Key points:

- Rainbow has revealed their planned rare earth extraction technology

- It looks like it will work technically, there's a good chance it will economically

- The big issue is how this will change the global rare earths market

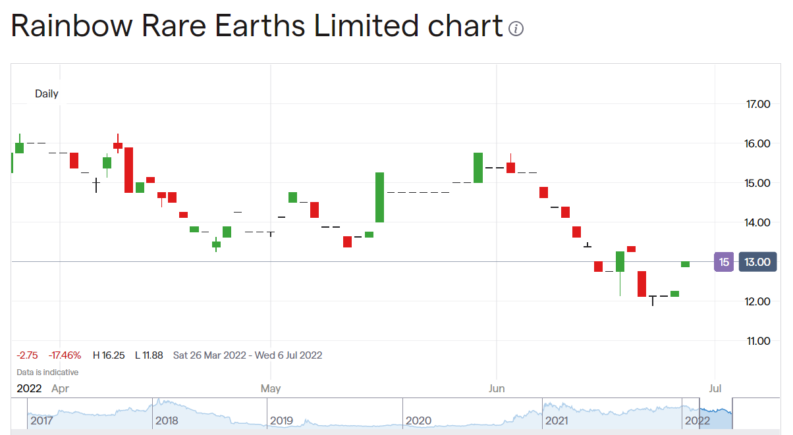

Rainbow Rare Earths (LON: RBW) shares are up 6% this morning on the announcement that they've designed a new rare earth extraction circuit and process. This could be thought of as something of interest only to technical geeks but it's actually of significant interest for two other reasons. Firstly, if this process really does work on an economic basis then it has much wider application than just the RBW site in South Africa. Secondly, it affects all the other people looking for rare earths as well – and affects them negatively.

The specific announcement by Rainbow Rare Earths is, at heart, this: “Following leaching of the phosphogypsum with sulphuric acid and subsequent rapid concentration of the rare earths in the pregnant leach solution, the concentrated rare earths solution is upgraded in K-Tech's proprietary continuous ion exchange (“CIX”) and continuous ion chromatography (“CIC”) process to deliver high-purity oxides of the target magnet rare earths, namely neodymium, praseodymium, dysprosium and terbium.” And that's not going to mean much to those not deeply involved in rare earths tech.

Also Read: An Analysis of the World’s Top Economies

What it actually means is the following. It's long been known that the extraction of phosphorous for fertilisers leaves behind phosphogypsum. This contains rare earths, thorium and the base material is gypsum – to make plasterboard or sheet rock. No one wants to actually use it because of the thorium contents. Any process that would extract the rare earths would also extract the thorium, that's just the way chemistry works. So, a rare earth extraction process would make that gypsum available – and also clean up the wastes from the fertiliser production.

Rainbow has combined two known processes here to do that extraction. Importantly, the end product is the individual rare earths, not a mixed concentrate. This means that they don't have to send to China for further processing. Or the alternative, which is spend $1 billion and change on a separation plant. The cost to them is a significant increase in the time taken to separate and thus a rise in working capital requirements. Finally, by producing only the pay metals (currently trying to process out lanthanum and cerium loses vast amounts of money per kg) they have greatly reduced their processing costs.

Assuming this process really does work in an economic manner then Rainbow has something interesting here. They've the right to process those phosphogypsum wastes in South Africa. The regulatory regime there for dealing with the thorium containing waste is sensible. So, should we climb aboard?

A paper design is perhaps a little early to be stating that the process will work entirely as advertised. But the big issue here is what happens if it really does fully work. Because there's an awful lot of that phosphogypsum out there. Central Florida is covered in great hundreds of feet mountains of the stuff. Meaning that if we do have a viable and complete extraction system then there's going to be a radical change in the global rare earths market along the line.

And that is the true issue over the valuation of Rainbow Rare Earths. How widely applicable is the technique and what is that going to do to the rare earths market? Trading positions for the long term need to be informed by views on that.