Meta Platforms (META) is doubling down on its artificial intelligence ambitions, CEO Mark Zuckerberg announced this week, unveiling plans for a massive expansion of its AI infrastructure.

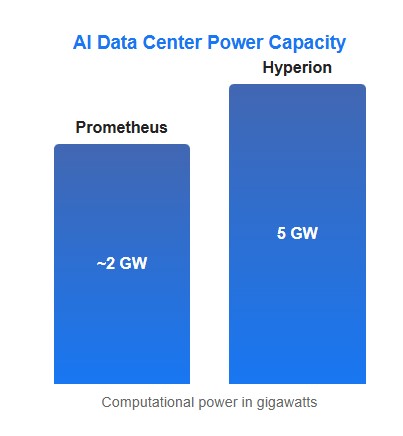

The initiative, spearheaded by the construction of several multi-gigawatt data centers, includes the “Prometheus” cluster slated to come online in 2026 and the “Hyperion” project, designed to scale up to a staggering 5 gigawatts of computational power over several years.

This aggressive push underscores Meta’s commitment to securing a dominant position in the rapidly evolving AI landscape and attracting top-tier research talent.

Zuckerberg emphasized the scale of these data centers, noting that a single “titan cluster” will occupy a footprint comparable to a significant portion of Manhattan. This ambitious undertaking reflects Meta’s belief that superior computing power is essential for breakthroughs in AI research, particularly within its newly formed Meta Superintelligence Labs. The company aims to provide its researchers with “industry-leading levels of compute,” fostering an environment conducive to groundbreaking advancements.

The move comes as Meta faces increasing competition in the AI arena. To finance this ambitious expansion, the company has reportedly sought to raise $29 billion from private credit firms, including Apollo Global Management, KKR, Brookfield, Carlyle, and Pimco. This significant capital infusion, potentially one of the largest private fundraisings to date, highlights the scale of Meta’s investment and its determination to stay ahead of the curve.

However, the enormous energy demands of these AI data centers raise concerns about sustainability and environmental impact. Meta’s plans to build a $10 billion AI data center in northeast Louisiana, while promising to create jobs and stimulate the local economy, have faced scrutiny due to the potential reliance on fossil fuels.

The prospect of new natural gas power plants raises questions about future energy costs for residents and the overall environmental footprint of the project. Meta is also securing long-term energy deals, including its first nuclear power agreement, to address the energy-intensive demands of AI infrastructure.

Analysts are closely monitoring Meta’s aggressive AI infrastructure investments and their potential impact on the company’s future earnings. The core advertising business, which generated nearly $165 billion in revenue last year, remains a crucial source of funding for these initiatives.

However, the long-term success of Meta’s AI strategy will depend on its ability to translate these investments into tangible products and services that drive user engagement and generate revenue.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- IG Top-tier regulation – Read our Review

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY