If Bitcoin doesn't become widely accepted, then prices can be expected to crash from current levels. What use is a currency if it can't be used to buy things? The binary nature of the Bitcoin trade is what generates extreme price moves in the market. The rally in 2020 saw the price of Bitcoin surge by more than 300% as the idea of digital transactions reached a wider audience. Going mainstream created additional problems because elements of that ‘wider audience’ included people willing to place the Bitcoin story under closer scrutiny.

One major new point of contention was the vast amount of energy required to operate the Bitcoin network. It’s calculated that Bitcoin is responsible for approximately 0.32% of total global energy consumption. This equates to Bitcoin’s energy consumption being as much as the whole of Argentina, Malaysia or Sweden, which means running a fact check is essential for anyone holding or thinking of buying Bitcoin.

Where Can I Find Out About Bitcoin Energy Consumption?

The report that initially brought the Bitcoin energy question to prominence in 2021 was issued by the researchers at the Cambridge Centre for Alternative Finance (CCAF). It highlighted how power-hungry the process of mining Bitcoin was. The estimated annual energy use of Bitcoin was calculated as 121.36 terawatt-hours (TWh).

The trick that turned the report into a must-read for crypto investors was the ease in which that number could be put into more relatable terms – by comparing the annual usage of entire countries. It was possible to put the incredible energy demands into context wherever you were in the world.

CCAF's Reported Annual Energy Use Numbers

- Norway 122.20 TWh per year

- Argentina 121 TWh per year

- The United Arab Emirates 113.20 TWh per year

- Netherlands 108.8 TWh per year

- Bitcoin 121.36 TWh per year

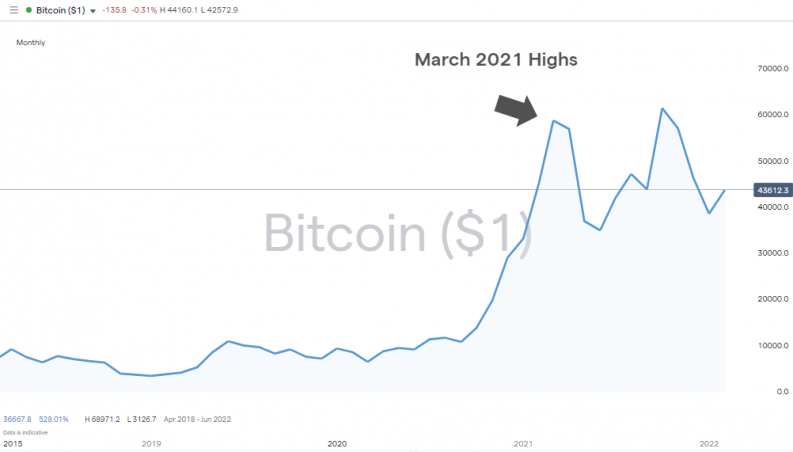

Proving a direct correlation between the CCAF report and market prices is hard to do, but it could be more than a coincidence that the time that the story gained momentum coincided with the froth being blown off the top of the Bitcoin market. Between March and June of 2021, the price of Bitcoin fell by 46%. A rebound into Q4 of 2021 saw BTC peak at $68,971 in November, but energy use concerns played a part in the subsequent +60% price fall from that all-time-high to the sub-20k price levels seen in July of 2022.

Source: IG

Bitcoin Mining Energy Use

The process of discovering a new Bitcoin is called ‘mining'. It has developed from being one-person operations managed by tech enthusiasts into an entire industry. Professional outfits running banks of specialist computers hook up to the Bitcoin blockchain network and process data relating to who owns what in the system.

Bitcoin mining can involve solving puzzles using proof-of-work algorithms. While these might not be integral to verifying movements of the currency, they provide a hurdle to ensure nobody fraudulently edits the global record of all Bitcoin transactions.

Intense interest in the issue led to the creation of online tools such as the Bitcoin energy consumption index. That index provided up-to-date reports on mining energy use and showed Bitcoin's energy usage has increased since the CCAF report was released.

The annual amount of electrical energy required by Bitcoin is estimated to be 204.50 TWh, which is comparable to the power consumption of Thailand and a carbon footprint of 97.14 MtCO2, which is similar to the carbon footprint of Kuwait.

Bitcoin Transactions – Energy Use

The mining of Bitcoin is a significant drain on the world's resources, but the story doesn't end there. Ongoing transactions recorded by buyers and sellers also have their power demands. Digiconomist estimates that a single Bitcoin transaction requires 2199 kWh of electricity, equating to 1,044 KgCO2 or watching YouTube for 174,123 hours.

Source: 123rf.com

Bitcoin and Waste

The numbers relating to Bitcoin energy consumption are pretty stark, but other aspects of the process are equally concerning from an ecological point of view. Miners use specialist chips called ASICs, which are designed solely to run mining algorithms. Cracking the puzzle is a hard-run race, and only the newest chips are powerful enough to compete, so miners constantly replace their ASICs with newer, more powerful ones.

Industry experts Alex de Vries and Christian Stoll calculate that ASICs have an average lifespan of 1.29 years which means Bitcoin's annual e-waste generation adds up to 30.7 metric kilotons as of May 2021.

This number is comparable to the amount of small IT and telecoms waste produced by Belgium. Breaking the numbers down even further, each Bitcoin transaction is estimated by the same report to generate waste equivalent to the weight of 2.08 iPhone 12s or 0.70 iPads.

Bitcoin and Coal

Total energy use is only part of the problem with Bitcoin's energy consumption levels. Circling back to Bitcoin miners operating on thin margins in a highly competitive industry helps explain where they are located in the world. With German electricity prices being almost x10 those of China, the amount of mining activity in China for a long time outpaced that of Germany.

Until China authorities clamped down on cryptos in 2021, coal-abundant Xinjiang and Inner Mongolia were popular spots for Chinese bitcoin miners. Not only were they using a lot of energy, but the electricity was being generated by one of the biggest CO2 polluters in the global energy network.

Other countries in the top-10 of Bitcoin mining countries include the United States (35.4%) and Kazakhstan, none of which top the charts in green energy production.

The organisation Change The Code Not The Climate has revealed that even more developed markets such as the US are not immune from miners accessing coal-fuelled electricity from plants that were otherwise due to be closed down.

Campaign director Michael Brune explains, “fossil fuel growth is outpacing renewable growth in bitcoin mining and that’s the fundamental challenge” (source: The Guardian). This comes down to the basic economics as explained by Chris Larsen, founder and executive chairman of crypto company Ripple and a climate activist. “The minute that there is the opportunity to go to something dirty, which is what you are seeing, that is going to happen” (source: The Guardian).

How Does the Price of Bitcoin Impact the Amount of Energy it Consumes?

The complex equations that Bitcoin miners solve help keep the blockchains’ books and records accurate and up to date. In return, the miners who crack the code of a particular puzzle first are rewarded with a piece of freshly mined Bitcoin.

The allocation of newly mined bitcoins has been likened to a lottery, but if the market price of Bitcoin goes up, there is additional incentive to load up on the energy-hungry machines which locate new coins. More and more miners can be expected to start up operations and the energy they use still counts towards Bitcoin’s carbon footprint even if they are one of the overwhelming majority of miners who are unsuccessful. To put it another way, current Bitcoin energy consumption levels, whilst being alarming, could skyrocket if the price of the coins increases and the risk-reward ratio for miners is scaled up.

The increase in energy use relating to transactions could be exponential if payment in Bitcoin becomes more widely accepted. Traditional payment systems might not have all of the functionality of crypto blockchains, but they are much more efficient. According to Marion Laboure, a Deutsche Bank analyst, mining one bitcoin consumes a larger carbon footprint than nearly two billion Visa transactions.

Projections of Future Energy Use by Bitcoin

There is the possibility of the energy-heavy proof-of-work protocols being upgraded. They aren't the only algorithm that can establish consensus in the blockchain, and proof-of-stake has been in development over recent years. This approach involves coin owners rather than miners creating blocks, and it is estimated that a switch to that system could reduce Bitcoin energy consumption by 99.95%.

The problems experienced by rival crypto Ethereum during its conversion from PoW to PoS make sense of Bitcoin’s reluctance to follow suit. PoW is also widely regarded as being more secure than PoS, which has resulted in Bitcoin taking a different approach to solving its energy use problem. That is, a shift towards using green energy,

Norwegian firm Kryptovault expects its mining operations to account for approximately 1% of Bitcoin's global energy use in 2022, and it uses only renewable energy. Other miners have turned to using carbon offsetting and some miners have set up operations in countries such as Iceland, where cheap geothermal energy is readily available. These alternative approaches may help Bitcoin move away from the tricky situation it has found itself in. It is estimated that 57% of the energy used for crypto mining currently comes from renewable sources. However,

the crypto industry attracts some of the sharpest minds on the planet and if there were any quick fixes, then they would have been put in place by now.

Bitcoin and Green Energy

There are some possible scenarios where Bitcoin’s high energy use could actually help the global economy shift to cleaner energy. Solar and wind power supplies are notoriously unreliable due to them being derived from natural forces. They also require massive amounts of investment. Bitcoin miners have already started flocking to areas where solar and wind power generators are operating.

During periods of peak flow, the electricity generated can often be above what can be effectively transferred into the national power grid. At that time, Bitcoin miners snap up the surplus energy at low rates and the power producer benefits from having an additional income stream. Developments such as this could help accelerate the rate at which renewable power plants are established.

Final Thoughts

Ecological concerns are playing a greater part in investment decisions across the financial markets, and it could be that the incredible amounts of energy required to operate Bitcoin block its rise to being the currency of the future. There would be some irony if the coin tipped to democratise the monetary system came unstuck due to the eco-based concerns of the average person. Reluctance from everyday Joe's and Jill's to accept Bitcoin energy consumption could be what blocks its progress in a way that the financial establishment and the world's governments have so far failed to achieve.

Bitcoin has experienced challenges like this before, and having some of the ‘smartest guys in the room’ working on a solution always helps. The energy use question looks set to be another variable which results in the market volatility of bitcoin being sky-high. But for many, the extreme risk-return ratio is part of the appeal of the market.

If you are looking to buy bitcoin, then one risk that can be managed relates to keeping your funds safe. The market is unregulated, so whether you’re an experienced investor or a new entrant to the sector, head to this list of secure crypto brokers to get your trading off to the best start. They also have all the research and analysis needed to get a clearer view on how energy use will influence the price of bitcoin.