Health and wellness company XpresSpa Group (NASDAQ:XSPA) have announced a $35.3 million direct offering sending its share price plummeting.

The company said that it has entered into securities purchase agreements with several institutional investors to purchase 11,216,932 of its common stock in a registered direct offering priced at-the-market.

The gross proceeds from the registered direct offering are expected to be $35.3 million, with the money set to be used for future locations, working capital, and “general corporate purposes.”

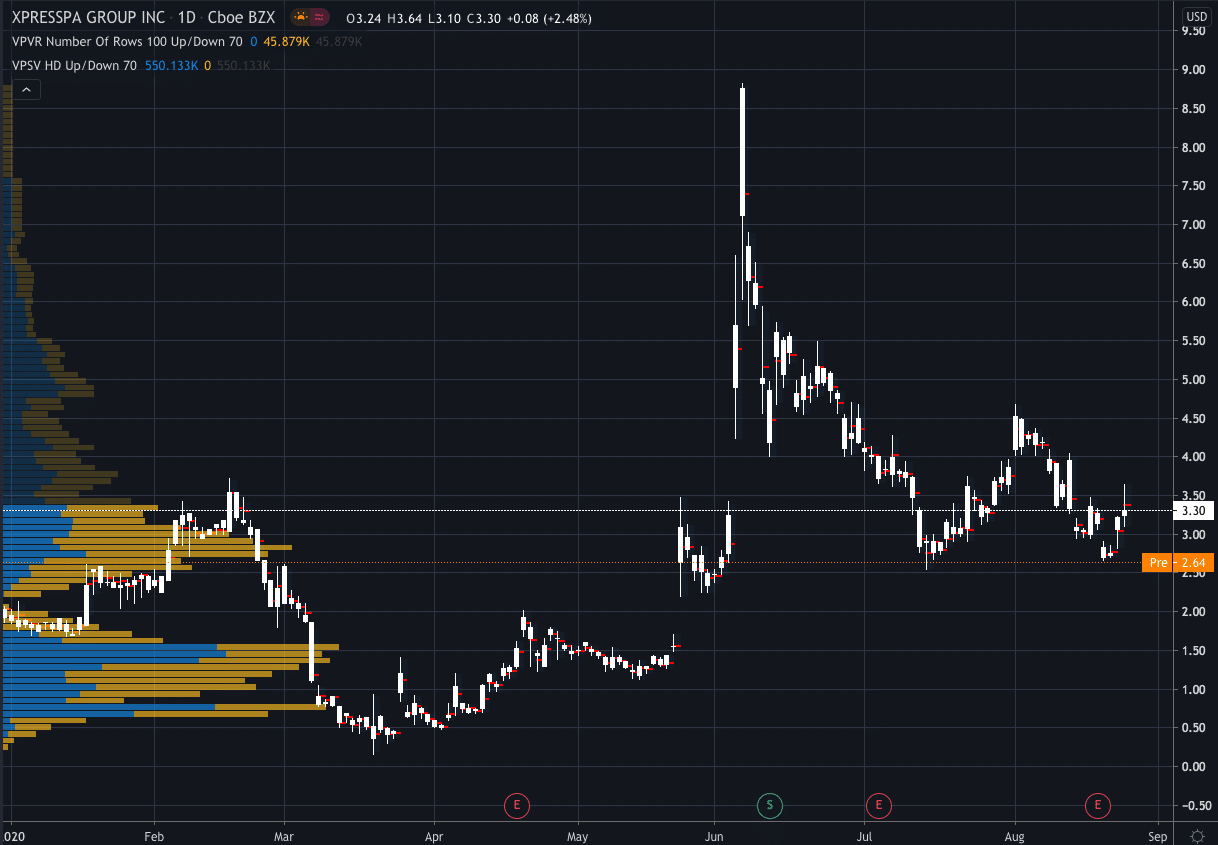

XSPA’s share price…

The news has seen XSPA’s stock plummet premarket on Wednesday. It closed Tuesday’s session at $2.20 and is currently trading at $2.65 per share, down 19.70% from yesterday’s close, although it is up 67% for the year to date.

On Monday the company announced that it slashed COVID-19 airport test waiting times from 48 hours to under 15 minutes.

“Our expansion plan includes offering a range of appropriate services and treatments too. We are proud to be playing our part in supporting the return of air travel to pre-pandemic levels by making sure both airport employees and travelers feel safe and confident when they come to the airport,” said Doug Satzman, XpresSpa CEO.