Westports Holdings Berhad (KLSE:WPRTS, 5246), a key player in Malaysia's port infrastructure sector, experienced a surge in its share price, briefly hitting a new all-time high of RM 5.87 today before closing down 1.21% on the day at RM 5.73.

Over the past month, Westports shares have demonstrated resilience, with a 13.92% increase in value on the Bursa Malaysia. While the pullback from the all-time high today suggests either some profit-taking, or a pause, the overall trend remains positive, supported by steady trading volume.

Technical analysis suggests that WPRTS is currently trading above its key moving averages, fueled by the recent surge in price. Markets are now looking eagerly to the release of the Q2 2025 quarterly results, scheduled for July 26, which will provide further insights into the company's performance and future prospects.

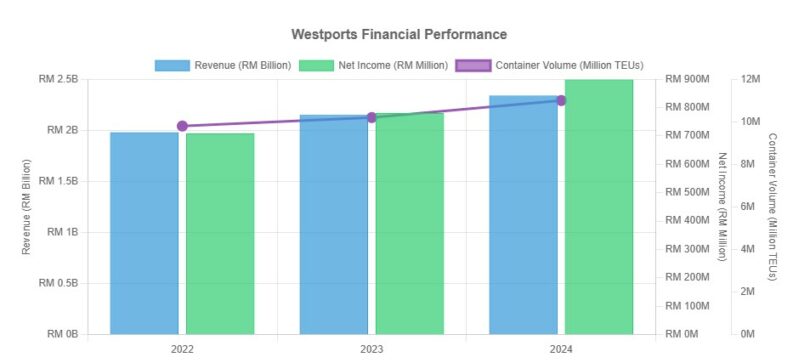

Westports' strong performance in the fiscal year 2024 has undoubtedly contributed to the positive sentiment. The company reported revenue of RM2.34 billion, an 8.9% increase from the previous year, and net income rose by 15% to RM898 million.

Earnings per share (EPS) reached RM0.26, up from RM0.23 in 2023, exceeding analyst expectations by 5.7%. This robust financial performance was driven by a record container volume of 11 million twenty-foot equivalent units (TEUs), highlighting the company's operational efficiency and its vital role in regional trade.

The company's consistent dividend policy further enhances its appeal to investors. In 2024, Westports maintained a total annual dividend yield of 4.2%, and analysts anticipate an average dividend yield of 4.4% over the next three years.

Analysts view of Westports has generally been positive, with ratings ranging from ‘Buy' to ‘Hold.' The average target price of 5.47, suggests there is mild potential downside from the current price, with analysts outpaced by the recent surge. The company is currently trading at a price-to-earnings (P/E) ratio of 19.28, which, while seemingly high, is lower than its 11-year historical average of 21.1x when considering the FY25 estimated EPS of RM0.30.

Looking ahead, Westports' ability to maintain its strong financial performance, capitalize on growing regional trade volumes, and navigate evolving market dynamics will be crucial to its continued success. The upcoming earnings results will provide valuable insights into the company's progress and likely set the stage for the weeks ahead.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY