Leverage in the stock market is a type of interest-free loan offered by a broker. Leverage can be used to increase the size of your position and, thus, its profits. Alternatively, leverage can be used to reduce margins and eventually provide you with the appropriate exposure in the financial markets. But how does leverage work in the market, and why is it important for your initial investment?

YOUR CAPITAL IS AT RISK

We will answer the question, “what is stock leverage and how does it work?”. We will also walk you through methods for determining the most optimal leverage, as well as discuss all of the benefits and drawbacks of trading with leverage, as well as real-world examples of leveraged trading.

Table of contents

What Is Leverage?

We touched on it above, but leverage in the stock market is like using a financial crowbar to amplify your buying power. It involves borrowing money from your broker to invest in more stock than you could afford with your own cash. Essentially, your broker puts up most of the capital.

Traders only need a portion of the positions to be opened. While this makes leverage appealing to investors, it also carries significant risks.

It's important to be aware that trading using leverage can be a double-edged sword, potentially leading to larger profits if the stock price goes up but also magnifying losses if it goes down. As a result, it is critical to understand the importance of risk management.

Trading leverage varies depending on the broker, platform, and instrument.

What Is a Good Leverage Ratio for Stocks?

In practice, more than 40% of traders prefer leverage of up to 1:10, while only about 17% use leverage greater than 1:100. For some trading instruments, European regulators recommend Forex brokers limit the maximum leverage on the opening of positions by retail clients from 30:1 to 2:1.

YOUR CAPITAL IS AT RISK

Leverage is set at 1: 2 – 1: 5 on cryptocurrency exchanges. Traders choose leverage up to 1: 1000 based on an emotional desire to increase the number of positions to the maximum without having enough funds in storage. Brokers with leverage greater than 1000 are usually not considered by me.

On a demo account, I would advise beginners to start with a minimum leverage value of 1: 1.

How Does Leverage Trading Work?

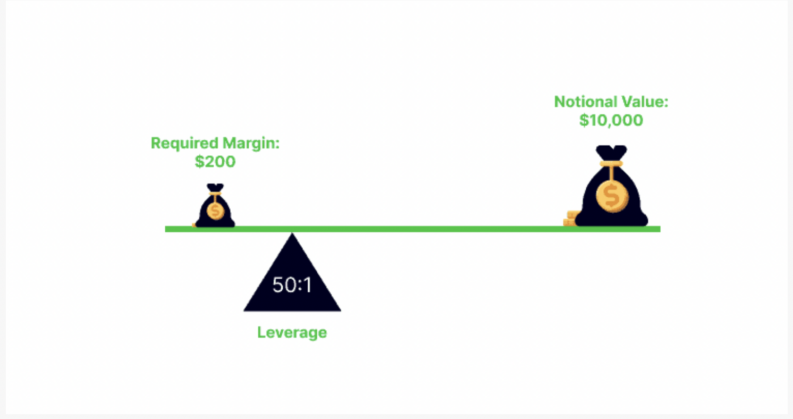

Leverage allows investors to increase their market exposure. The leverage ratio compares the amount of exposure to the amount of cash required (margin). A leverage ratio of 1: 100, for example, means trading assets worth $100,000 with only $1,000.

When you buy shares in traditional investing, you get what you pay for. For example, if you buy 10 shares of a company priced at $1 each, you pay $10. With leverage trading, you only need a portion of the total amount.

It is impossible to separate the concept of leverage in margin trading. Margin is the amount of money required by traders in order to use leverage. Brokers only require a good faith deposit before they can extend credit to traders. Margin is expressed as a percentage. If the broker requires a 2% margin, you have a 1: 5 leverage, and if they require a 0.5% margin, you have a 400: 1 leverage.

As an example, If a trader has $1,000 in his or her account and uses a leverage ratio of 1:5, he or she can purchase assets worth $5,000. If a trader has a leverage of 100:1, he/she can purchase assets worth $100,000.

Stock Leverage Examples

Assume you'd like to trade the FTSE 100. You are confident that the FTSE 100 will rise in price in the next 24 hours after analysing the chart. So you decide to increase the leverage on your trades to 5:1.

You have a balance of $500 in your trading account. You use a 10:1 leverage, so your trade is worth %5,000. Later that day, the price of the FTSE 100 increased by 3%. In most cases, your $500 order will result in a profit of $15 ($500 x 3%).

However, if you use a 10:1 leverage, your profit is $150 ($15 x 10).

| Available Funds | Leverage | Position Size | Price Change | New Position Size |

|---|---|---|---|---|

| $100 | 1:2 | $200 | 10% -10% | $220 $180 |

| $100 | 1:5 | $500 | 10% -10% | $550 $450 |

| $100 | 1:10 | $1,000 | 10% -10% | $1,100 $900 |

YOUR CAPITAL IS AT RISK

As you can see from the example above, applying leverage can increase your profits when the trade goes according to your wishes. However, investors need to also remember that leverage can also amplify your losses.

Which Markets Can You Use Leverage On?

Forex, CDF, equity, indices, stocks, cryptocurrency, and Exchange Traded Funds (ETF) markets are among the markets that traders can use with leverage.

Leverage vs. Margin

Leverage is defined as a tool traders can use to increase their potential position size, while margin, on the other hand, is the amount of money required as collateral in your account in order to trade with leverage.

1: 100 operating leverage means that the trader will need 100 times less money, i.e. 10 units, to open a position of 1000 units of the base currency.

This sum of money is known as the margin, and it is the amount that the broker holds until the opened position is closed.

The following is the general formula for calculating margins:

Margin equals the number of positions (contract size, lot) divided by the leverage.

For example, if you use 1: 2 leverage to enter a $100 trade, your margin requirement is $100/2 = $50.

Tips for Using Leverage in the Stock Market

Traders must first: before trading with borrowed funds, traders must:

- Learn how to create and tailor risk management strategies for each trading system. They must be careful to increase risk in a quiet directional market while decreasing risk in a volatile market.

- Learn to control emotions and let go of greed, joy, and the desire to compensate for losses. Risk management is vital.

Only when beginners are confident in their skills and abilities should they begin trading with real money. A good leverage for beginners on a real account is 1:10.

Pros and Cons of Leverage in Stocks

| Pros | Cons |

|---|---|

| Improve Capital Efficiency -One of the primary advantages of leverage trading is that it allows you to access additional funds for specific trading positions. | Higher Losses – Everything has two sides, including leverage trading. While it has the potential to boost your profits, it also has the potential to significantly increase your losses. |

| Increase Profits – Leverage effectively increases your profit potential. | Increased Risk – An increase in total open trading volume is associated with increased risk. A rise in position volume raises the value of a point. As a result, your potential loss grows. A rise in risk can also impact your trading psychology. |