenshot, using a virtual account, we booked a trade to buy $10,000 of Bitcoin at eToro.

After the trade was executed, it was possible to visit the Portfolio section of the platform to get an up-to-date assessment of the position's value.

Until the moment you sell your position, your Bitcoin will show an ‘unrealised' profit or loss. As long as you don't sell it, the value of the position will keep on changing in line with the underlying market price.

Step 6 – Closing Out The Trade

A trade doesn't necessarily need to be in profit for you to decide to close it out. Cutting your losses on bad trades is as important as running your winners. When the time is right, regardless of whether the position shows a profit or a loss, the mechanics of closing out the trade are the same.

The exact buttons you press will differ from broker to broker. At eToro, it's a case of clicking on your open position, clicking ‘Close', confirming ‘Close All' and the position of BTC is sold and converted back to cash.

As soon as you click to close your position, your account will sell your Bitcoin at the market price and crystallise your profit or loss.

As mentioned previously, online broker accounts are nowadays very similar to online bank accounts. This extends to being able to withdraw funds from your brokerage account and return them to your bank account if that is what you want to do.

Final Thoughts

The process of putting on a trade, monitoring it, and closing it out is straightforward. Brokers have invested heavily in making the trading experience as positive as possible.

Intuitive functionality and helpful customer support staff come as part of the package. Behind the scenes, powerful software tools and regulatory compliance processes ensure your trades are booked in a secure and compliant way.

The more challenging part is fine-tuning your trading decisions so that they make a profit. But beginners who follow the standard advice of trading in small sizes or using a Demo account to gain experience give themselves the best option of successfully trading Bitcoin.