- Gold’s week-long break with normality continues.

- The traditional safe-haven asset initially rallied due to increasing concern over the coronavirus outbreak.

- Then on 9thMarch, everything changed. Gold prices fell just as orthodox theory would have predicted the opposite.

- The anomaly offers a succinct insight into the state of the broader markets.

- It also offers a trading opportunity in the metal.

One significant feature of the current market meltdown is the apparent breakdown of gold’s status as a safe-haven asset. As concern grew over the outbreak of Covid-19, the price rallied. The move from $1,517 per oz on 1st January to $1,703 on 8th March was in line with standard economic theory and reflected increasing geopolitical uncertainty. The near 15% price crash to $1,455 in the next six trading sessions is an alarming disconnection. The reasons for it lift the lid on what is going on in the wider markets and also gives an insight into when and why gold might rebound.

Gold — December 2019–17th March 2020:

The two main reasons for the fall in prices are demand for liquidity and a dramatic retreat into even ‘safer’ cash.

The liquidity aspect of the crash illustrates the extent to which investors had scaled up on riskier positions. An element of hubris permeated the markets at the turn of the year. The majority of analyst projections predicted equity markets would be positive in 2020. Not wanting to appear greedy, even uber-bulls held little hope of repeating the stellar performance of 2019. The S&P 500’s rise of 30% was always going to be hard to repeat. Looking ahead to the next 12 months, Graeme Wearden wrote in The Guardian:

“Investors are expecting 2020 to bring further rising asset prices and lively merger activity.”

Source: The Guardian

The coronavirus scuppered those plans and as riskier assets continued to drop in price, positions in gold were liquidated to meet margin calls on other highly leveraged trading books.

The liquidity crunch illustrates the distress in the markets and is rare but not unprecedented. Moving out of gold into cash is an even stronger signal of the scale of panic gripping the markets. Despite two emergency rate cuts by the US Fed, traders have been piling into the US currency. The fact that near-zero interest rates mean there is no return on cash balances the attraction of being in the most liquid asset of all has seen the dollar index rally by 4.38% in four days.

US Dollar index (DXY) — 7th February–17th March 2020:

Liquidity trap

After a decade of pumping liquidity into the markets, it comes as something of a surprise that central bankers are now taking steps to ensure the global economy doesn’t run out of cash, in particular US dollars. Quantitative easing and record-low interest rates fuelled an asset bubble of record proportions. Events of the weekend point to drastic measures being taken to administer more of the same medicine as central bankers fear a liquidity crunch like that seen in 2008. Those looking to trade further downward movement in the market need only consider how low prices would go if a financial meltdown accompanied a coronavirus breakdown of economic activity.

The US Fed’s decision of Sunday, to set target interest rates at just above zero grabbed the headlines, but the detail of the announcement reveals a dollar liquidity plan. The dollar overnight index swap market doesn’t usually drive the direction of the markets, but it could be about to.

That the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank worked in unison on the plan gives an indication of its importance.

Pricing on the standing US dollar liquidity swap arrangements was lowered by 25 basis points, so that the new rate will be the US dollar overnight index swap (OIS) rate plus 25 basis points.

The term of the swap is also being extended from the typical weekly cycle to 84 days. The Fed announced that offering cheaper money for longer will reduce the strain on “the supply of credit to households and businesses, both domestically and abroad” (source: Federal Reserve).

The fact that a concerted approach was adopted also provides support to the badly beaten up bulls. Bloomberg reported on Shigeto Nagai, chief Japan economist at Oxford Economics in Tokyo, who said:

“I initially worried that the U.S.-first Trump administration may hesitate.”

Source: Bloomberg

Nagai continued:

“For international financial markets, where the U.S. dollar dominates as an international currency, strong U.S. leadership in containing global market disruptions is still essential.”

Source: Bloomberg

Credit lines

Large corporations operating in the airlines, casinos, hotels and energy sector all took up options to extend their credit lines last week. Boeing, Hilton and Wynn being notable names. This is something to be expected as the spread of the disease creates existential problems for those industries. What was not expected is consumer firm Kraft Heinz announcing on Monday that it was drawing down up to $4bn of its credit line. The ketchup to noodles manufacturer is seen as one of the few firms that is well-positioned to ride out the storm. A statement from the company said:

“The demand for our brands, our cash flow and our balance sheet remain strong… As a matter of practice, we typically maintain a conservative liquidity posture, which is even that much more important as we focus on making sure all our products remain available to the public during these challenging times.”

Source: ZeroHedge

The firm’s hoarding of cash comes at a time when it is struggling to meet unprecedented levels of demand for its products. They are selling out so quickly that supermarket shelves holding its products are stripped bare. With this being the case, it’s easy to understand the move in the markets, out of gold and into cash.

Reverse engineering and trade entry points

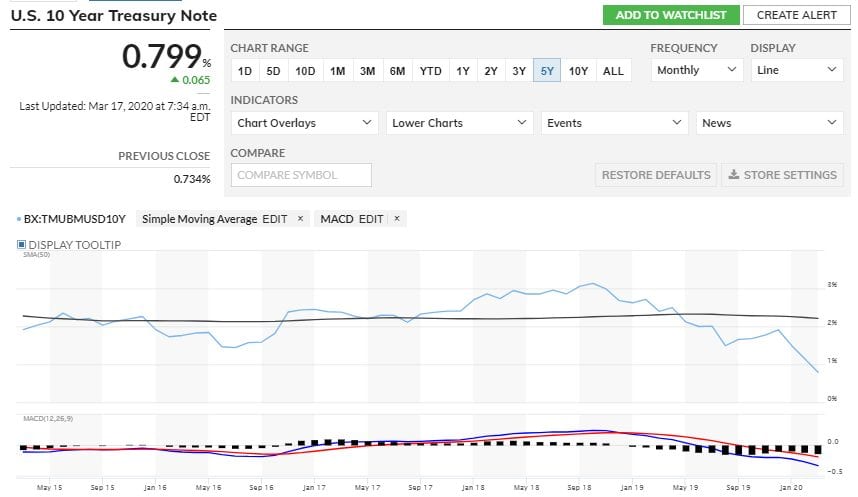

As and when the process reverses, a buying opportunity in gold will benefit from the same factors operating in the other direction. One scenario includes world leaders announcing a fiscal stimulus and economic support package. Recent moves by central banks mean they now have little ammunition. From a political standpoint, they have also moved out of the way and passed the responsibility for policy intervention to governments. Germany actually operates a fiscal surplus and other less prudent nations have governments that can borrow long-term debt at near-zero interest rates. US Treasuries with a 10-year maturity currently yield/charge an interest rate of 0.799%.

US Treasury — 10-year note (TMUBMUSD10Y) — five-year price chart:

The question for gold-bugs is whether a rush back into riskier assets would bypass gold. The argument that this is unlikely stems from the continuing uncertainty regarding the economic and social impact of the Covid-19 disease. Gold remains a safe-haven asset, it’s just not the safest at this moment in time. The forced selling means that it’s also cheap.

Gold vs USDX — year-to-date chart — 17th March 2020:

Gold has for thousands of years been seen as a safe-haven asset. The divergence since 9th March can be explained by that suddenly no longer being the case or a temporary blip caused by short-term necessity.

Gold — daily candles — June 2019–16th March 2020:

Nick Crawley, analyst at DailyFX highlights the importance of the 200-day moving average.

“Gold has dropped through old horizontal support levels with ease and the only technical indicator that may help buttress the price is the 200-dma. Despite trading below this long-term indicator, gold has not closed below here and until it does the 200-dma may provide some support.”

Source: DailyFX

Gold — daily candles — year-to-date — 17th March 2020:

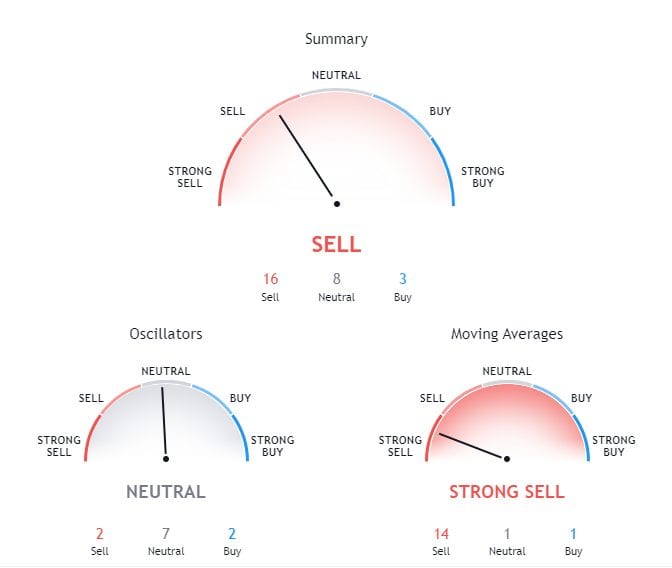

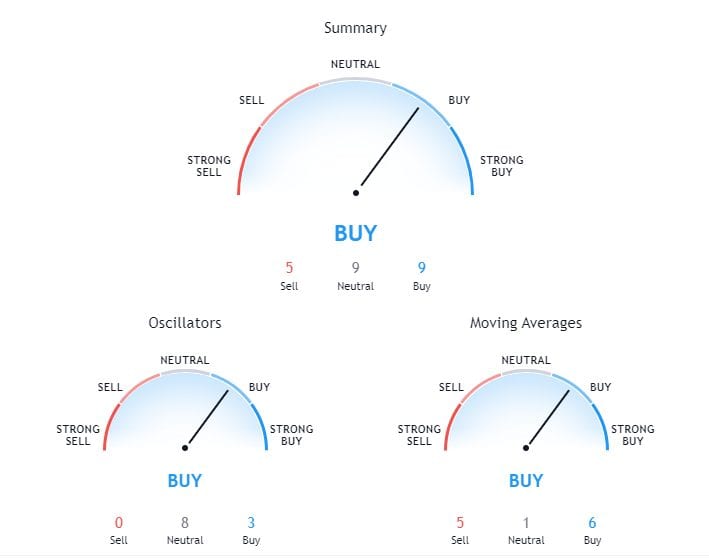

DailyFX has a ‘bullish’ status on the metal. The price action and daily technical dashboard are currently showing weakness, but there is more positivity shown in the monthly technical dashboard.

TradingView — technical dashboard gold — daily:

TradingView — technical dashboard gold — monthly:

It might be time for the market to recall the advice that a small holding of gold fits well into a diversified portfolio. There are profits to be made but, given the volatility and irregular market conditions, the emphasis should be on trading in small size.