Nano Nuclear Energy Inc. (NASDAQ: NNE) is drawing increased attention this week, closing Thursday’s session at $38.95, up 5.5% on the day. This uptick reflects growing confidence in the company’s microreactor technology and recent financial moves.

The stock’s performance comes amid speculation that NNE may be undervalued compared to peers like Oklo (OKLO) and NuScale Power (SMR). The buzz is fueled by news of successful private placements and advancements in their ZEUS microreactor technology.

NNE’s stock price has been on the move this year, with the YTD gain of 62%, and 183% gain on the last 12 months offering up some impressive outperformance.

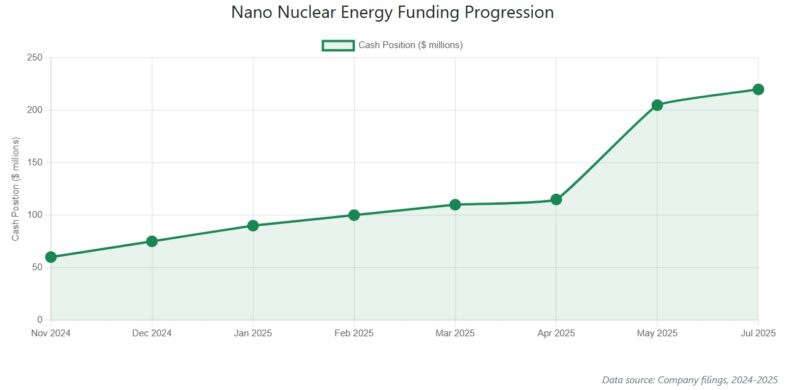

A key driver of the recent enthusiasm is the successful closing of a $105 million private placement in May. This influx of capital, combined with a previous $60 million placement in November 2024, has bolstered NNE’s cash reserves to over $200 million.

“These funds are earmarked to expedite the development of portable nuclear microreactor technologies and drive growth toward initial revenue generation,” the company stated following the November placement.

NNE’s ZEUS microreactor is a focal point, with the company recently filing six new utility patent applications related to its design. The ZEUS design boasts a solid-core battery reactor with a fully sealed core, utilizing a highly conductive moderator matrix to dissipate fission heat.

The elimination of fluid inside the core reduces the risk of coolant accidents. The reactor’s design allows it to fit within a standard shipping container, enhancing transportability to sites lacking conventional energy infrastructure.

The advanced nuclear energy sector is experiencing a surge in interest, driven by growing electricity demand and support from tech giants. Microreactors, with capacities under 20 MW, offer rapid deployment and are attractive to energy-intensive industries.

Despite positive analyst sentiment, the lack of concrete revenue and net income figures should give investors pause. The advanced nuclear energy sector faces challenges such as high initial costs, complex licensing processes, and regulatory hurdles.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- IG Top-tier regulation – Read our Review

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY