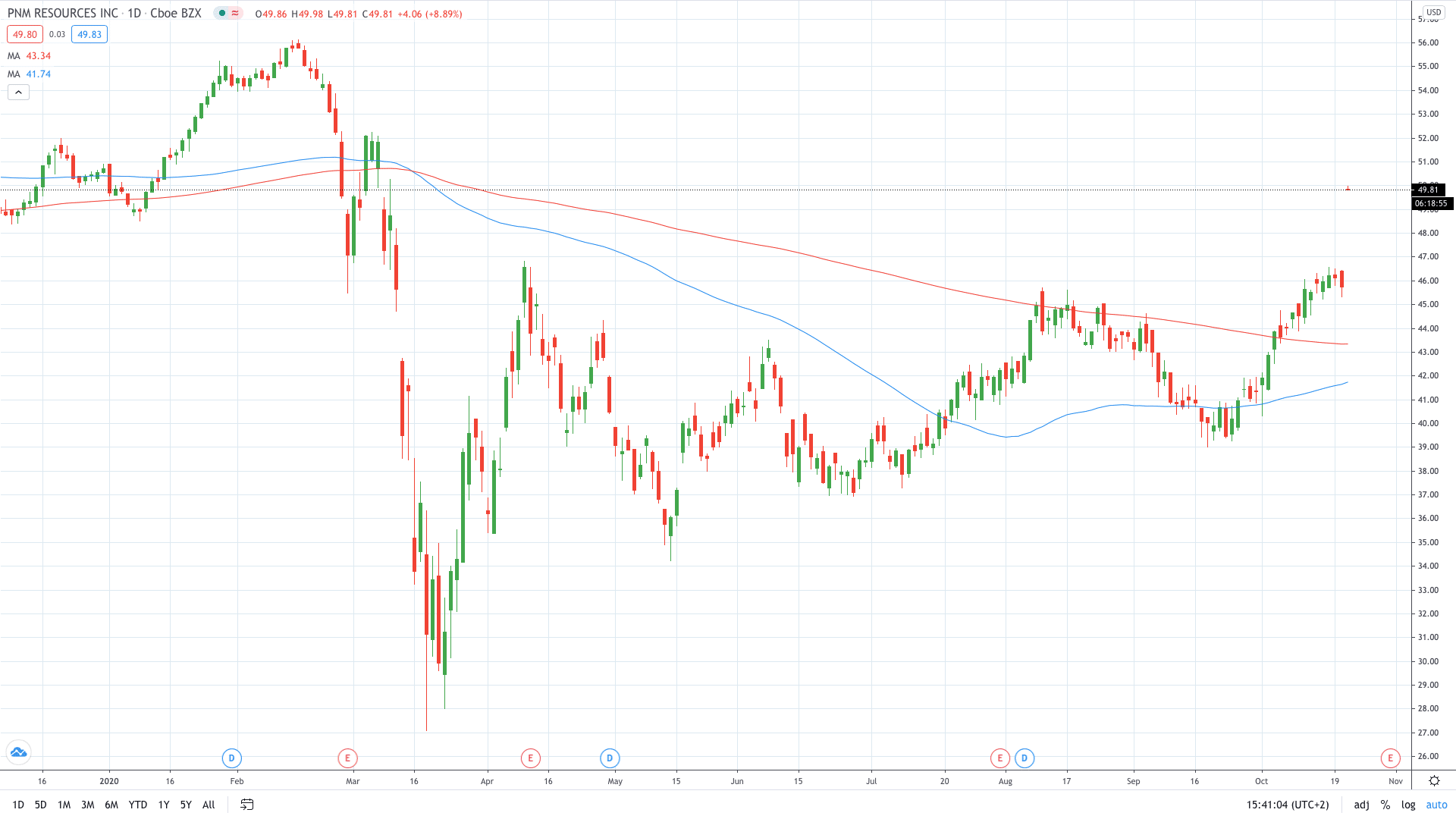

Shares of PNM Resources (NYSE: PNM) gapped over 9% today after the company accepted a takeover offer from Avangrid worth $8.3 billion including debt.

Avangrid, a subsidiary of the Spanish giant Iberdrola, will now become the third-biggest renewable energy operator in the United States. A new company will be created that will have a combined market value of more than $20 billion.

“This merger between AVANGRID and PNM Resources is a strategic fit and helps us further our growth in both clean energy distribution and transmission, as well as helping to expand our growing leadership position in renewables,” Dennis Arriola, Avangrid’s CEO said.

Avangrid will pay $4.3 billion to PNM shareholders, based on the agreed $50.3 per share price. This is around 10% higher than the company’s closing price yesterday.

“Our combined companies provide greater opportunities to invest in the infrastructure and new technologies that will help us navigate our transition to clean energy while maintaining our commitments to our local teams and communities,” said Pat Vincent-Collawn, chairman, president and CEO of PNM Resources.

PNM share price now trades at $49.89, or 9.14% higher on the day. Conversely, shares of Avangrid fell nearly 8%.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan