- Prices of gold and silver have rallied on the back of announcements that have triggered traders to act on established buy-signals.

- In terms of geopolitical risk, statements from Donald Trump point to increased friction with China.

- The statement from the US Fed on Wednesday confirmed that the present record low-interest rates might be the new normal. Low rates often drive precious metal prices higher.

- The two metals are, however, different beasts. A short-term pull-back could be on the cards inviting traders to buy into the metals, but there is a question of which one offers the better return?

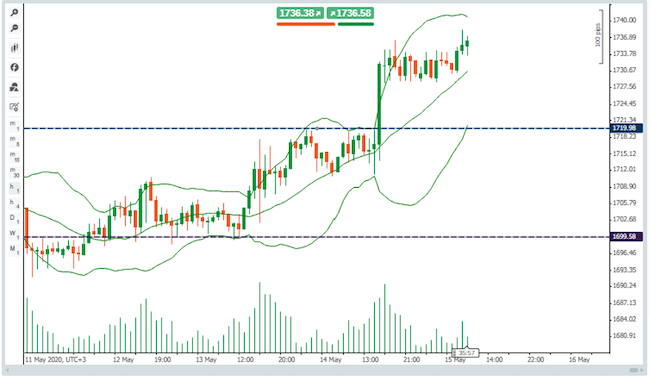

Price charts from broker Pepperstone show both gold and silver breaking out into upward price trends. The one-hour chart of each showing a break of a sideways channel which had formed after the last leg-up in prices on the 7th of May.

Gold XAUUSD – 1 hr price chart

Silver XAGUSD – 1 hr price chart

The Daily Fix area of the Pepperstone website is free to use and not being behind a paywall can be accessed easily. Not only does the market analysis and comment come at no charge, it is also insightful and current. Chris Weston, the brokers Head of Research on Friday issued a note on gold, he wrote:

“I would be looking at the fact that ‘real’ (or inflation-adjusted) rates have pushed a touch lower has also helped, not to mention further talk of fiscal stimulus which will only increase the deficit. The bulls look to be in control here, and I expect an upside break to get plenty of attention.”

Source: Pepperstone

There could be good news for those traders looking to take a little time doing some research. Further and more detailed analysis can found in the Pepperstone note entitled, The Japanification of the US – the truly bullish case for gold. With gold being something of a bellwether for the global economy, even those looking at macro-trends, rather than the gold market itself would do well to be familiar with the ideas shared by Weston.

“Gold is a hedge against a blow out in the fiscal deficit, it is a hedge against central bank experiments and fiat currency debasement and is for 2020 perhaps a hedge against a re-focus on the global pool of negative-yielding bonds.”

Source: Pepperstone

Taking time to brush up on current trends may also benefit traders in terms of trade-entry timing. Dimitri Zabelin, an analyst at DailyFX, can see the recent rally losing some steam, at least in the short term. Markets don’t go up in a straight line, and Zabelin detailed the levels at which gold bulls might look to take advantage of a pull-back in price and enter into long traders. He wrote:

“Recent price action suggests the precious metal may be losing steam as it trades within the range of the slope of appreciation. If it cracks under the weight of increased selling pressure, XAU/USD may encounter some downside friction between 1671.81 and 1671.84 before turning lower.”

Source: DailyFX

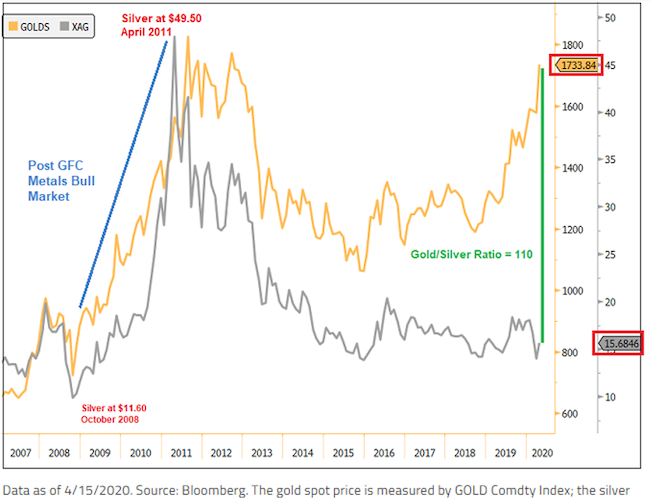

While the market typically focuses on gold prices, silver is coming up on the rails. Investors have recently noted the difference in the price performance of the two metals. Gold’s rally is leaving silver in the blocks.

This anomaly has happened before. Trading the delayed reaction by silver and subsequent convergence of the two prices is a well-established strategy. Pepperstone offers clients markets in both metals and also the chance to short them. That opens up the opportunity to trade the spread between gold and silver by going long on one and short on the other. As both metals rise and fall in line with the general economic outlook traders can take advantage of the change in relative prices and still maintain a degree of neutrality to the wider market.

In her report entitled ‘Silver outlook is bullish' Maria Smirnova, Senior Portfolio Manager at Sprott Asset Management LP, gave her outlook on the spread between the two metals:

“The gold/silver ratio is very high at 110, given that the ratio has averaged 65 since the 1980s. Silver has a strong correlation to gold, and it has the potential to move significantly if the gold/silver ratio reverts to historical norms.”

Source: Sprott

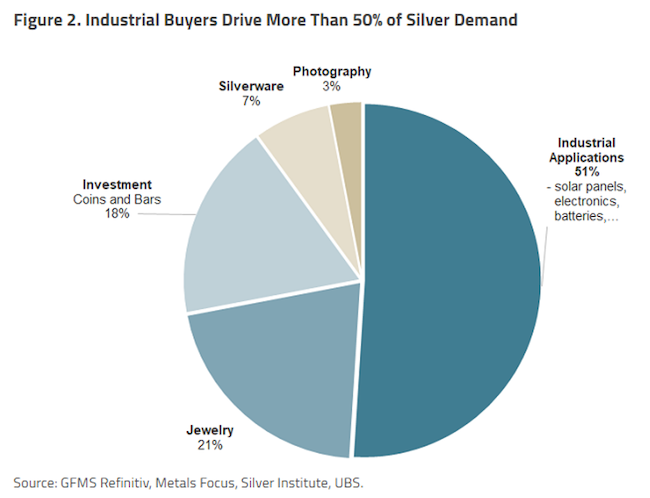

Ms. Smirnova is not alone in identifying the return to economic production as a possible catalyst for silver prices to start outperforming those of gold. Half of the global demand for silver comes from industry. That is a higher proportion than for gold which is traded mainly as a financial asset. The argument for both metals being safe-havens and a hedge against risk and inflation stands firm. For silver though, the turning wheels of industry add a kicker to the metal’s price.

With the global lockdown easing and industrial production resuming, the price lag by silver could be about to be narrowed. Naked long positions, possibly after the next fall-back in prices, will bring profits to some. Many traders are still grappling with the risk that markets may either rally or crash soon or indeed both. For them, a market-neutral trade on the spread between the two metals may be the answer, and fortunately for them, Pepperstone supports both strategies.