Key points:

- IAG shares are down nearly 40% in the last 12 months

- But fundamentals such as travel demand and financials are improving

- The company expects to be profitable this year

International Consolidated Airlines Group (LON: IAG) is an airline holding company that owns carriers including Aer Lingus, British Airways, Iberia, Level and Vueling.

The company's share price has been pummeled since the start pandemic began, and despite a couple of attempts to break higher, it is firmly on the slide, down 17% in 2022 and almost 40% in the last 12 months.

Travel Demand Continues to Grow, But Staffing Issues Remain

We all know about the current airport chaos, and the IAG brands have not been immune to the trouble. With a lack of staff, as a result of the pandemic, airlines are struggling, and the labour shortage headwind may be around for another few months yet, continuing to weigh on IAG shares. The company has offered £1,000 bonuses to new employees, but it also faces the issue of a possible strike by current staff.

Also Read: The Best Travel Stocks To Buy Right Now

A strike ballot began last week, ending on June 23, with workers angry that a 10% pay cut set during the pandemic has not been reinstated – even though bosses have had their pay reinstated. If industrial action is voted for, it will take place during the summer holiday period and cause significant disruption for the company.

Following the release of IAG's results in May, the company's CEO, Luis Gallego, said: “Globally the travel industry is facing challenges as a result of the biggest scaling up in operations in history and British Airways is no exception.”

Despite the current issues, I think IAG, at current levels, is attractive as a long-term play.

Travel demand is rising significantly. In its results for the three months to March 31, IAG said “strong customer demand is expected to drive profitability from quarter 2 onwards,” a sentiment many other airlines have expressed. Business travel, something that is key for IAG’s British Airways brand, was also strong, the company said.

IAG passenger capacity in the first quarter was 65% of 2019 capacity, up from 58% in the fourth quarter of 2021. It expects capacity for Q2 at 80%, Q3 at 85%, and Q4 at 90% of 2019 levels, resulting in a full-year capacity of around 80% compared to 2019.

Demand has been boosted by the relaxing of travel restrictions, and in the past few weeks, further positives have kicked in with Spain allowing what it classifies as unvaccinated travellers to enter the country with a negative Covid-19 test and the USA ending its testing requirement for travellers to enter the country.

British Airways takes significant revenue from its London to New York (and vice versa) route.

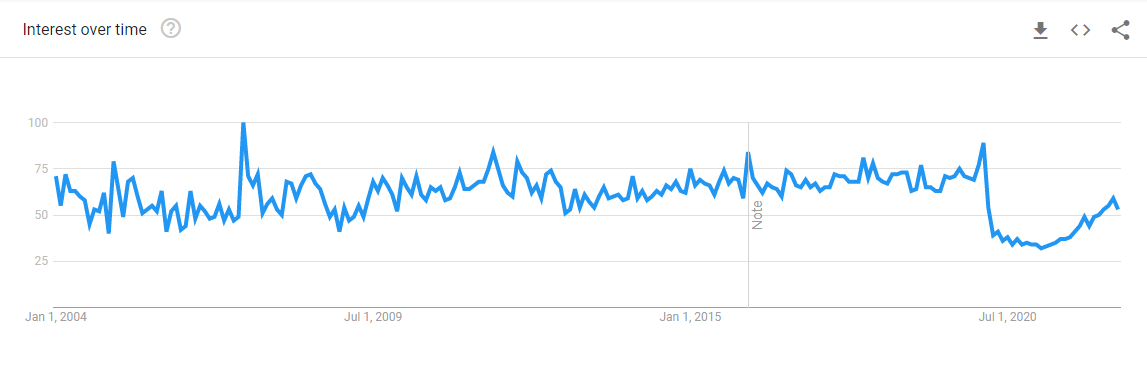

Looking at Google Trends, we can see demand for the London to New York route is steadily rising towards pre-pandemic levels.

The significant fall you can see is, of course, due to the pandemic, but there's been a nice climb of late, giving us an indication that transatlantic travel (and business travel, for that matter) is improving, providing a macro tailwind for IAG, and one that can't be ignored.

Financials

IAG’s financial situation is also improving. Its operating loss for the first quarter of 2022 was €731 million, compared to the €1.07 billion operating loss in Q1 last year. Meanwhile, total revenue was €3.44 billion, slightly above expectations for the quarter.

As mentioned, the company expects a return to profit in the second quarter and for the full year.

Bottom Line

It’s hard to ignore the current issues that IAG and the wider travel industry are facing. However, these are currently shorter-term headwinds.

Thinking with a longer-term investing mindset, travel demand continues to rise, with restrictions continuing to fall, and the company’s financial situation is improving, with an expected return to profitability this year.

With IAG shares significantly below pre-pandemic levels, it's still a stock I like as a long-term hold.