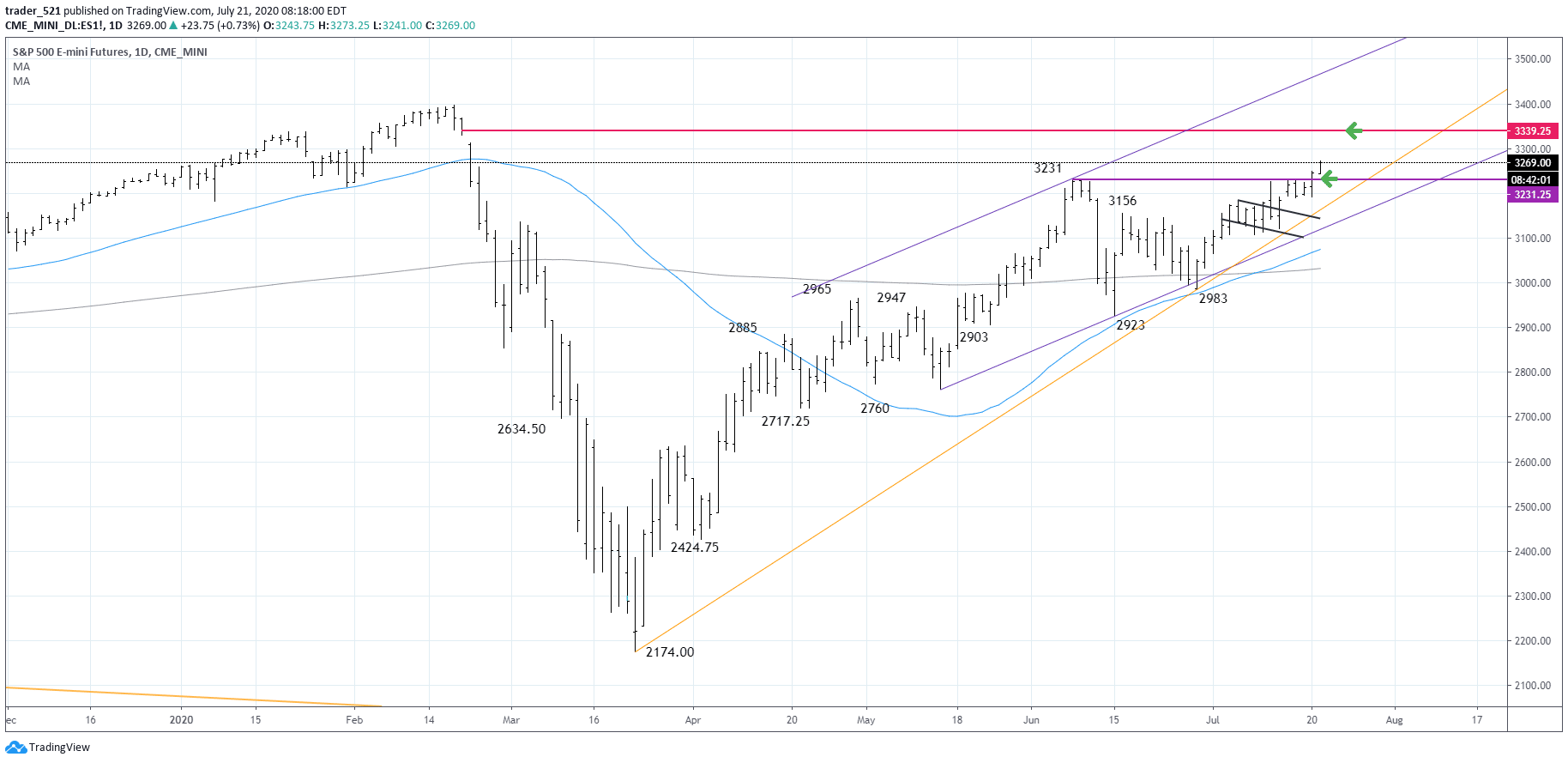

- The SP500 futures broke the resistance mentioned earlier, led by technology to All time highs, the US market is in a momentum move. The next stop to the SPX futures is 3330-3340 zone. The market is incredible and the momentum names are moving well. The earnings season is getting more active this week so watch for unexpected results.

- Europe is a lot better than yesterday with DAX +1.78%, FTSE +0.54%, and CAC40 +1.24%. Asia is doing well. European leaders confirmed 750billion package to fight the economic slowdown due to coronavirus. At the moment Asian markets are holding as well so there is a lot of funds floating into the economy that will help the markets. https://money.cnn.com/data/world_markets/europe/

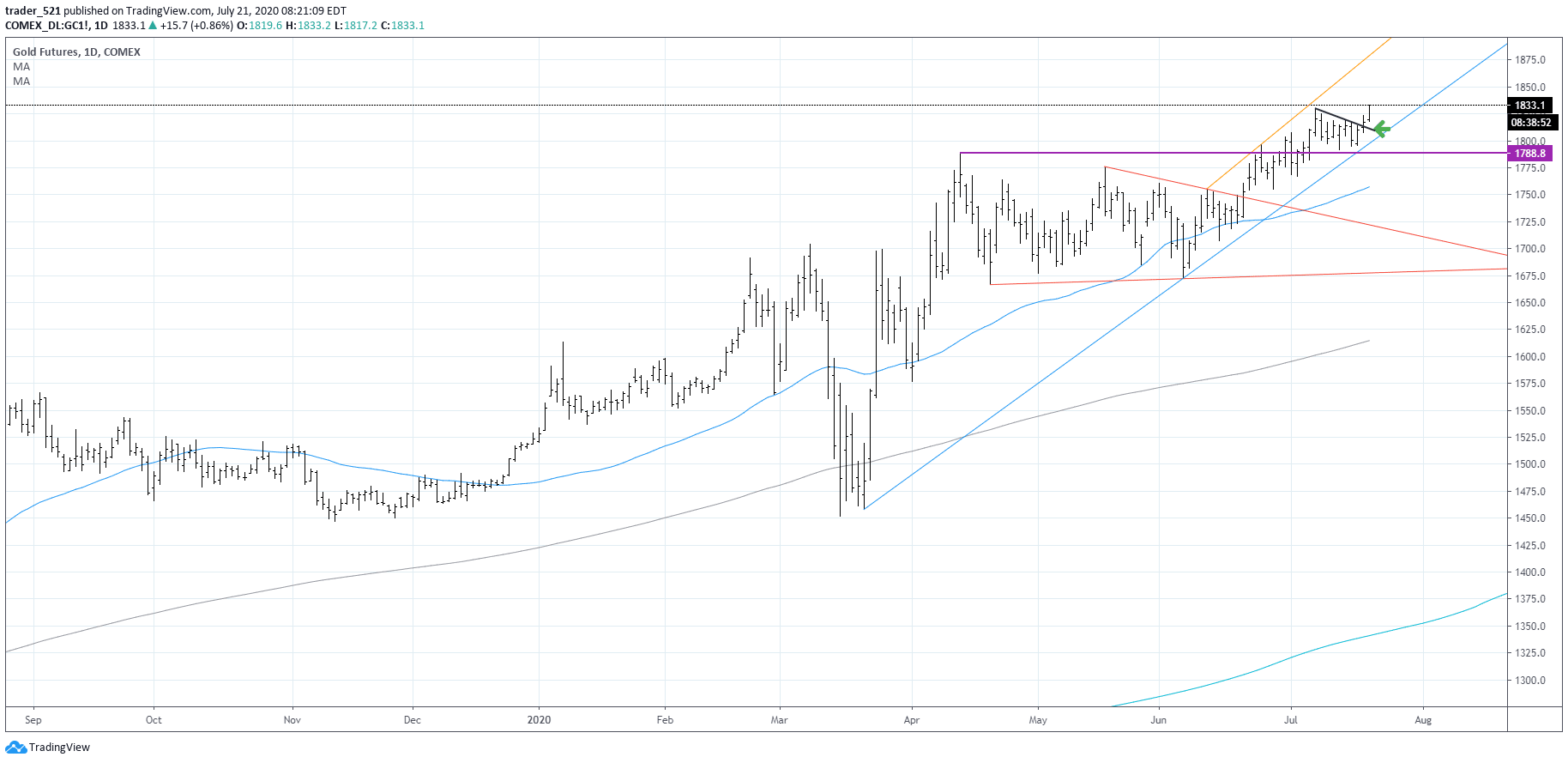

- Commodities: Despite the market strength, Gold is also feeling great, with GC1! Futures at new 52w highs and ready for more. The break of the flag as shown in previous notes is confirmed and we might move higher to 1840-1850 in the nearest sessions. Great holdings to have in your portfolios for 6-18months.

- SNAP reports after the market close. Some other companies worth watching are: UAL, TXN and ISRG. A lot of airlines will be moving this week so watch reaction of the transportation index JETS. https://www.estimize.com/calendar?tab=equity&date=2020-07-21

- There are no important news to be considered this morning but watch the reaction of the market to the gap up. We are also seeing 250+ gaps this morning as the market is gapping considerably higher. Watch the reaction in the first 30mins of trading as some pull-backs might occur in momentum stocks.

https://www.investing.com/economic-calendar/

For more ideas, market videos and analytics, sign up to our premium room: https://www.asktraders.com/stocks-live/