Shares of Standard Chartered PLC (LON: STAN) plunged more than 4% on Thursday after the London-based bank posted a 33% fall in first-half profit.

Standard Chartered, also known as StanChart, recorded a profit of $1.63 billion in the first half of the year. This is 33% less than $2.41 billion in the same period last year. Still, profit figures came in better than the $1.53 billion the market analysts expected.

“Low interest rates and depressed oil prices continue to be headwinds and we expect new waves of COVID-19 related challenge in the coming quarters,” Chief Executive Officer Bill Winters said.

StanChart said that credit impairment jumped to $1.58 billion from $254 million a year earlier. The bank also reported a decrease of 10% in expenses, with a plan to stay below $10 billion in expenses in 2020 and 2021.

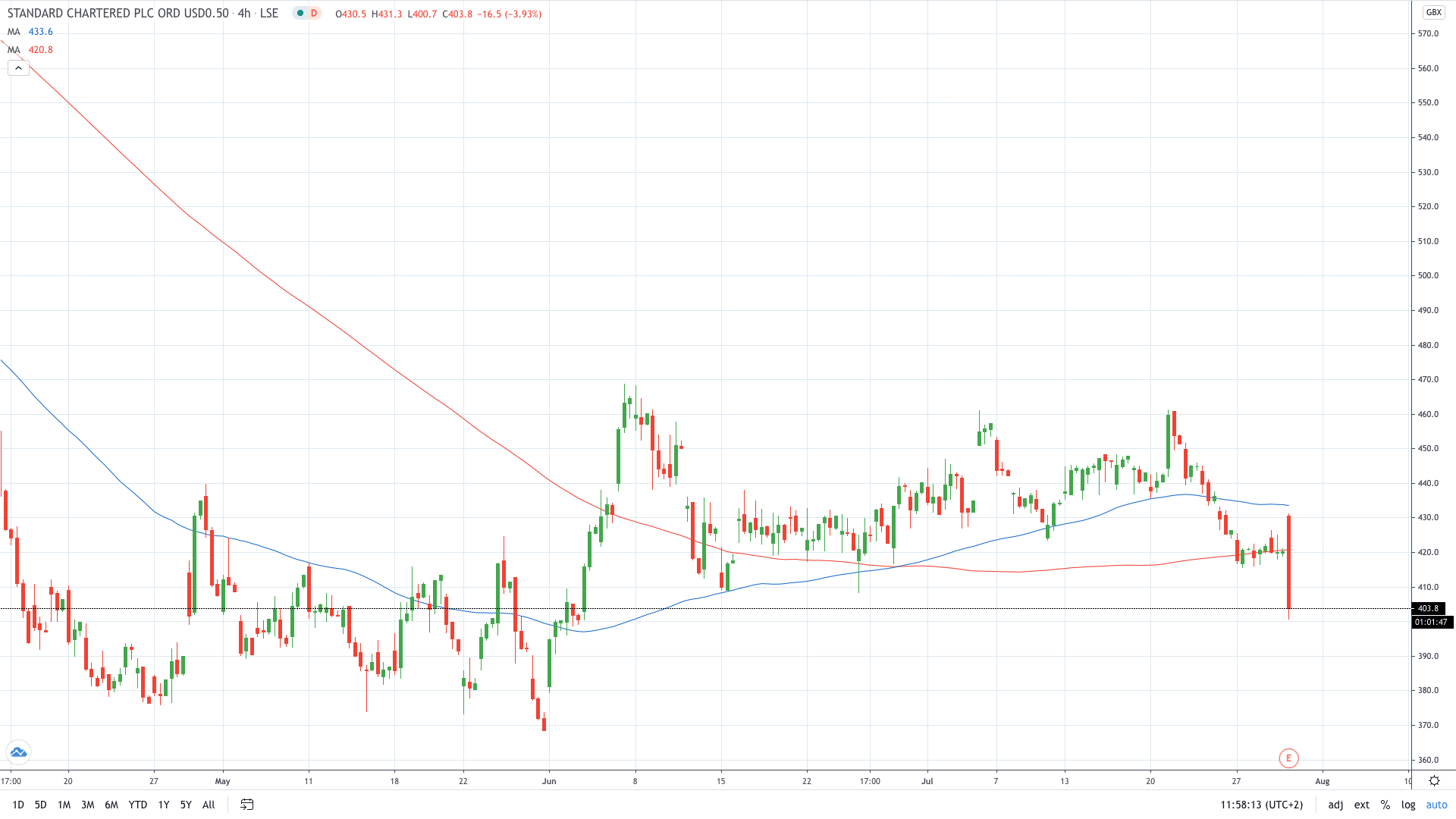

Standard Chartered share price tumbled over 4% today to trade at 400p for the first time in 8 weeks.

- Start learning more about strategies for online stock trading

- Learn how to trade stocks