In India, the combination of a ‘young’ population of 1.38bn, established footholds in innovative sectors such as tech, and strong regulatory governance ticks a lot of boxes. As a result, the potential for growth and long-term returns is attracting investors from all over the world.

Since March 2020, India’s Nifty 50 index of the largest stocks listed in the country has increased in value by an eye-watering 130% – but there could be further gains to be made. Indian listed stocks aren’t the only way to buy into the country’s success story. A range of well-known multinationals are also positioned to benefit from their strong exposure to one of the world’s most exciting economies.

Identifying the right long-term investment opportunities involves using fundamental analysis to find the right target and technical analysis to optimise trade entry points. Used in conjunction, they offer a way to spot and buy the best long-term stocks in India.

Nifty 50 Stock Index Continues Its Upwards Trend

Source: IG

Best Undervalued India Stocks

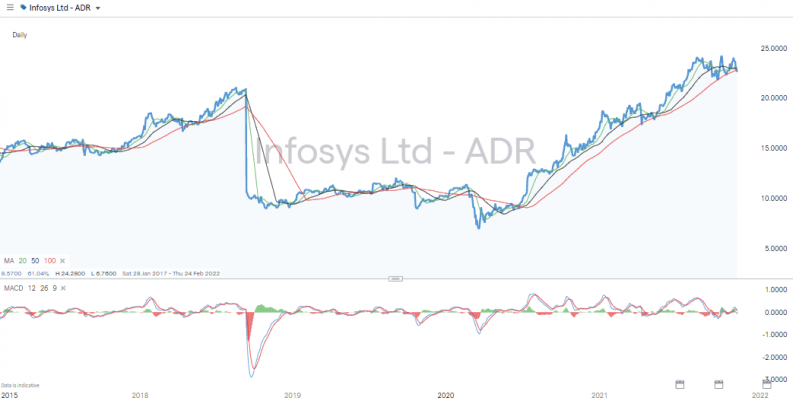

1. Infosys

Any shortlist of top India stock picks has to consider IT and outsourcing giant Infosys. The Bangalore-based firm has a global client base that spreads across more than 50 countries, which it supports from largely India-based offices. Infosys has been operating for more than 40 years, and with a market cap in the region of $96bn, the firm offers a secure route into a growth sector.

Big names including Goldman Sachs use services offered by Infosys, and the Covid-19 pandemic and ‘the new way of doing things’ has seen more interest in the outsourcing and consultancy services offered by Infosys. The firm employs more than 267,000 people.

Infosys Share Price – 2018-2021

Source: IG

The many recent successes of Infosys have resulted in it outperforming the Nifty 50 index. Infosys stock rose by more than 230% from the lows of March 2020. By Indian standards, it pays a healthy dividend with the current yield being in the region of 1.78%. The P/E ratio is relatively high but in line with the tech sector and supported by the improving balance sheet fundamentals.

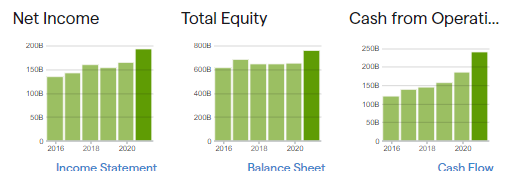

Infosys – Balance Sheet

Source: IG

Highlights from the financial results for the six-month period up to 30th September 2021 include:

- Infosys Ltd ADR revenues increased 19% to RS574.98bn

- Net income increased 17% to RS106.16bn

- Financial Services and Insurance (FS) segment revenues increased 23% to RS187.83bn

- Retail, Consumer packaged goods and Logistics (RCL) segment increased 21% to RS85.05bn

- Manufacturing (MFG) segment increased 32% to RS59.21bn

- North America segment increased 21% to RS355.38bn

Source: IG

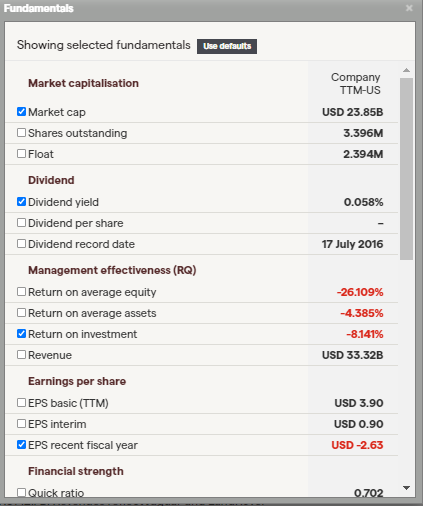

Infosys – Fundamentals

Source: IG

Infosys shares can be traded using local brokers or using the ADR (American Depositary Receipt) version of the stock, which is listed on the New York Stock Exchange and available to trade at offshore brokers.

2. Hindustan Unilever

Hindustan Unilever is a subsidiary of UK-listed multinational Unilever. The consumer goods company has a head office in Mumbai and makes a range of products set to be in greater demand as average income levels in the Indian population increase. Its products include foods, beverages, cleaning agents, personal care products, water purifiers and other fast-moving consumer goods.

Unilever Share Price – 2015-2021

Source: IG

The share price of Unilever has lagged behind those of other sectors. One reason for this is the potential risk posed by inflation. As the price of raw materials increases, manufacturers are faced with the challenge of being able to pass the extra costs onto consumers. This can’t be guaranteed, and the risk of shrinking profit margins goes some way to explaining the flatlining of the share price over recent years.

One alternative view that long-term investors could take is that the bad news about inflation is already largely priced in. The term the ‘great resignation’, which has been coined to explain high levels of staff turnover post-Covid, could allow workers to drive up wages and at the same time consumer spending power.

Commodity prices continue to be at elevated levels

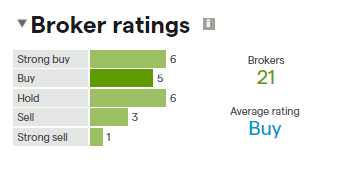

Unilever is one of the largest firms in the world with a market cap in the region of £100bn. It might not offer the same growth potential as a tech start up, but the low P/E ratio of 18.4 suggests the share price could be undervalued, and the average analyst rating on the stock is ‘Buy’.

Unilever Broker Ratings – Still a Buy

Source: IG

One key consideration for long-term investors is dividend yield. A lot of the charts showing exponential share price growth over several years stress that such returns are associated with reinvesting dividends into more company stock rather than taking a cash pay-out. For many, that is the secret of successful long-term investing. The good news for those considering investing in Unilever is that it has a history of paying generous dividends, which can then be reinvested back into more stock.

Unilever – Strong Fundamentals

Source: IG

The firm’s policies on waste and environmental issues suggest it is aware of the need to future-proof its products from growing consumer concern about environmental issues. Being the greenest operator in a market can now be good for the trading bottom line, and Hindustan Unilever claims it will be able to achieve ‘100% plastic waste collection’ by the end of 2021.

Technical Analysis of Unilever

From a technical analysis perspective, the Unilever share price is approaching a fork in the road. The descending wedge pattern, which dates back to 2019, suggests Unilever could continue to trade sideways in the near future, but at some point, something will have to give. The strong support in the region of £37 marks low price points in Feb 2018, March 2020 and March 2021. Breaking below this price level would require considerable selling pressure, and a breakthrough of the upper trendline would appear to be the path of least resistance.

Unilever Share Price – 2015-2021 Trading Into a Wedge Pattern

Source: IG

Highlights from the financial results for the six-month period up to 30th June 2021 include:

- Unilever plc revenues increased less than 1% to EUR 25.79bn

- Net income decreased 5% to EUR 3.12b

- Food & Refreshment segment revenues increased 4% to EUR10.2b

- Asia/AMET/RUB segment increased 2% to EUR12.04b

- Europe segment increased 1% to EUR 5.73bn, also reflecting Beauty & Personal Care segment decrease of 2% to EUR10.41bn

- Home Care segment decreased 3% to EUR 5.18bn

Source: IG

3. Tata Motors Ltd

Automobile manufacturer Tata Motors offers a full suite of vehicles to a global client base. It has operations in the UK, South Africa, South Korea, China, Austria, Brazil and Slovakia, but is very much an Indian firm with its headquarters located in Mumbai. It makes cars, SUVs, trucks, buses, defence vehicles and electric vehicles.

EVs are a hot topic at the moment, and Tata has got off to a strong start in that market. Tata Motors' overall share of electric vehicle sales in its 2020 reports stood at 43.3%, and an official statement announced that this booming market is poised for further growth in 2021 and beyond.

There is fierce competition in the sector, and Elon Musk’s Tesla Inc may dominate the headlines, but sales of Tata’s entry-level EVs can be expected to skyrocket once the tipping point in terms of EV charging infrastructure is reached. The network needed to support EVs is still being developed, which is why Tata could pay off as a long-term investment.

Long-term upgrades to the financial health of the firm are also planned and could help the Tata Motors share price. Management has recently announced plans to turn debt-free by 2024 by selling stakes in Tata Technologies Ltd and Tata Hitachi Construction Machinery Co. Pvt. Ltd.

Tata Motors Ltd – Daily Price Chart 2015-2021

Source: IG

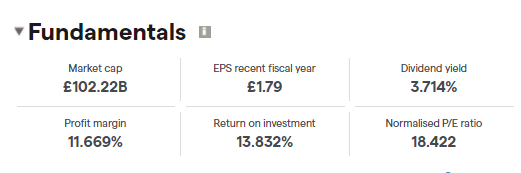

Tata Motors has a market cap in the region of $23bn, which offers some security to investors, and the dividend yield of 0.058% – while modest – at least demonstrates the firm is not averse to the idea of sharing profits with investors.

Dividend yields can be expected to improve as debt is offloaded from the balance sheet, and if the firm starts returning more cash to investors, big institutional funds such as pension funds can be expected to move in to buy Tata stock. Increased interest from those ‘buy-and-hold’ investors will offer long-term support to the share price.

Tata Motors Ltd – Fundamentals

Source: IG

Tata Motors stock can be bought on the domestic exchange or the internationally tradable ADR (American Depositary Receipt), which is listed on the New York Stock Exchange.

For the fiscal year ending 31 March 2021, Tata Motors Limited (ADR) reported that:

- Revenues decreased 4% to RS2.482trn

- Net loss increased 25% to RS142.7bn

- Jaguar and Land Rover segment revenues decreased 7% to RS1.927trn

- Commercial Vehicle segment decreased 8% to RS331.78bn

- Rest of World-segment decreased 24% to RS351.66bn

- United States segment decreased 10% to RS467.58bn

Source: IG

The price breakout in December 2020 burst through the downward resistance trendline, which dates back to 2015. Since then, the Tata share price has increased by more than 88% in value, and the strength of momentum suggests there’s little chance of the stock price falling back into that downward channel. A short-term pull back can’t be discounted but could represent a buying opportunity with the next (and final) major resistance level formed by the all-time high of 51.73 printed in 2015.

4. Google (Alphabet)

Tech giant Google may be headquartered in the US, but the Hyderabad development centre is the largest one the firm has outside of North America. The Google India subsidiary of Google Inc. also has offices in Bangalore, Mumbai and Gurgaon. Google India has 20,000 employees.

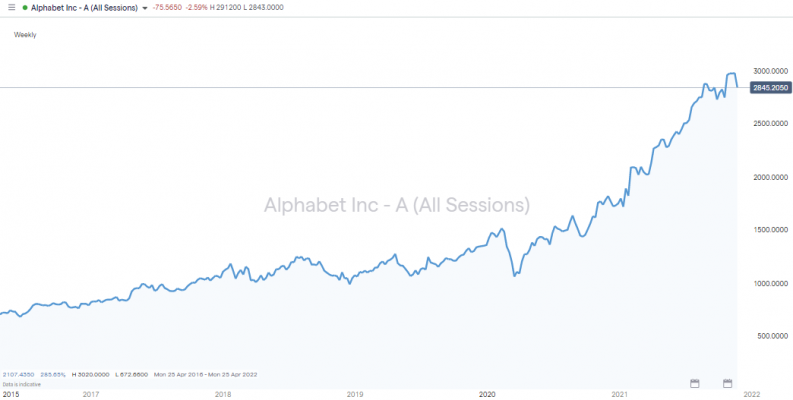

Google (Alphabet) Share Price 2020-2021

Source: IG

Like many investors, Google has identified India as a potential growth market. As well as running its own branded operations, the firm also invests in start-up projects to improve its chances of the ‘next big thing’. In 2020, Google CEO Sundar Pichai announced a new digitisation fund. He stated that Google will invest $10bn in India over the next five years. The ventures to receive support include equity investments, joint ventures and operational, infrastructure and ecosystem investments.

Google (Alphabet) Share Price 2020-2021 with Trendline Support

Source: IG

Google’s impressive +160% stock price rally from March 2020 has recently found support from a year-long trendline. While that support line holds, dips that touch it but don’t break it represent opportunities for long-term investors to take on long positions at optimal prices.

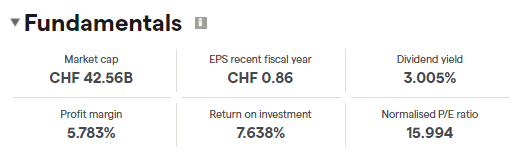

5. ABB India Ltd

ABB is a leading global technology company with a market capitalisation of approximately $42bn and a track record of over 130 years in transforming social and industrial processes. The Swiss firm is a global operation with employees in more than 100 countries, and it specialises in long-term infrastructure and technology projects. These can take years to come online, but when they do, they generate substantial returns to investors.

Unsurprisingly, ABB has targeted India as a good place to do business. ABB India Ltd is setting up an ecosystem of charging stations for electric vehicles in India, which is estimated to be a $3bn per year opportunity. The global shift to EVs is mirrored by the steps taken by some of India’s state governments to set up dedicated policies to support EV adoption.

ABB Share Price – 2015-2021

Source: IG

The EV opportunity is just one of ABB India Ltd.’s business lines. It is also a market leader in electrification, robotics, automation and electric motors. Those who decide to buy stock in ABB are well positioned for the long haul. The firm combines the security associated with a strong historical track record and forward-looking projects in growth sectors.

One other long-term trend to consider is a shift towards ethical investing. Big institutions are managing investment mandates, which include requirements on the subject of ESG (Environment, Social & Governance) and CSR (Corporate Social Responsibility). These two buzz words look set to become increasingly important, and the stocks of firms such as ABB that are ‘on message’ look set to gain from an inflow of investor cash.

The good news for ABB investors is that the firm has a solid track record of generating dividends. Even through the Covid-19 pandemic, its operations still managed to generate +3% dividend yield. It also has a relatively modest P/E ratio of 15.99, which means there is room for further stock price gains before it begins to look overvalued.

ABB – Fundamentals

Source: IG

Technical Analysis of ABB

Those who consider that the fundamentals of ABB make it a prospective long-term investment can finesse their trade entry point using technical analysis.

ABB Share Price – 2020-2021 – Double-bottom & Resistance

Source: IG

In August and September, the stock printed at prices last seen in 2008. This bullish price signal followed a 20-month bull run and a breakout of a +10-year trading range. The recent slide in price can be interpreted as the stock taking a break rather than a full-blown reversal. October’s double-bottom price pattern in the region of CHF 30 signals considerable support at that level.

ABB Share Price – 2000-2021 – Price Channel & Break Out

Source: IG

While FOMO will come into play, there is a chance for more price weakness and optimal entry into long positions. Those playing an even longer game could wait for the price to break higher than the September 2007 high of 34.84.

How to Buy Stocks in India

Most of the workload associated with building a successful stock portfolio is carried out before trading. A successful research and analysis stage involves identifying targets as well as trade entry and exit points. In addition, there are other factors to consider that can help you make the most out of your investments.

Portfolio Risk Management

The above shortlist of the best long-term stocks to buy in India is made up of companies in a wide range of industrial sectors. Investing in different areas of the India economy can diversify risk and smooth out returns as stocks don’t all go up and down at the same time.

If one sector, such as India tech, is just too much to resist and the target of most of your capital, then taking small positions in a lot of stocks also mitigates against single stock risk, the chance that one of the positions may go badly wrong. Trading in small sizes can take the emotion out of investing and avoid the risk of rash decisions being taken during a time of market upheaval. It’s also worth remembering that investing in the markets should be limited to amounts of money that you can afford to lose.

Operational Risk

Thanks to some revolutionary technological upgrades at online brokers, the trading experience is now extremely user friendly and can be done from desktop or mobile devices. The functionality of the platforms, markets offered, and terms and conditions can vary from broker to broker, and it’s important to find a good fit. Of equal importance is the need to ensure your broker can be trusted. Listed below are five simple steps to make sure you don’t make any slip-ups when putting trades on.

1. Choose a Broker

The most important factor to consider when choosing a broker is the security of your funds. There are scammers operating in the market, and there is nothing more disappointing than making a paper profit to only realise you’ve been scammed. The first basic rule to follow is to select a broker that is regulated by a Tier-1 authority, such as one of the following:

- The Monetary Authority of India (MAS)

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The U.S. Securities and Exchange Commission (SEC)

- Cyprus Securities and Exchange Commission (CySEC)

- Securities and Exchange Board of India (SEBI)

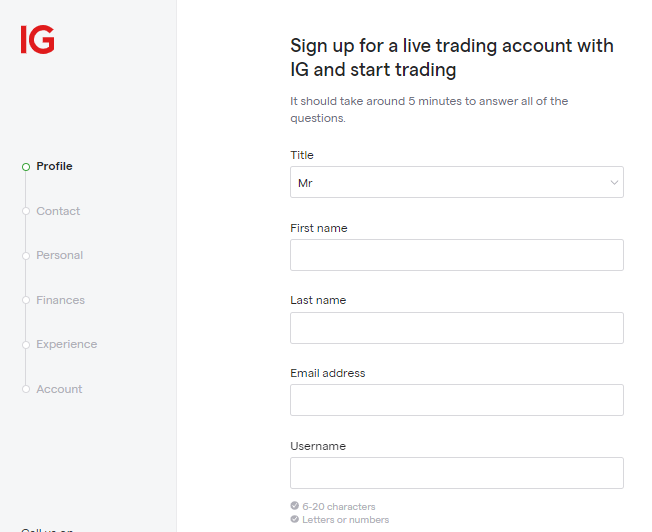

2. Open and Fund an Account

An account with a global online broker is very similar to any other online bank account and involves sending funds to a third party. For that reason, the registration and ID verification process require sharing KYC (Know Your Client) information so that you, and only you, have access to your account. The process typically takes less than 10 minutes to complete and can be done from a desktop or handheld device.

Brokers regulated by Tier-1 authorities must also comply with Anti-Money Laundering (AML) laws, with one requirement being that funds must be returned to the account from which they originally came. That cuts down the risk of someone gaining access to your account and forwarding money on to a scammer’s account.

Source: IG

Most brokers offer a minimum of 10 different payment options, which means clients can transfer funds using debit and credit cards, bank transfer and ePayment apps. Brokers typically don’t apply any charges on deposits, but it’s worth checking if there are commissions on withdrawals and if your paying agent will add on any costs.

The time to process payments also varies according to which route you take. With long-term investing involving a degree of patience, there is an obvious benefit in choosing the most cost-effective transfer method so that administrative costs don’t eat into returns before you’ve even started trading.

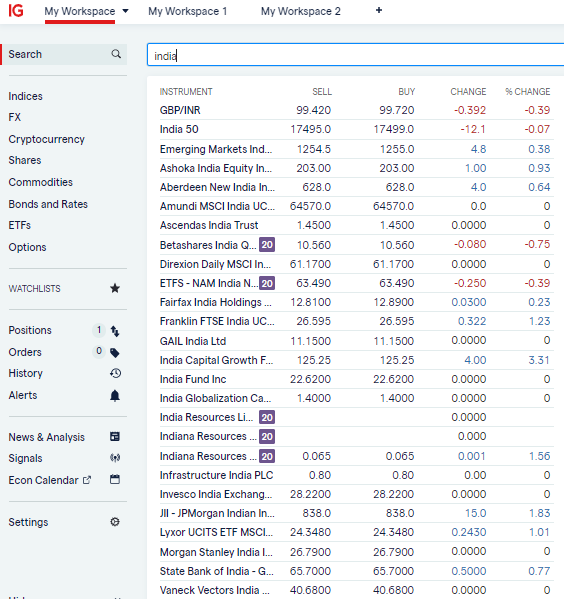

3. Open an Order Ticket and Set Your Position Size

Offshore broker platforms pride themselves on their user-friendly functionality. At IG, for example, it’s possible to filter by country and pull up an extensive list of India stocks that the broker offers markets in. Stock picks in India are a hot topic at the moment, so having a broad range to choose from is certainly a plus point.

Source: IG

Clicking on any of those listed markets takes you through to the dashboard for that stock, where you'll be able to access price charts, financial statements, broker ratings and news reports. The trade-execution interface has data fields where you can input the quantity of the stock you want to buy, as well as a ‘Buy’ button that executes the trade when pressed.

Source: IG

One important check is to make sure you’re buying the share outright rather than in CFD (contract for difference) form. Buying outright involves the broker going into the market to buy a stock position and then placing it in your account. CFD trading involves clients having a direct agreement with the broker about price.

CFDs have a lot of advantages over stock trading, such as being able to sell short or use leverage. This is why they are popular with traders using short-term strategies, but long-term investors would come undone due to the daily financing charges associated with CFDs. These charges would rack up over time and eat into any returns and can be avoided by buying the stock outright.

4. Set Your Stops & Limits

There are other risk management tools available to investors that can help enhance returns. Stop-loss instructions are orders built into the system that will automatically sell some or all of a position if price goes in the wrong direction. Take profit orders work in a similar fashion but lock in gains if price reaches a certain level. Both instructions can be added and removed from trading positions at a client’s discretion.

Long-term investors need to be aware of the benefits of stop-loss and take profit instructions, but buy-and-hold investors often avoid using them. The view taken is that a short-term price crash could kick them out of a position that would ultimately come good. Take profit orders will lock in gains but cap potential upside when a stock finally gets going.

5. Make Your Purchase

Whether you’re using a desktop or mobile device, the final act of opening a new trade is simply a case of clicking or tapping ‘buy’. At that point, part of your cash pile will be converted into a stock position, and the value of that position will be 100% dependant on market price.

Accessing the Portfolio section of the platform will allow you to monitor the unrealised P&L (profit and loss) on the position. It is also possible to set price alerts so that you receive a message if the price reaches key price levels.

Visiting the Portfolio area of the platform after executing a trade allows you to carry out one final check. It is crucial to double-check you traded in the way you intended to. Even experienced traders make ‘fat finger’ errors and click sell instead of buy or input the wrong amount. Errors like these that are not corrected immediately can turn out to be very costly.

Summary

Once your research is completed and trades have been executed, then investing in India stocks can be a lot about sitting back and monitoring performance. If you want to practise building a portfolio before using real cash, that is possible too thanks to demo accounts, which offer new traders a chance to get familiar with the mechanics of trading. They’re free to use and a great way to test out new strategies and trading ideas. Since they use live prices, it is possible to very quickly see if your decision making is heading in the right direction.

The impressive returns made by Indian stocks are attracting local and overseas investors, and many are looking to make long-term investments. The willingness to buy and hold is based on strong fundamental factors such as the United Nation predicting that India is due to become the most populous nation in the world by 2022. The heavy weighting towards industries of the future is another plus point.

Those who follow the simple guidelines around risk management and how to find a trusted broker will find that buying Indian stocks has never been easier or safer. Once the hard work of fine-tuning your selection has been completed, following the step-by-step guide will take you into the markets. Then it’s a matter of monitoring and waiting for the hoped-for returns to show up in your account.