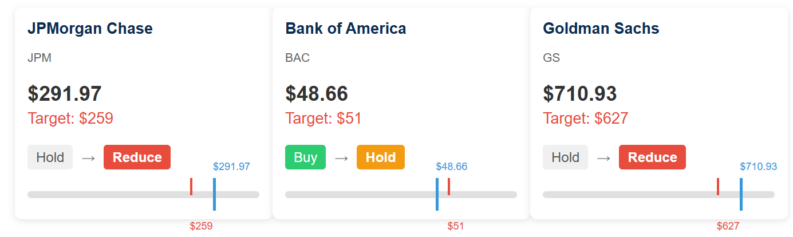

HSBC has issued downgrades for major U.S. banks ahead of next week’s upcoming earnings season. JPMorgan Chase (NYSE:JPM) and Goldman Sachs (NYSE: GS) were both downgraded from “Hold” to “Reduce” with price targets significantly below their current trading prices, suggesting HSBC believes these stocks are overvalued.

Bank of America’s stock (NYSE:BAC) was downgraded from “Buy” to “Hold” with a price target slightly above its current price, indicating limited upside potential. These downgrades, coming just ahead of the mid-July earnings releases, suggest that HSBC anticipates challenges or limited upside for these institutions despite their recent resilience.

The timing of these downgrades is particularly noteworthy, as the banking sector has generally enjoyed a period of relative strength, buoyed by investor optimism regarding economic growth and a favorable interest rate environment. However, Martinez’s analysis indicates that the current valuations of these banking giants may have outstripped their fundamental growth prospects, leaving them vulnerable to potential corrections.

The HSBC downgrades are not occurring in a vacuum. Recent market volatility and macroeconomic uncertainties, including concerns about inflation and potential interest rate hikes, have created a more challenging environment for financial institutions.

Furthermore, recent credit rating downgrades from Moody’s Ratings, which affected JPMorgan Chase, Bank of America, and Wells Fargo, have added to the negative sentiment. Moody’s cited weakened prospects of federal support following the U.S. sovereign debt downgrade as a key factor in their decision. These downgrades could potentially increase borrowing costs and regulatory pressures for these institutions.

The implications of these downgrades are interesting in that they serve as a reminder that even the largest and most established financial institutions are not immune to market risks and valuation concerns.

Next week’s guidance and outlook could prove to be particularly illuminating, with the potential to shape much of the early part of earnings season ahead.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- IG Top-tier regulation – Read our Review

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY