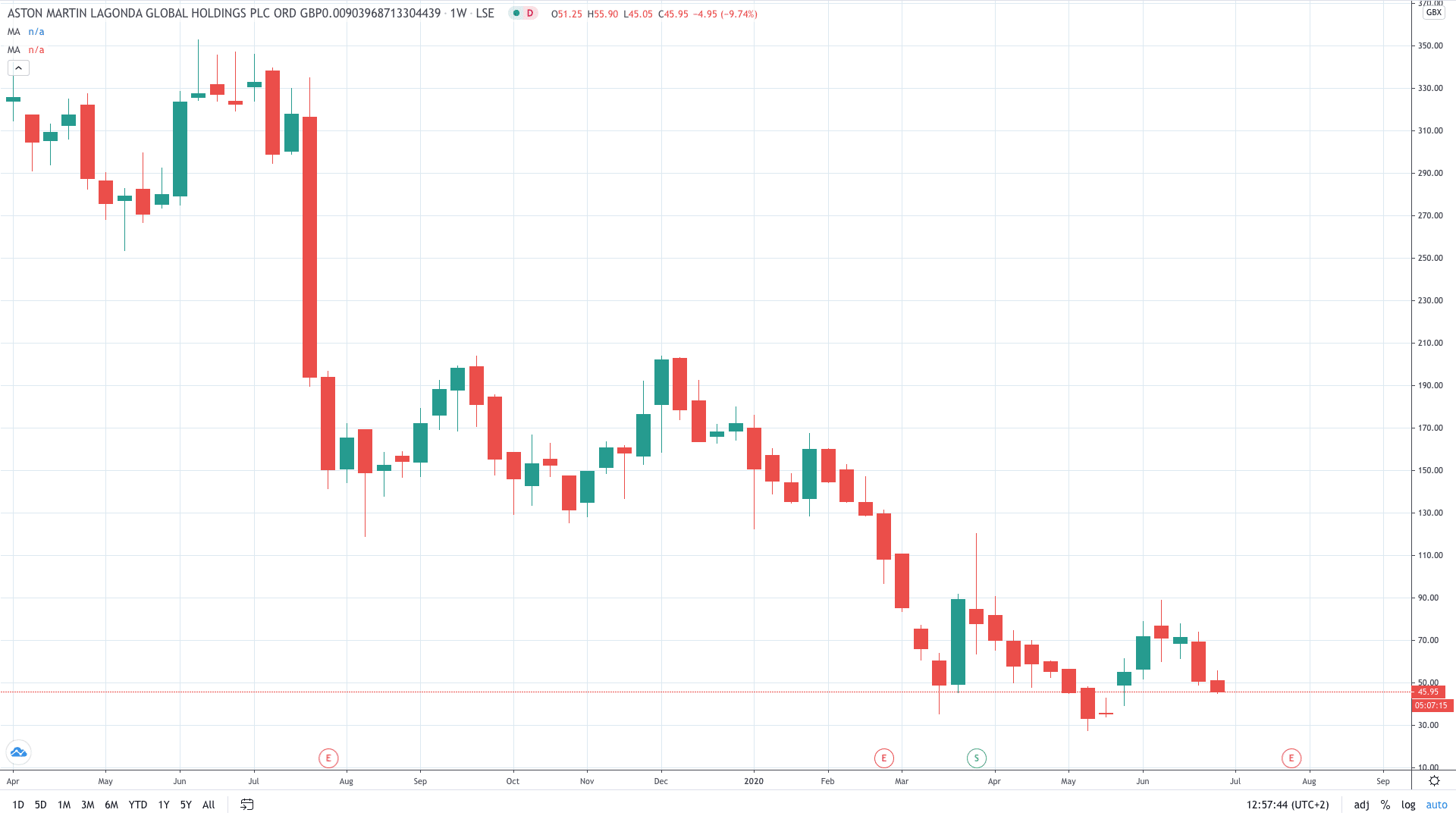

Shares of Aston Martin Lagonda Global Holdings PLC (LON: AML) have collapsed 9% today after Deutsche Bank slashed its price target for the stock.

The banking giant said it expects a bleak performance from the car-maker in the second quarter. Last week, Aston Martin announced it is seeking to raise around £180 million to bolster its finances.

“Today we announce further steps to improve financial flexibility in a period of ongoing uncertainty with this additional funding to execute the business plan,” new chief executive Lawrence Stroll said in a statement.

The company also said that the Q2 sales are “expected to be below first quarter’s take”.

This warning prompted Deutsche Bank to issue a note today to cut the stock price target from 40p to 35p. Still, Deutsche has kept a “hold” rating for the Aston Martin stock.

The banking giant now expects losses to exceed £80 million in addition to negative free cash flow.

Shares of the company are trading around 9% lower near 45.00p. Aston Martin share price has lost nearly 40% in the last two weeks. Still, shares trade at a premium of 23% compared to Deutsche’s target price.

Aston Martin is due to present its second-quarter results on July 29.

- You can trade Aston Martin shares with the best stock brokers

- Learn the fundamentals of the stock trading