Key points:

- The Digital Bridge stock price is not down 75% today

- Exactly the opposite, it's up 300% today

- Why are the exchanges recording this the wrong way around?

One of the little mysteries of modern life is why Digital Bridge Group (NYSE: DBRG) stock is listed as being down 75 (OK, 73.83) percent when in fact the share price is up some 300%. That stock prices can indeed move these sorts of amounts is correct, that stock markets should be able to report them correctly is one of those hopes that we have. Currently the NYSE has this the wrong way around and that's then feeding through into other tickers across the trading universe.

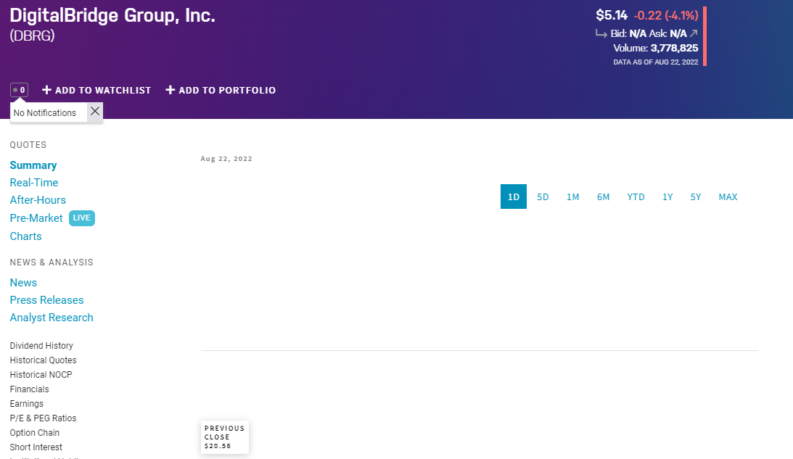

As you can see here:

We've a previous closing price of over $20, with a current quote at $5 and change. A 75% fall. If we look at Google then we see something different:

Also Read: AT&T Stock Forecast

Yesterday's – and preceding – price was $5 and change. It's today's price which should be $20 and change, leading to a 300% Digital Bridge stock price rise, not the recorded 75% fall. The problem here – the problem with the price reporting – is simply that NASDAQ (or the NYSE itself) has the data entry the wrong way around. Which isn't a good look for a stock market to be fair about it.

As to what's actually happening this is, of course a stock split, but it's also a reverse stock split, a consolidation to Brits. This was announced back on July 5, with the change to take effect today. Four pieces of old stock now become one piece of new stock – a 300% nominal price rise should happen. Not a 75% price fall, as the ticker is recording.

As to why do stock splits at all, this is purely fashion. The New York market has this idea that a proper, sound and sensible, company should have a stock price in the $10 to $100 range. So, companies will manipulate the number of shares in existence to keep the price in that sort of range. Thursday sees Tesla issuing more stock to bring its price down, Google has done the same recently.

It's more common for us to see reverse stock splits – consolidations – when stock prices are under a $. Because if a stock price stays down there in the pennies for long enough then the NYSE or NASDAQ quote can be lost. “Penny stocks” having a bad name for manipulation and so on therefore the Big Boys don't want those on the Big Boy exchanges.

We can also show that this is purely fashion because that solid and dependable company share price range in London is £1 to £10. This is why most London quoted ADRs are 10 pieces of the original stock – to get into that fashionable range on both ends.

Here Digital Bridge isn't fighting the NASDAQ rules – well, not unless they think there's some seriously bad numbers coming down the pike – so the reverse stock split is simply to get the nominal price back up into that fashionable range between $10 and $100. In the absence of any significant improvement in the business performance they've had to do it by changing the number of shares in issue.

All that remains to wonder is why the exchanges are getting the price changes the wrong way around.