- A suspected accounting scandal at DAX 30 Index member Wirecard has shocked investors who are watching its share price plummet towards zero.

- The unravelling situation brings the stock into play for short-sellers and bottom fishers.

- The Payments Processing sector and German equity market also look like possible plays as traders study the knock-on effects of a firm finding a $2bn black hole in their accounts.

At face value, Wirecard ticked a lot of boxes for investors looking for a healthy return. The firm has been something of a darling of the German equity market due to its exposure to the blossoming fintech sector. Its entrance into the flagship DAX 30 Index in 2018 came at the expense of centuries-old Commerzbank AG and heralded a changing of the guard. Wirecard, a new national champion for an otherwise auto-focused economy, has disappointed on a scale that many find incomprehensible.

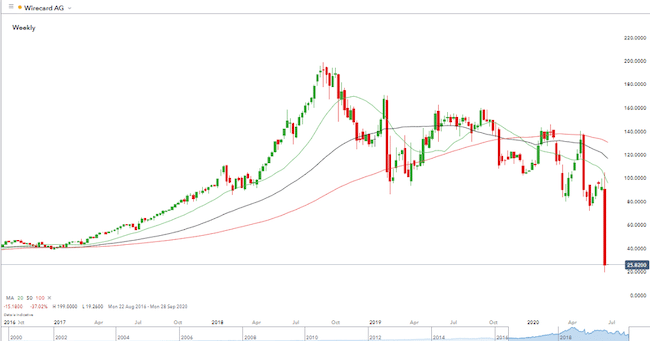

Wirecard – Weekly candles – 2016 – June 2020

The Wirecard share price which as recently as August 2018 was as high as 199 plunged more than 60% in trading on the Frankfurt exchange on Thursday. It then lost another 35.3% on Friday to close at €25.82. The weekend offered the firm little respite and at Monday's market open the Wirecard share price had at one point fallen a further 42.7% to €14.7.

Short-sellers who had circled the firm for years were finally vindicated, and those who hadn't been shaken out of their positions by the bumps in the road would have finally cashed in as it became clear the firm had ‘misplaced' €1.9bn.

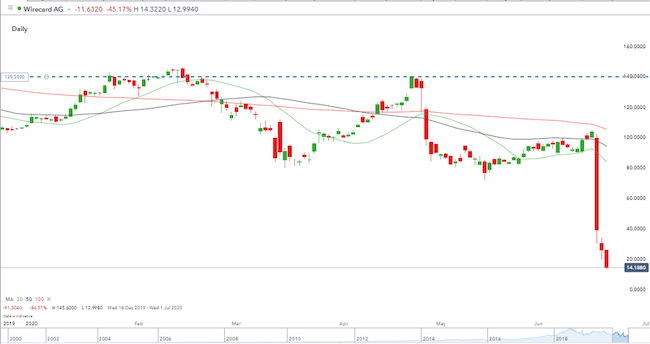

Wirecard – 1H candles – 15th May – 22nd June 2020

Allegations of fraud have dogged the firm for some time, but Thursday's statement delivered by Markus Braun, Wirecard's CEO lifted the lid on the scale of the issue. Explaining how cash amounts equivalent to a quarter of the value of the firm's balance sheet were missing, he said:

“It is currently unclear whether fraudulent transactions to the detriment of Wirecard AG have occurred. Wirecard AG will file a complaint against unknown persons.”

Source: CNBC

The shock of the announcement was amplified by the willingness of some investors to go ‘all in' on the firm that apparently had a bright future. In April, Wirecard AG reported that in the fiscal year 2019, it had “substantially” boosted both sales revenues and earnings. According to preliminary figures, consolidated sales revenues in 2019 rose to €2.8bn and thus by around 38 per cent (2018: €2.0bn). Source: Wirecard

It also achieved the tell-tale V-sign recovery from the coronavirus pandemic. The share price on the 22nd of April being less than one per cent below the close of the 13th of February and the broad market sell-off which followed.

Wirecard – 1D candles – Dec 2019 – 22nd June 2020

Peer group pressure

The sector in which Wirecard operates looks the most likely to be able to shrug off the bad news. The recent boom in Payments Processing has created a fiercely competitive environment, and there are many firms still worth buying into. The possible demise of one of the competitors leaves the other competitors able to step in and increase their market share. The surprising event also comes as COVID-19 lockdowns have driven down the use of cash and increased the appetite for electronic payments.

Before they were finally ousted, the outgoing Wirecard management team were resolute that the issue at the firm was accounting-related and nothing to do with their core offering. That may be the case, and the firm might be able to recover from this crisis, but it is better news for Wirecard's competitors.

The bad news for the Wirecard share price is that investors like management teams who can accurately count and safely store profits as much as coming up with ingenious ways of making them. Many rivals have noted the need to not only have a team with the swagger that comes from being the smartest guys in the room but also that they should be competent bean-counters.

PayPal

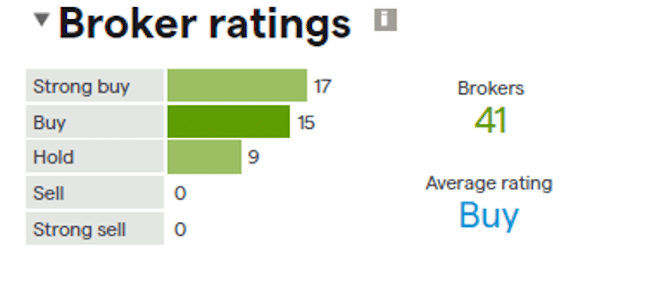

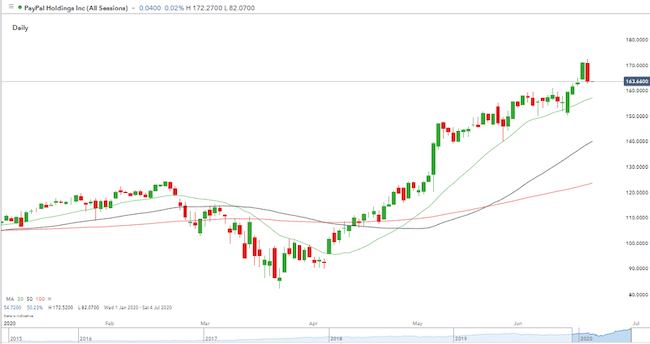

The PayPal Holdings Inc share price matches the range of very positive analysts broker ratings the firm has gained.

Posting significant year to date gains, the Nasdaq listed firm (Nasdaq: PYPL) has thrived on the opportunities facing tech stocks in a more digital post-COVID environment. Having a significant rival like Wirecard fall out of the market would be more good news for the stock.

PayPal Inc – Daily Candles – Year to date

The PayPal stock price showed weakness on Friday, closing in New York at $163.66. The supporting trend line still holds and the momentary weakness looks likely to attract the attention of those looking to work into the stock at a reasonable price level. The PayPal share price hasn't closed below its daily 20 SMA since the 3rd of April.

The analyst team at Investors.com has studied the stock. Their report forming a catalogue of influential fundamental and technical factors suggesting the stock is a buy:

“In conclusion, PayPal stock is extended past a new buy point in the new stock market uptrend, as it trades at new highs.”

Source: Investors.com

The firm is also well-positioned to capitalise on the global quarantine that is making not only cash but also contactless payments challenging to process. The team at Fool.com also have a bullish rating on the stock. Their analysis stating:

“It's clear that PayPal is doing its best to make lemonade of the lemons that the pandemic-battered economy has handed all businesses, and digital payments where a physical card isn't present are getting a boost. This leader in digital payments, peer-to-peer money movement, and e-commerce is investing heavily for growth, and that's yielding results.”

Source: Fool.com

Aftershocks

Two sectors looking more vulnerable to the Wirecard scandal are the accountancy firms tasked with conducting independent audits, and the German equity market.

For not insignificant fees, firms such as EY are expected to carry out independent audits to ensure investors interests are protected. EY's refusal on Thursday to sign off on the annual accounts due to “spurious balance confirmations” was the trigger for the major sell-off. The firm stated that there had been efforts made to:

“Deceive the auditor and create a wrong perception of the existence of such cash balances.”

Source: CNBC

Similar scandals have occurred in the UK. In recent years, Tesco, Patisserie Valerie, Carillion, BHS and Ted Baker have all had red flags raised over their accounting practises and only one, Tesco managed to survive the episode.

The partnership structure of the big auditing firms means their stock isn't tradeable. There is a suggestion that challenger firm Cogital may one day take a public listing. That event is well worth keeping on the radar.

The inability of the big four to keep on top of the situation could still have ramifications for firms listed on exchanges. Taking a long position in a firm and accepting market risk is one thing. Dealing with operational risk, and the chance that company accounts have been cooked is another. Moments of distress, such as post a global viral pandemic, are just the time when such misdemeanours are flushed out.

There are also long-term plans to bolster the audit process in a way that adds extra overhead costs onto the balance sheet of businesses. Those who have nothing to hide might baulk at the thought of the imposition of additional costs just as they try to come out of lockdown. However, the new plans are some way down the line. One proposal is that audits of members of the FTSE 350 index should be carried out by at least two firms, one being outside the Big Four.

In February of this year, the Independent Review into the Quality and Effectiveness of the UK Audit Market led by Sir Donald Brydon announced its advisory board and terms of reference. The project is expected to be complete by the end of 2020 and will have market-wide ramifications. Studying the “audit expectations gap,” it is likely to mark out the difference between what investors can expect audit firms to deliver and what it entails. Transparency may be welcomed, but the deadline represents a point when investor exposure will be laid out in black and white. As that time approaches, it could cause market jitters through H2 of 2020, particularly if the fallout from Wirecard (or other yet unknown scandals) becomes toxic. It's safe to say all trading positions would be exposed to rumours of another accounting scandal and will be investigated as a high priority.

The Wirecard situation is more bad news for the German equity market and the regulator Federal Financial Supervisory Authority (BaFin). Wirecard offered the German stock market the hope of moving away from being dominated by big auto-manufacturers, who also had their past scandals to deal with.

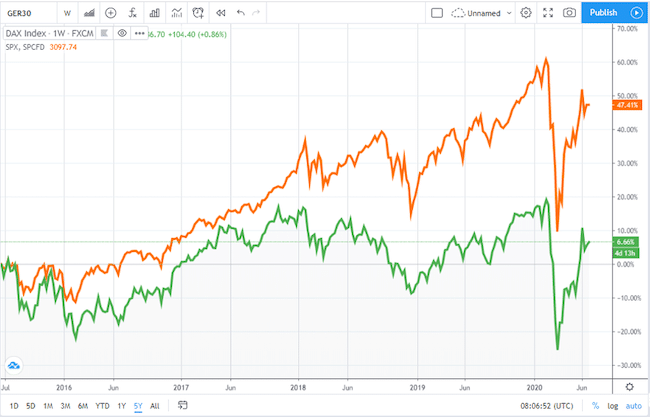

An index futures pairs trade could offer a chance to capitalise on German weakness. The long-term trend has been for the Dow Jones Industrial Average to outperform its German counterpart. Over the last five years, the US equity benchmark has returned gains above 40 percentage points difference.

Dax 30 vs DJIA – 5year price chart

This divergence has reversed since the start of May. The recent relative strength of the DAX and the possible catalyst provided by the Wirecard share price slump could entice those looking for an entry point into a Long DJIA / Short DAX trade which has a degree of market neutrality.

Dax 30 vs DJIA – 1st May – 22nd June 2020

Wirecard the wildcard

With the Wirecard share price trading at such low levels, there will be some looking to take long positions.

The theory behind any bottom-fishing is that the issues relating to the business are accounting-related and that the fundamentals remain strong. Monday's price action points to this being a proposal which needs to be handled with care mainly because the payments sector is reliant on trust.

Wirecard's blog page carries an article from late 2019 that uses language which now appears ‘unfortunate' considering the firm has lost almost €2bn. The Wirecard Editorial team referring to the thoughts of “payment expert” Maik Klotz, wrote:

“All this shows: payment becomes more and more invisible. If you look at the Amazon Go Stores in the US, you can see where the journey can take you. Paying has almost become insignificant there. The consumer doesn't notice the payment process anymore, because it happens completely invisibly in the background.”

Source: Wirecard

There also appears to be a question mark over the culture of the firm. The company's four board members, including CEO Braun, may have resigned but have been under investigation since early June. Munich prosecutors had even searched the firm's headquarters for evidence of “market manipulation”.

Going short?

The Wirecard share price crash of Thursday represented one of the biggest one-day payouts for short-sellers for some time. Which suggests the short trade may have already run its course – but there will be some that are targeting a complete demise of the fintech operation. If the Wirecard share price does reach zero, that would still offer a chance for bears to profit.

Even after notching up their success, the short-sellers may be wondering if the risk taken was worth it. Until now, the short trade has been particularly painful. A weekend headline in the Wall Street Journal pointed out.

“Short Sellers Made $2.6 Billion Off Wirecard's Plunge, but Not Without Scars”.

Source: WSJ

High profile campaigns by short-sellers such as analyst Matthew Earl have been met with accusations of the firm retaliating by using spies to undermine their reporting. The murky world of Wirecard is finally being exposed to daylight and with it comes trading opportunities and risks.