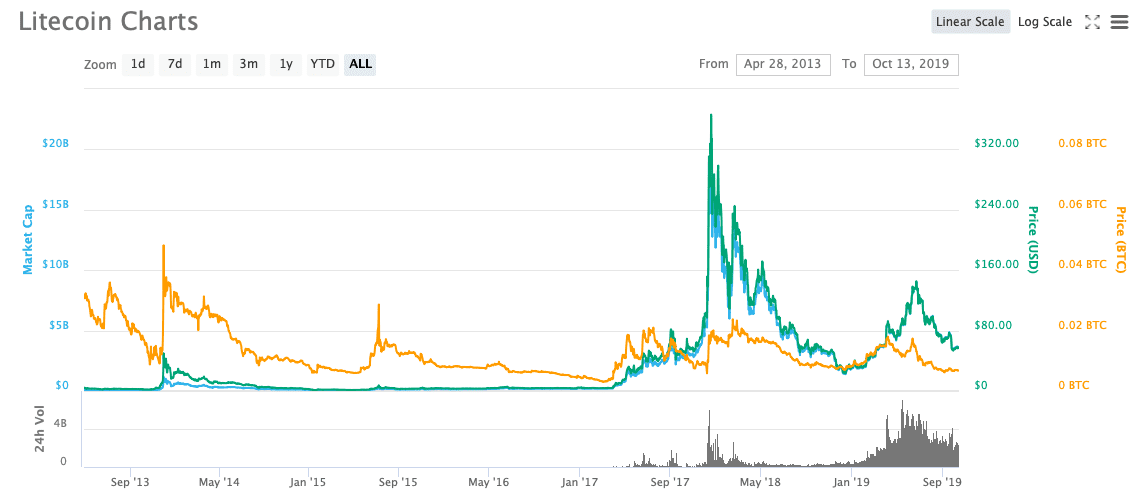

Litecoin (LTC) Price and Market Capitalisation

At the number 10 ranking under the market cap for cryptocurrencies, Litecoin (LTC)’s price is currently at $50.68 (at the time of writing). With a total of $3,314,449,872 market capitalisation, LTC's all-time low price was $1.15 in January 2015, while on an all-time high as of January 2017 at $360.66.

1 BTC = 226.22 LTC

How to Buy Litecoin (LTC) With Cash

While there are numerous methods to choose from when deciding how to pay for Litecoin, here are some of the most popular ones:

1. Litecoinlocal.net

Those who prefer to complete a cash transaction with someone near them will want to turn to Litecoinlocal.net. This platform is similar to LocalBitcoins, in that the platform connects buyers and sellers and acts as an escrow service to provide security. Begin by entering your location at the top of the website, which will then update to display current offers near you.

Using Litecoinlocal.net, you can choose to purchase Litecoin in person using cash or online via an agreed-upon payment method. In either case, the platform facilitates a peer-to-peer exchange and always acts as the escrow. This platform’s nice feature is its buyer’s guide, which includes information on its basic use. As with other exchanges, you must first make an account on Litecoinlocal.net, after which you can look for sellers.

Select a seller to work with, paying attention to their chosen payment method, and begin arranging the details. The seller will send the Litecoin to an escrow account. You then pay in the agreed-upon method and mark the payment as complete. Once the seller confirms you paid, your Litecoin is released. There are options to cancel the trade as well as open a dispute. In addition to cash, you may find payment options that include SWIFT bank wires, PayPal, cash deposits, specific banks, and “other.” You can specify how you want to pay during your search to filter out results.

2. Coinmama

With Coinmama, one can pay cash over the counter at a Western Union as a transfer. This is a popular method for buying Litecoin with cash.

3. Cryptex24

Cryptex24 allows investors to pay for Litecoin in cash over the counter at a money transfer service.

4. 247exchange

Investors can make a cash deposit at a bank or just pay cash for a Flexepin voucher that is prepaid. The voucher can then be used to purchase Litecoin.

Buy Litecoin with a Debit or Credit Card

Litecoin can be bought with a credit card on Coinmama, Indacoin, Coinbase, 247exchange, Kraken (with direct bank transfer), etc.

1. Coinbase

There are multiple payment methods for Coinbase, which is among the best-respected cryptocurrency exchanges in the world. Keep in mind that if you discover how to buy Litecoin in the UK with Coinbase, you will have to pay a 3.99 percent fee, but the process will be simple.

Coinbase is offered in the UK and other parts of Europe, Canada, the United States, Australia, and Singapore. As a bonus, Coinbase also has a Litecoin wallet, so you do not need to set up a separate one ahead of time.

Coinbase is available via the website or mobile app, including versions on Google Play and the Apple App Store, so everyone should find a format that works for them. In terms of payment options, Coinbase has multiple choices, including the ability to pay with a debit or credit card.

This ability makes it highly convenient for those in the UK who want to buy Litecoin just once. Alternatively, you can link your bank account to your Coinbase account for a more straightforward purchasing in the future.

If you plan to make additional purchases in the future, you can also choose to deposit then store funds in your Coinbase account to make instant transactions in the future. Bank accounts tend to take one to three business days to process.

Paying with a Coinbase balance or debit/credit card is instant. However, using a card does lower the purchase limit somewhat.

2. Coinmama

Another cryptocurrency exchange that supports buying Litecoin in the UK and around the world is Coinmama. This exchange works in 188 countries and has been around since 2013. You can buy Litecoin using either USD or EUR, not GBP.

This means that you will likely also have to pay a small fee for a fiat currency conversion, either with the platform or your credit card company.

Using Coinmama is relatively straightforward, and there is a dedicated page for buying Litecoin. From there, you can choose one of the platform’s packages where you spend set amounts of fiat currency (such as $100 or €85).

Below these offers, you will find the ability to choose a different amount to spend in EUR or USD or select how much LTC you want to buy.

Among the various methods to buy Litecoin in the UK, Coinmama only accepts payments via credit and debit cards. It accepts VISA and MasterCard but not American Express or Discover.

You must also verify your account to buy Litecoin via this platform, which requires a government-issued ID and a selfie of you with the ID. To increase your limits, you can add a secondary ID plus a utility bill.

Buy Litecoin Through a Bank Transfer

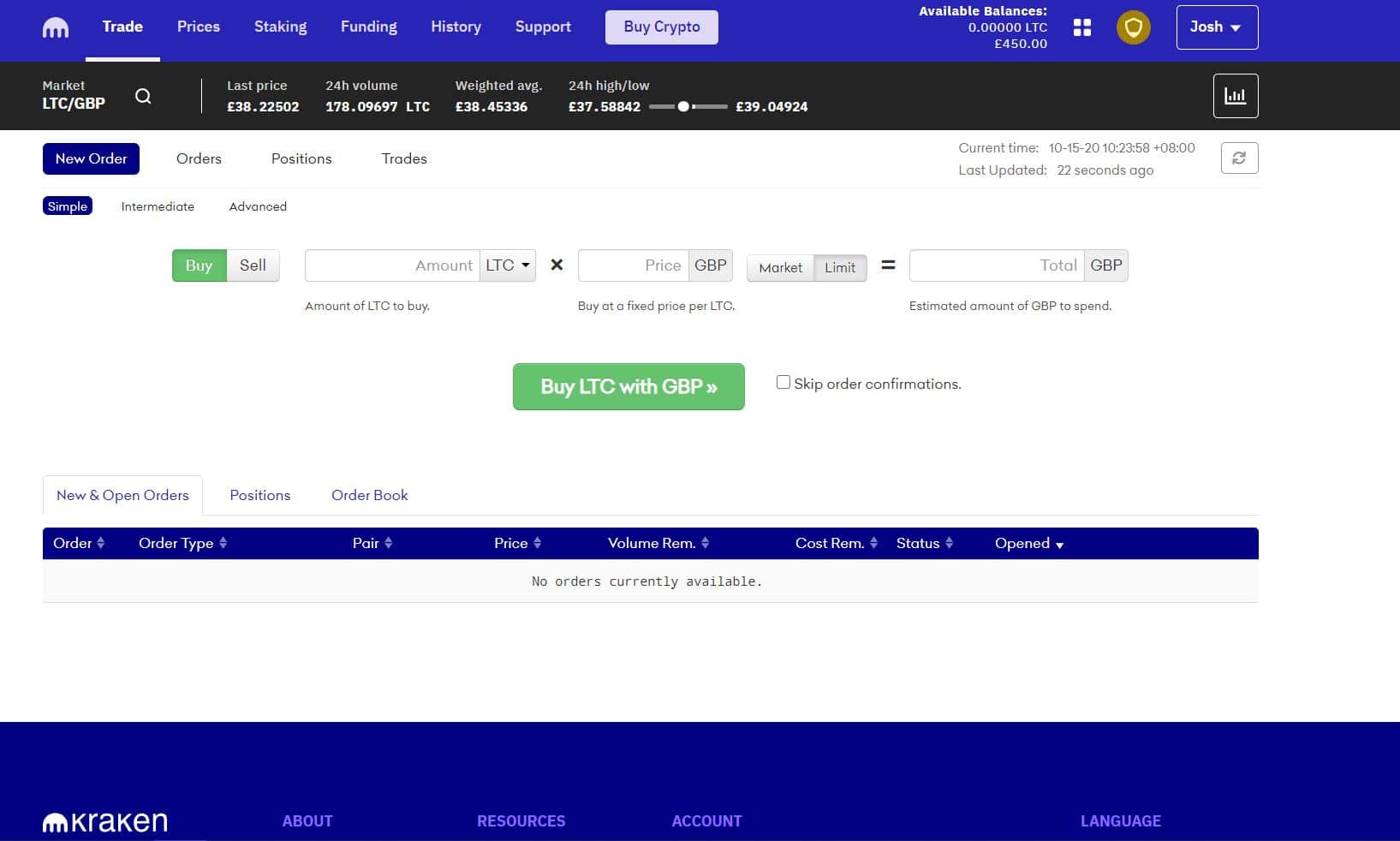

1. Kraken

If you want to purchase Litecoin on Kraken, you can do so in Euro, USD, or Bitcoin. You cannot use a debit or credit card to buy Litecoin using this platform, but you can complete a bank deposit.

To use Kraken, you first deposit your funds, complete a trade for Litecoin, and, finally, withdraw any remaining funds or transfer your Litecoin to your Litecoin wallet.

While it remains part of the EEA, the funding options include a free SEPA deposit in Euro. You can also opt for a bank wire deposit in Euro for a fee of €10 or a bank wire deposit in USD for a fee of $10. Withdrawal options are the same, although the fees vary.

One of Kraken’s benefits is that in addition to buying Litecoin in the UK, you can also use this platform to buy a long list of other cryptocurrencies.

Kraken is particularly worthy of consideration for more experienced cryptocurrency traders due to the range of options available.

Most other exchanges simply offer a market rate or the option to buy and sell with peers. However, Kraken allows for market and limit orders, stop losses, take profits, settle positions, and combine order types.

Other Ways to Get Litecoin

1. Trading of other cryptocurrencies:

We can get Litecoin by trading other altcoins on a designated cryptocurrency exchange

2. Mining:

One of the most popular methods is to mine Litecoin, but this way will not be profitable unless the special equipment and environment are provided.

3. Accept in exchange for services and goods:

Any investor can accept LTC once he or she provides their cryptocurrency wallet address, through which a third party can transfer LTC.

How is Litecoin a Good Investment?

- Relatively cheap: At the time of writing, Litecoin was only valued at $50.58, compared to $11,400 for each Bitcoin (BTC). As such, the barrier of entry to Litecoin investment is much more affordable.

- ASIC resistance: makes it possible for GPU and CPU miners to mine the cryptocurrency. On a related note, Litecoin has a simpler algorithm than Bitcoin, scrypt-hashing, as opposed to SHA-256 hashing, which makes it easier to mine. These mining-related shortcomings of Bitcoin make some people hesitant to begin using it.

- Liquidity: Litecoin is part of numerous cryptocurrency exchanges, making it relatively straightforward to purchase this cryptocurrency if you wish to do so.

- An improvement over Bitcoin: The team behind Litecoin took the existing Bitcoin blockchain technology and enhanced it, leading to a broader appeal and more reasons to purchase the cryptocurrency. One example of improvement between Bitcoin and Litecoin would be transaction speed. You must wait around 10 minutes to confirm Bitcoin transactions, but Litecoin transactions take just 2.5 minutes.

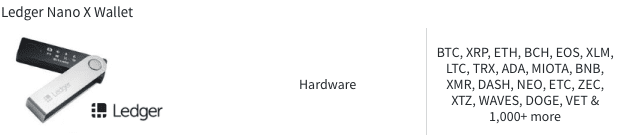

Litecoin Wallets

Before you purchase Litecoin, you will need to have somewhere secure to store it. In the case of cryptocurrency, this means a digital wallet. While there are not as many Litecoin wallets as you will find for other cryptocurrencies, there are still many options. These are some of the available options:

Here are some of the most popular choices for an investor to consider. Some of these are hardware wallets, which are considered the safest way to store a cryptocurrency:

In addition to these, the following options can be considered as well:

- Litecoin Core. This is free for desktop installation but will download the full blockchain. As such, the download can take a while and requires plenty of storage space.

- Loafwallet is another choice, and it was developed by the creator of Litecoin, Charlie Lee. This is a mobile storage solution for Litecoin, with options for both Android and iOS devices. The wallet is completely free to download, although donations are encouraged. Loafwallet includes such features as app sandboxing and AES hardware encryption for security. It also has an open code so that you can review it yourself.

- Those in search of added security might also want to consider a paper wallet for their Litecoin. Just a handful of other Litecoin wallets worth looking into include Coinbase, CoolWallet S, and KeepKey.

Conclusion

If you are interested in learning how to buy Litecoin in the UK, you will have multiple choices available, some of which are simpler than others.

The most common decision is to buy from a cryptocurrency exchange, some of which will accept GBP while others only accept USD or EUR.

Some exchanges accept your payment method of choice, whether it is a debit or credit card or a bank transfer. Those who wish to pay in cash also have options available, such as peer-to-peer exchanges.

If you want to pay using another method, you can always purchase Bitcoin and then use a crypto-to-crypto exchange to buy Litecoin in the UK.

Regardless of your preferred payment method, you can buy Litecoin from anywhere in the United Kingdom, store it in your Litecoin wallet, and start taking advantage of this popular cryptocurrency.

PEOPLE WHO READ THIS ALSO VIEWED: