When you also factor in the unique nature of cryptos and the constantly changing environment they operate in, it becomes clear that a degree of blue-sky thinking is required. Fundamental and technical analysis come into play, but so does the role of regulators, inflation, and the health of crypto trading platforms.

Below are the thoughts of some experienced crypto traders. The next recession will be a new experience for them as much as it will be for someone who buys crypto today. Here are the possible ways the situation could pan out.

What Is A Recession?

Recessions are relatively infrequent, but as the time since the last one grows, the ‘R’ word can be expected to become more widely used. The view taken by the investment community is that it’s not a question of if, but when, one will occur. An economy technically goes into a recession when its gross domestic product (GDP) contracts for two consecutive quarters – other metrics such as employment levels, inflation, and industrial production, help gauge how severe the slump is.

While no one wants a recession to happen, they are part of the natural economic growth cycle, so preparing ways to trade crypto during a recession makes complete sense. When it comes, it will pose challenges for crypto investors but also offer opportunities as well.

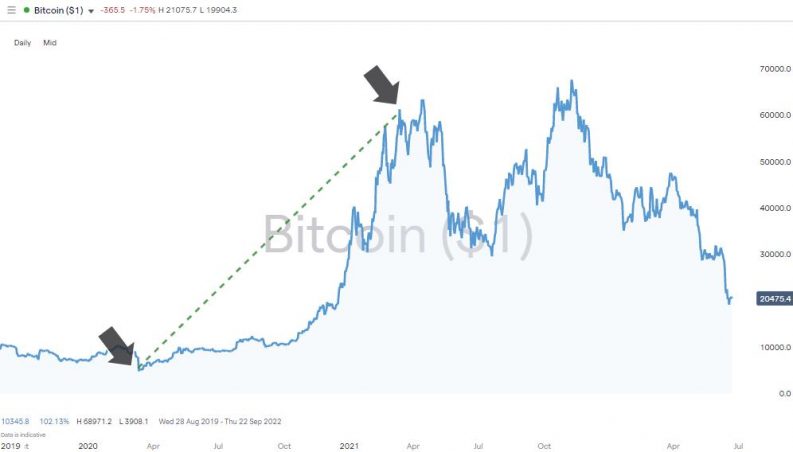

Bitcoin – Daily Price Chart – 2019 – 2022 – +900%

Source: IG

A Historical Perspective On Recessions

The last major global recession occurred between 2007 and 2009 and the first of the cryptos, Bitcoin, wasn’t even founded until 2009. There have been momentary slumps in economic activity since then, with the March 2020 contraction caused by COVID technically being a recession, even if it was only short-term in nature. During 2020, crypto prices rallied, which raises the question of whether crypto will perform well in a recession, but on the whole, the monitoring of crypto behaviour during such a period is very much unchartered territory.

Gauging how cryptos might perform in a recession is made more difficult by the extreme price volatility associated with the sector. The prospects of Bitcoin will be very different depending on whether it goes into the next recession in buoyant mood, trading at $60,000 and near the all-time highs, or at the much lower price levels it crashed to in the first half of 2022. With coins able to move from one price level to another in a short period of time, a double-check of the health of the market can influence the view on where prices will be when they come out on the other side.

Not all recessions are the same, so even though cryptos weren’t around in 2007, cross-referencing to history books can help establish the possible length and severity of a future recession. They can be short-lived and as short as two quarters of a year. Alternatively, they can be long-term in nature and run for several years. The repeated cycles of recessionary activity that formed the Great Depression lasted between 1929 and 1938.

The final piece of historical context that can help establish what will happen to cryptos in a recession relates to how effective government and central bank policies might be. If ‘stagflation’ occurs and the recession is also a time of high inflation, then those managing the economy will have to make a choice on which problem to prioritise.

Could A Recession Be Good For Crypto Prices?

There is only a limited amount of historical information available regarding how crypto performs during a recession, but there is some. Using that data and applying more hypothetical analysis points to several reasons why crypto could perform well during the next recession.

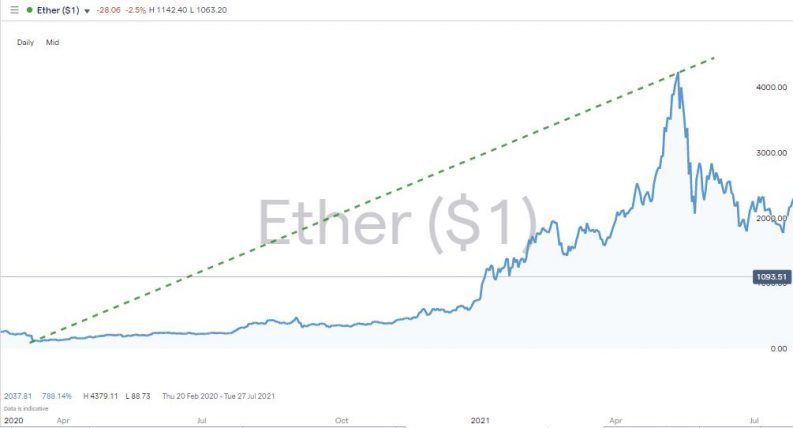

Ether – Daily Price Chart – 2022

Source: IG

Crypto and the Recession of 2020

It’s worth starting off by digging deeper into the events of 2020 when the COVID-led lockdown of global economic activity triggered a recession. It was relatively short-lived, thanks to ground-breaking stimulus measures that governments quickly introduced, but in the 12 months between March 2020 and March 2021, the price of bitcoin rose by a staggering 994%.

Part of that price surge was down to global interest rates plummeting to near zero, which reduced the appetite investors had for holding cash. At the same time, central banks pumped extra cash into the financial system, increasing the risk that fiat currency could become devalued in real terms. In contrast, cryptos are structured in a way that increases supply in line with a set formula.

The argument about whether crypto is a viable alternative to fiat currency is far from being resolved, but as prices surged, crypto became big news and institutional investors started taking them seriously.

A report released by Morgan Stanley Wealth Management in March 2021 illustrates how the boost to prices caused by a recession brought crypto to the attention of mainstream investors.

“For speculative investment opportunities to rise to the level of an investable asset class that can play a role in diversified investment portfolios requires transformational progress on both the supply and demand sides. With cryptocurrency, we think that threshold is being reached.”

Source: Morgan Stanley

Crypto as a Safe-Haven Asset

The incredible spike in crypto prices in 2020 can also be attributed to crypto’s potential as a reserve asset – a form of digital gold. The correlation between the two assets varies over time, but both offer just what investors want during a time of uncertainty, such as that seen in March 2020.

Bitcoin might not yet be a highly effective means of exchange, but like gold, it is seen by many as a way to securely store wealth. Cryptocurrencies are also global in nature and transfers are made without borders, which means the coins aren’t pegged to the fortunes of one country or region.

It's yet to be seen whether this analysis carries over into a recession driven by economic factors rather than a worryingly new challenge of a global pandemic, but crypto’s credentials as a safe-haven asset were boosted during 2020.

Hard-Core Crypto Enthusiasts

The crypto price spike in 2020 was followed by a period of price consolidation and a dramatic sell-off in 2022. This reflected speculators locking in profits and moving out of positions. Crypto prices could head to zero, but at some point, there will be resistance from hard-core fans of coins.

The passion for crypto shown by these true believers is also likely to be recession-proof. Which suggests there is a ground-swell of long-term support that will provide a base level price for coins.

Cryptos, Recessions and Creative Destruction

The uncertainty associated with recessions could fit in well with the innovative nature of cryptos. The tech-heavy approach and start-up mentality of the sector puts it in a position to thrive on the creative destruction brought on by economic turmoil.

Not all of the coins will make the right call, meaning some could collapse, but that will allow other coins to grow as they fill the vacuum.

Howard Greenberg, a cryptocurrency educator at Prosper Trading Academy, tips Bitcoin to do well. Speaking with, Coinbase he said:

“During an extended recession I think we will see positive price movement with BTC but the rest of the crypto market would face headwinds as investors continue to move risk off and investors find it harder to raise funds in a tighter lending market.”

Source: Howard Greenberg

According to Statista, there are 9,900 cryptos in existence and some consolidation might not be a bad thing – especially for the stronger coins. Identifying which of the coins will be a ‘winner’ in a recession is obviously key. An environment with a survival of the fittest ethos could help some cryptos gain enough market share to begin to look like the real deal.

It could be a mistake to read too much into the crypto bull market of 2020 coinciding with the recession of that year. The exceptional circumstances of the pandemic and lockdown created an opportunity for millions around the world to surf the net and consider new ideas such as cryptocurrencies. Not all recessions will be similar in nature.

Crypto and Interest Rates

One scenario that could result in lower crypto prices during a recession involves ‘stagflation’ – a period of contracting output but also rising prices. The extra liquidity pumped into the global financial system since 2009 could result in central bankers facing this challenge during the next downturn.

Worryingly for crypto-fans, the history books suggest that in such instances, inflation tends to be the primary target. The textbook response is for interest rates to rise, instead of fall, and potential returns from cash diminish the attractiveness of cryptos as an investment.

Crypto is regarded as a high-risk investment and these types of assets are the first to suffer during a recession. Any ‘fear factor’ is particularly worrying for crypto investors due to the sector still being in its infancy.

Crypto Infrastructure During a Recession

Cryptocurrencies themselves may be virtual, but the platforms that support them are very real and will face the same challenges other businesses do during a recession. The collapse of Luna and the Terra blockchain in May 2022 serve as reminders of how badly things can go wrong with that coin losing 99% of its value overnight.

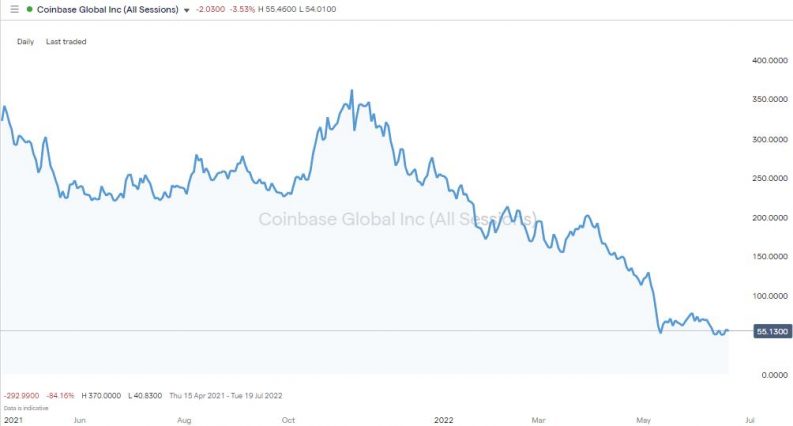

In June 2022, during a time when fears of a pending recession were building, the specialist crypto platform Coinbase announced it was laying off 18% of its staff. This move came down to business fundamentals and over-aggressive growth plans being scaled back. But such moves are alarming in an industry full of highly-leveraged firms.

Coinbase Global Inc Share Price – Daily Price Chart – 2021 – 2022

Source: IG

Actions such as those of Coinbase damage investor confidence and raise the question, ‘is my crypto safe?’ Investors who are looking to enter the market and buy crypto during a recession would do well to consider the structure of their broker. Firms such as those found on this shortlist of good crypto brokers offer trading in crypto markets but some deal in other asset groups as well. With their income streams being better-diversified, they offer access to crypto but haven’t gone ‘all-in’ on the sector.

The fast-moving nature of the crypto space means some questions remain unanswered regarding how cryptocurrencies perform during a recession. One of the most important outstanding ‘wildcard’ items is how regulators might treat cryptos during an economic slowdown.

High-profile firms go bust during a recession, and cryptos, and the exchanges that support them won’t be immune to that. If that results in investors losing out, then regulators could use it to justify a clamp down on the sector.

That’s when things get interesting. Would greater regulation result in die-hard fans leaving the space, or would it bring the coins further into the mainstream? If it is the latter, then prices can be expected to surge, but it’s hard to tell because cryptos are yet to navigate a long-term recession or one where their prices fall rather than rise.

Final Thoughts

Recessions are associated with an uptick in price volatility in all asset groups due to increased uncertainty. It’s just harder to make a call on the many variables that influence valuation models. Cryptocurrencies are known for being highly volatile, even during quieter moments in the market. Throw in that they are yet to be tested by a prolonged recession and the only thing which can be guaranteed is that when that does happen, volatility can be expected to go sky-high.

Buying cryptocurrencies during a recession could turn out to be the trade of a lifetime, but basic principles of risk management need to be considered. The most important one being to only invest amounts of money that you can afford to lose completely.

If the trade does come good, then ensuring your broker is still operating and able to pay out will be crucial. Accessing the market using multi-asset brokers offers greater protection and the user-friendly functionality of platforms such as eToro means there is no need for specialist wallets. They’d offer an ideal route into the crypto markets but when a recession comes, expect a bumpy ride.