Tesla's stock (NASDAQ:TSLA) is is under pressure today, down 8.54% at $304 following the release of its Q2 earnings. Out of the gate, TSLA fell lower, hitting an early intra-day low of $301, testing whether support around $300 would hold.

Following on from the earnings disappointment came an analysis by Barclays, which suggests a growing divergence between Tesla's ambitious narrative and its underlying fundamentals.

Barclays maintains an Equal Weight rating on Tesla with a $275 price target, indicating a cautious outlook. The investment bank argues that while Tesla's AI and robotaxi ventures capture headlines, the company's core business faces significant headwinds.

Tesla's Q2 earnings, while initially appearing in-line with expectations, revealed deeper challenges.

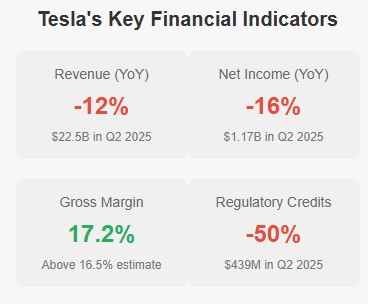

Gross margins were a bright spot, coming in at 17.2%, surpassing Wall Street's estimate of 16.5%. However, this was achieved amidst ongoing price cuts and incentives, raising questions about long-term sustainability.

Revenue for the quarter fell by 12% year-over-year, and automotive revenue saw a 16% drop, landing at $16.7 billion. Net income also decreased, falling to $1.17 billion, a 16% decline year-over-year.

A key concern highlighted by Barclays is the expiration of U.S. EV tax credits, new tariffs, and a significant reduction in regulatory credit sales. These credits, historically a substantial revenue stream for Tesla, have been curtailed, impacting the company's bottom line. In Q2 2025, regulatory credit sales dropped by approximately half to $439 million.

Adding to the pressure, Tesla's production continues to outpace deliveries. The company reported a Q2 surplus of over 26,000 vehicles, signaling potential softening demand. This imbalance, coupled with declining revenue, raises concerns about Tesla's ability to maintain its growth trajectory.

Tesla is attempting to pivot its narrative toward AI, robotics, and robotaxi initiatives. CEO Elon Musk has repeatedly emphasized the long-term potential of these ventures, suggesting substantial financial benefits may materialize by late next year. The company even launched its first robotaxi service in Austin, Texas, marking a strategic shift toward autonomous driving and AI-driven services.

However, Barclays remains skeptical, arguing that the earnings call reinforced the view that Tesla's core business fundamentals are “choppy” and likely to deteriorate further in the coming quarters. This assessment is echoed by other analysts, who point to the impact of reduced government support for electric vehicles and broader economic uncertainties.

The stock's recent performance reflects these concerns. After trading in a relatively stable range of $320 to $330 in the preceding days, the sharp pre-market drop below $320 suggests a potential break below key technical support levels.

While the prevailing sentiment leans towards caution, it's worth considering that Tesla has consistently defied expectations in the past. Barclays' latest report indicates a perceived downside of ~10% from here, yet the company's ability to innovate and disrupt markets shouldn't be underestimated. There could be further surprises ahead.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY