Shares of Ryanair Holdings PLC (LON: RYA) are trading over 4% lower today after the carrier said it plans to cut jobs and introduce unpaid leave after it was forced to slash the number of planned flights from November to March.

Ryanair now plans to fly at 40% capacity of where it was last year, lower than previously expected 60%.

Moreover, the expected full-year passenger volumes sit at 38 million, which is way below prior expectations of 60 million. Ryanair anticipated 70% load factor for the winter, which will help the company to minimize the cash burn.

“Our focus continues to be on maintaining as large a schedule as we can sensibly operate to keep our aircraft, our pilots and our cabin crew current and employed while minimising job losses.

“It is inevitable, given the scale of these cutbacks, that we will be implementing more unpaid leave, and job sharing this winter in those bases where we have agreed reduced working time and pay, but this is a better short term outcome than mass job losses,” boss Michael O’Leary said.

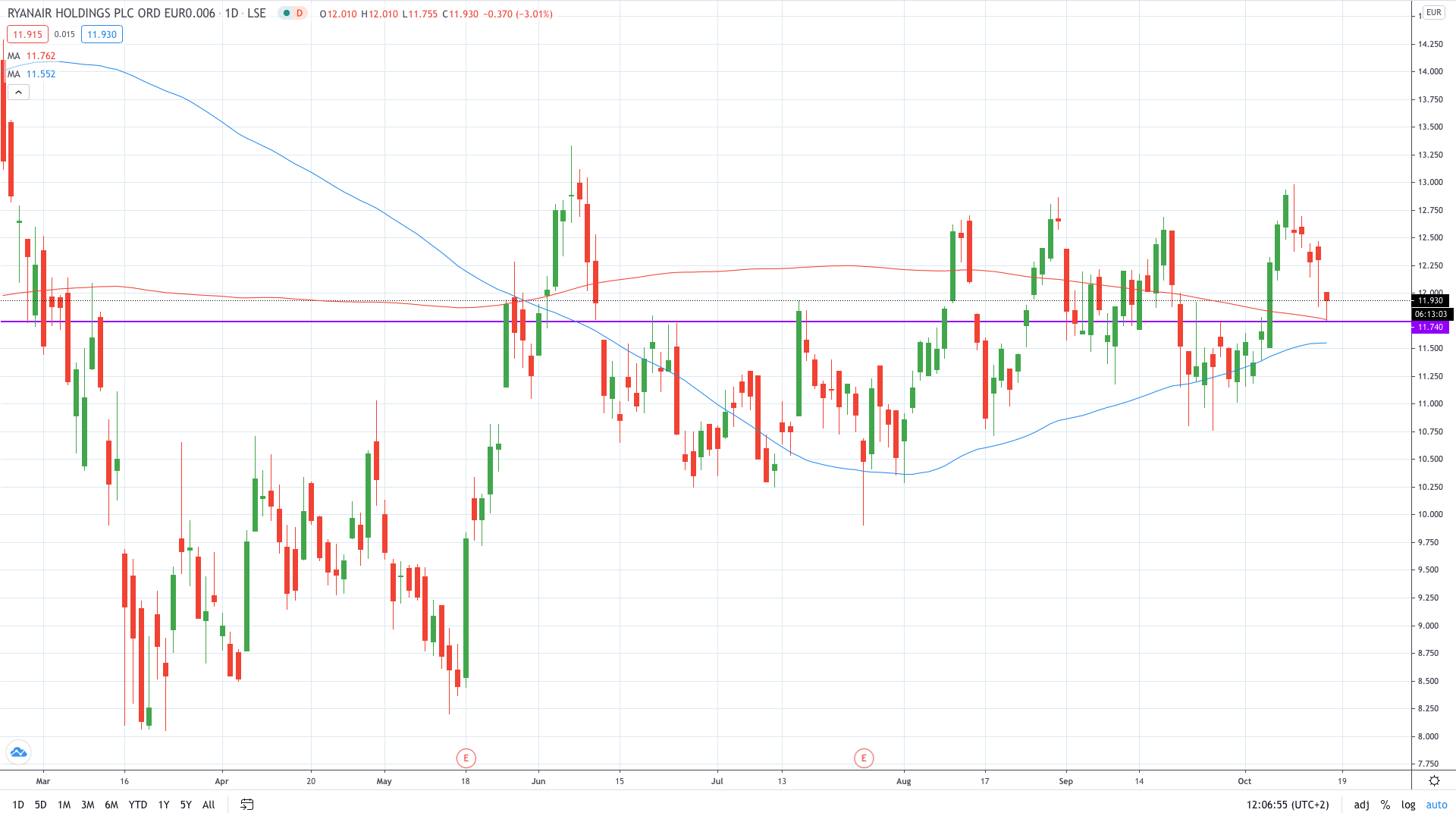

Ryanair share price fell over 4% to 11.75 to test the 100 daily moving average.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan