- The UK chancellor announced another massive increase in government spending on Wednesday and the UK property sector was one of the main beneficiaries.

- Sunak told MPs the cut meant that 9 in 10 of those buying their main home this year would not pay the tax.

- Whether this translates as improved prices of firms operating in that sector is the question.

- The chancellor’s effort to keep every company solvent and save every job, regardless of what is happening elsewhere, will have some kind of impact.

The UK property sector was one of the primary beneficiaries of the new support package outlined on Wednesday by chancellor Rishi Sunak. The willingness of Sunak to borrow in the financial markets and to implement a breathtaking fiscal policy has even required the new approach to be given a moniker – ‘Rishi-nomics’.

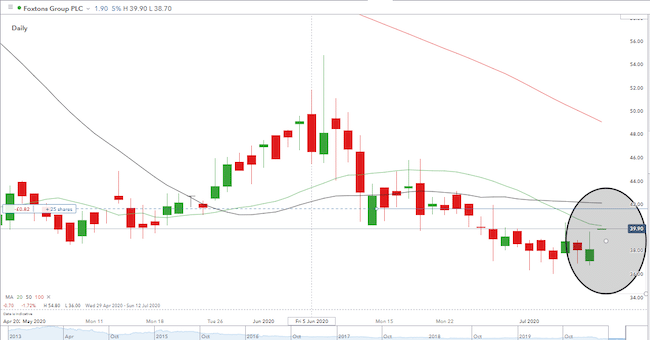

From a market perspective, the plain truth is that no one knows if the measures will have the desired effect. Investors in property sector firms appeared unable to take an immediate view on the likely outcome. At the close of the London exchanges on Wednesday, the estate agent firm Foxton’s share price had increased from 37.10p to 38.09p. That represented a move in line with daily volatility rather than the welcoming of a ‘New Deal’ style economic package.

Foxtons Group Plc share price – Daily Candles – 29th April–9th July 2020

There was more optimism for the UK estate agency on Thursday morning. While the broader market sold off, Foxtons share price bucked the trend and at market-open was testing the psychologically important 40p resistance level. The Foxton share price looks likely to fall victim to a wider sell-off. It is also still trading below the 20, 50 and 100 SMA’s but at least appears willing to test those levels. The suggestion of a trend line break to the upside will be a pointer for those looking to buy a dip and then to see if Rishi-nomics filters through into the Foxton’s share price.

Foxtons Group Plc share price – Daily Candles – 29th April–9th July 2020

The property sector is often the target of direct financial support from governments. Massaging the living conditions of the population can ultimately funnel through as election day votes. There is less chance of a future scandal emerging as it's harder to syphon public funds out of the economy when the scheme focuses on assets that are stuck in situ.

Wednesday’s announcement was a further attempt to kickstart a property market that has slumped since the start of the coronavirus outbreak and the ensuing lockdown. The tool Sunak used was Stamp Duty, a transaction tax paid by house-buyers. He hopes that by reducing stamp duty and making it cheaper to purchase properties, improved property sales will have a trickle-down effect into other areas of the economy.

Until 31st March next year, those buying a main home will not be charged any stamp duty on the first £500,000 of the transaction.

Second-home buyers, the investment orientated buy-to-let sector, will only pay the tax at a rate of 3% on the first £500,000 of a property's price. Previously, they would have paid 3% on the first £125,000, and after that be charged 5% on the next £125,001 to £250,000. Someone buying an additional property worth £500,000 will see the tax bill on that transaction fall from £30,000 to £15,000.

Jamie Johnson of property investment firm FJP Investment was speaking with the Telegraph when he said:

“Faced with ongoing changes to the buy-to-let market, there has been a notable increase in the number of landlords exiting the market. This provides some much-needed relief to a section of the property market that has long felt neglected.”

Source: The Telegraph

There are reports from regional estate agents that ‘urban flight’ could be taking place. Owners of homes in cities, most notably London, are cashing in on their premium postcodes while they can. They then set up residence in a rural idyll and take advantage of the more flexible work patterns which were established during the lockdown.

A tax saving of several thousand pounds might be enough for potential sellers to accommodate or just get over, social distancing obstacles which are an inherent part of allowing strangers to tour your home.

This anecdotal evidence was backed up by hard data on Wednesday. The property website Rightmove said traffic to its listings increased by 22% immediately after the chancellor announced his £3.8bn tax break. The move in the Rightmove share price is suggesting that market investors are not feeling the same urge to buy shares in that company.

Rightmove share price – Daily Candles – 29th April–9th July 2020

Hit or miss?

Property booms are driven by the Fear Of Missing Out, and FOMO can be so intense that it leads to spectacular booms and busts. If Sunak’s plan is going to work, it requires the number of transactions to increase, not the value of the assets. The project does have a time constraint, which could incentivise those who are considering the idea to take action. The bad news is that there is an argument that the stamp duty cut might miss the mark.

Anthony Codling made a name for himself during his time as a property industry analyst at investment bank Jeffries. His scathing critique of online estate agent Purplebricks coincided with the company’s share price plummeting from 500p to 50p in the space of three years.

Purplebricks share price – Weekly Candles – Feb 2017–9th July 2020

Codling is now the chief executive of PropTech firm Twindig. His ability and willingness to dig into the granular detail of the property sector acts as a counterbalance to those looking to buy the dips in firms that provide services to the industry. Estateagenttoday.com noted that Codling wrote:

“Making changes to Stamp Duty will not address the bigger issue of helping first-time buyers secure a big enough deposit to get on the housing ladder.”

He continued:

“If we take the home costing just under £300,000 the first-time buyer stamp duty is nil but a five per cent deposit is £15,000. Most lenders have stopped offering 95 per cent Loan To Value mortgages during the COVID crunch with most focusing on 85 per cent LTV which takes the deposit from five per cent or £15,000 to 15 per cent or £45,000.”

Source: Estateagenttoday.com

There is also the fact that investors, in particular the new entrants into the market, might be put off by the risk of property prices falling by a greater amount than the tax saving made on transaction costs.

Property firm Savills has forecast UK house prices will fall by about 7.5 per cent this year while the Bank of England predicts a 16% decline. If the central bank is correct then that £500,000 property which now has a £15,000 tax saving on it, could be worth £80,000 less very soon.

Unemployment, or more specifically, the risk of unemployment can scupper any plans to move to a new house.

Those considering Wednesday’s comments from The Institute for Employment Studies may be getting cold feet about their move to the country. The IEA called the chancellor’s statement:

“A how-to kit for dealing with consequences of a big recession” with the £1,000 bonus “particularly well targeted at supporting lower paid workers at risk of job loss”.

Source: The Telegraph

It continued:

“Even with these announcements, we will almost certainly see unemployment rising above 3m in the coming year to levels that we have not seen since the 1980s”.

Source: The Telegraph

More support?

It will take time to establish if Rishi-nomics turns the tide; there could well be a short-term flurry of activity. That would support Foxton’s share prices as its London focus would tap into those sellers incentivised to make a move that they might have already been considering. It is the sellers rather than the buyers who pay the estate agency fees.

If the plan doesn’t work, pressure may build on the chancellor to change his approach. His speech was quoted as lasting 30 minutes and costing a total of £30bn, that’s £1bn per minute. Those funds could have been used on a package which would have abolished UK business rates. Such a move would remove one of the considerable fixed costs for most small businesses, and help to re-invigorate the high street at the same time.

Matthew Lynn is a financial columnist and author and noted that traditional recipients of government support might not be worthy of additional assistance. Put another way, Wednesday’s package could be ‘kill or cure’ for certain areas of the economy. Considering ‘Rishi-nomics’, he wrote:

“It is fast turning into a heroic, but possibly futile, attempt to re-create the old economy – when what it should be doing is incentivising the creation of the new services and products people will need as the country emerges from lockdown.”

Source: The Telegraph

Two footnotes presented in the speech outlined the size of the challenge. The first was Sunak’s reminder that the borrowing taken down to support this spending will one day have to be repaid, which translates as higher taxes or slashed budgets in the future. The other was that in the past two months, the economy had shrunk by 25%. That obliterated the growth of the last 18 years even before the job losses from the furlough scheme crystallise. Sunak’s view that the country faces “profound challenges” is looking like something of an understatement.

A short-term flurry could well be on the cards, and the time-lag between the announcement and that occurring means investors have time to consider the Foxton’s share price before buying in.