Key points:

- Lululemon shares have declined 24% in 2022

- The current macro headwinds have impacted the stock

- But analysts see the stock moving higher

Athletic apparel company Lululemon Athletica (NASDAQ: LULU) is down over 24% this year, declining 15% in the last month.

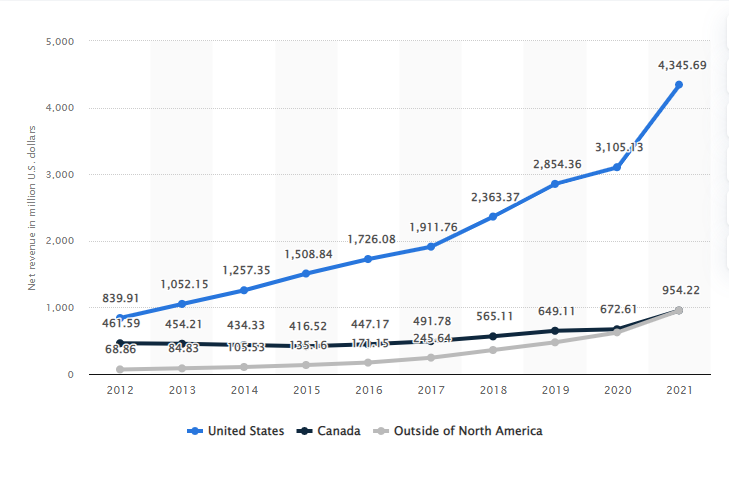

The company has grown significantly in recent years, coping well during the pandemic, particularly in the US, where revenue growth has surged.

Also Read: How To Rejuvenate Your Investment Portfolio

However, Lululemon shares have tumbled in 2022, as macro headwinds such as soaring inflation and interest rates have impacted the general market as well as consumer spending.

Despite the decline, analysts are overwhelmingly positive about the stock. According to TipRanks, based on 22 analysts who have given stock ratings on Lululemon in the last three months, one has issued a sell rating, two have issued Hold ratings, and 19 view the stock as a Buy, with the average price target at $400.89, representing a potential 35.6% upside from its current price of $295.50.

On Tuesday, Piper Sandler upgraded shares of Lululemon to Overweight, raising the price target to $350 per share based on data from the firm's Spring “Taking Stock With Teens” 2022 survey.

In its note to clients, Piper Sandler said that the athletic apparel company maintained the number two favorite athletic apparel brand among teens and beat Nike to become the favorite athletic apparel brand among females. Piper Sandler remarked that the survey points to “continued brand affinity for lululemon,” and the firm now sees less promotional risk in the current environment than initially expected.

Piper Sandler's upgrade has been followed by Raymond Jame initiating coverage of Lululemon with a Strong Buy rating and a $345 price target. Meanwhile, in September, JPMorgan raised the firm's price target on Lululemon to $464 from $396, maintaining an Overweight rating on the shares.

While the current environment doesn't suggest now is the time to jump into apparel stocks, the current analyst consensus suggests that Lululemon is a stock that investors should be watching.