Since then, the benchmark index of India’s largest 50 listed companies has increased in value by an additional 35%. Domestic and international investors have been piling in to buy Indian stocks, which thanks to the underlying strength of the economy are seen even from a global perspective to be the next big thing.

- NIFTY 50 up in value by 88% in the five years between August 2016 and August 2021

- NIFTY 50 up in value by 236% in the 10 years between August 2011 and August 2021

NIFTY 50 Daily Price Chart – 2015-2021

Source: IG

NIFTY 50 Monthly Price Chart – 2010-2021

Source: IG

Is now the time to buy India stocks? Finding the answer to this question is the first part of the process. The second is making sure that you do so safely. The below easy-to-follow, step-by-step guide will draw on the knowledge of Asktraders experts and outline what to look for when choosing a good broker. It will then explain the mechanics of putting on a trade, and following that plan of action, it is possible to buy India stocks with a trusted broker within a matter of minutes.

Why Buy Stocks in India?

Establishing why now might be a good time to buy stocks in India doesn’t need much gazing into a crystal ball. Instead, it’s a case of listening to the arguments put forward by those who have already started buying.

India – Bouncing Back From the COVID-19 Pandemic

From a global perspective, the India economy managed the COVID-19 pandemic to a largely satisfactory extent. The unique demographics and characteristics of the country led many to fear the worst, but despite significant personal hardship and countless individual tragedies, the healthcare system just managed to cope. Managing the healthcare system and public health policies of a country with 1.36 billion inhabitants was never going to be easy, but the country and its people have shown much resilience. On the subject of population numbers, it’s also worth observing that the Indian population is booming and due to surpass that of China by 2027, when India is predicted to become the most populous country in the world.

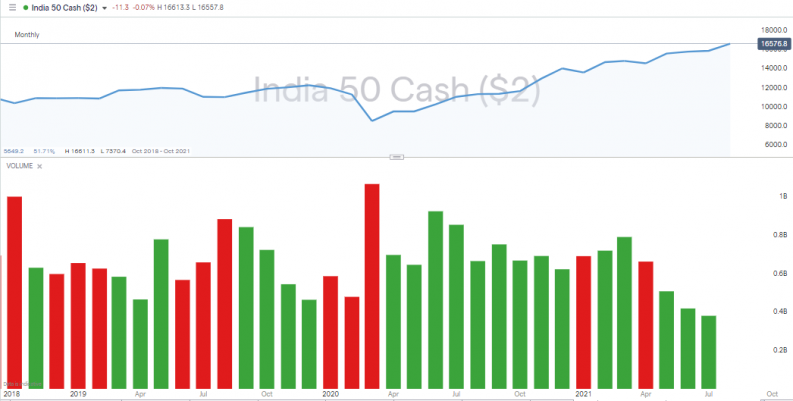

NIFTY 50 Monthly Price Chart – 2010-2021 – With Trading Volumes

Momentum Is Already Building in the India Stock Market

The prospect of Indian companies being able to develop their earnings on the back of economic growth has resulted in stock prices surging. As of 17th August 2021, the NIFTY 50 was posting a year-to-date return to investors of more than 18%. That surpasses the year-to-date return over the same period of the tech-heavy Nasdaq 100 index (16.53%) and the long-established Dow Jones Industrial Average index (15.93%).

The monthly price chart showing trading volumes as well as price shows that the upward price movement is well supported. Trading volumes in the India stock market are consistent, which suggests that the move is down to long-term momentum rather than a momentary spike in interest.

Which Stocks to Buy?

The NIFTY 50 contains the largest listed companies by market capitalisation, but there are plenty more other firms to consider investing in. The members of the 50 might offer healthy dividend returns as well as growth potential, but they can sometimes have maxed out in terms of developing new markets. Smaller stocks that focus on growth have their own fan base, with some investors buying into stocks in the expectation that they might one day become market giants.

Nothing can be guaranteed, but the price has been trending upwards for weeks, months and years, which means that now looks like a great time to invest in stocks in India.

How to Buy Stocks in India

The buzz of excitement about the India stock market has brought it to the attention of experienced and novice traders. Absolute beginners are hearing about the returns being generated and asking the question, how do I start investing in stocks in India? However, it is also important to consider the two main risks involved.

Market Risk

The first is market risk, the chance that your India stock purchase might be a bad choice. This is unfortunately unavoidable, though the below notes offer hints and tips on how to stack the odds in your favour.

Operational Risk

Managing your account effectively and ensuring that you sign up with a trusted Indian broker addresses the second risk. There is a lot more scope for individuals to manage this situation. In fact, if you stick with the below guidelines, you’ll help yourself get to a position that is a long way from the scammers who do unfortunately operate in the market. In terms of brokers, finding the best fit for you can help your trading bottom line. There are a lot of good, trusted brokers out there and each one has its own take on what services to offer its clients.

1. Choose a Broker

Choosing a safe broker is even more important than getting your stock picks right. The unfortunate fact is that if you sign up with a scammer, you are likely to lose all your money and might even double down and wire funds in a vain attempt to get your initial stake back. The scammers are clever and ruthless, which means that avoiding them is rule number one.

Fortunately, financial authorities such as the Securities and Exchange Board of India (SEBI) make it their duty to regulate the financial markets. The regulator was founded in 1988 and operates under the jurisdiction of the Ministry of Finance, and the best news for retail investors is that the organisation’s mandate involves looking after the interests of the little guys. It also handles investor complaints and ensures the fair and efficient operation of financial markets.

The licences of approval that regulators offer can only be attained by the broker completing a range of costly and time-intensive tasks. These include providing reports on the health of the company and how it treats its clients.

If the brokers on your shortlist of candidates are regulated by one of the below Tier-1 authorities, it’s a sign that they are a legit operation.

- Securities and Exchange Board of India (SEBI)

- Monetary Authority of Singapore (MAS)

- Financial Conduct Authority (FCA)

- Australian Securities and Investments Commission (ASIC)

- US Securities and Exchange Commission (SEC)

- Cyprus Securities and Exchange Commission (CySEC)

It is possible to flip stock positions and engage in short-term speculative strategies, but if you’re buying for the medium and long term, then you’ll want to use a broker that also has a good track record. A firm that has recently set up may have a lot of neat new features, but if you want to avoid sleepless nights, then choosing one with a minimum track record of five years could offer some comfort.

The trading dashboards provided by online brokers have a lot of shared functionality but do differ from broker to broker. It’s also worth noting that some brokers offer more instruments and markets than others. Most will allow clients to trade the NIFTY 50 index and some big-name individual stocks, but if you want small-cap stocks or exotic international names, then it’s worth putting in a little research. That way, you can avoid switching brokers at a later date.

One tried-and-tested way to run all those checks and really test a broker’s performance is to open a demo account. These take seconds to sign up for, are provided free of charge, and typically only require you to submit an email address. The platform that you practice on will likely be exactly the same as the one that you would use for live trading, so you can really test its capabilities and practice your trading. You’ll be using virtual funds, so if you make any newbie errors, they won’t impact your real-cash pile but might help your progress towards being a better trader.

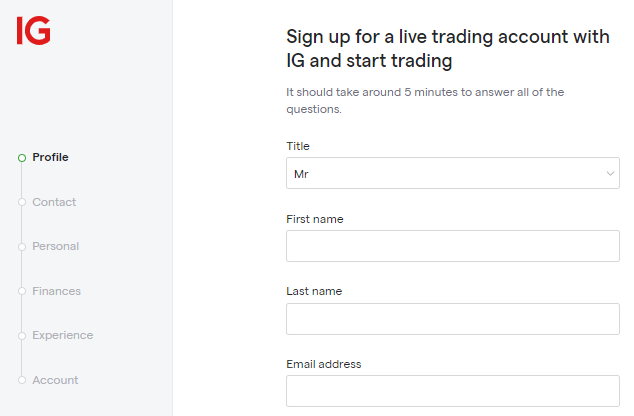

2. Open and Fund an Account

To upgrade your demo account to a live trading account requires providing the broker with some personal information. You can also just head to a live trading account by following the ‘Open an Account’ link found on a broker’s homepage.

Source: IG

Opening an Account

Onboarding is done online, and regulated brokers use a relatively generic template. After submitting personal details, there may be a series of questions relating to topics such as trading experience and investment aims. This is because the broker wants to build a profile for you so that it can comply with client care rules. The final stage of the application process involves verifying your ID, and at that point, your account is set up. The whole process can be completed online and can be done using a laptop, PC, tablet or mobile handset. Once completed, you’re ready to wire funds to your account.

Funding your Account

At the point of sending funds to your new trading account, it’s worth pausing and running a sanity check and considering if any part of the process was suspicious. You are, after all, about to be wiring hard-earned cash to a new account, so ask yourself questions such as, are you the only person with knowledge of the account user ID and password?

If you give yourself the green light and your broker is legit, then there’s another security protocol to be aware of that might offer additional reassurance. International anti-money laundering (AML) laws have been put in place to prevent criminals and terrorists from moving money through broker accounts and out to someone else.

The rules stipulate that any funds paid into an account at a regulated online broker can only be returned to the account from which they originally came. Even you won’t be able to receive funds back into another one of your accounts, and while this may be a slight inconvenience, it does reduce the risk of someone accessing your account and forwarding your funds to a scam account. A broker that complies with international AML laws just won’t allow that to happen.

The process of sending funds to your new brokerage account is like any other online purchase or banking transaction. In fact, most brokers allow clients to fund using a variety of payment methods, though bank transfer, credit card and debit card tend to be the most popular. It is worth checking the terms and conditions at your broker to find the one that comes with the lowest administrative charges and fastest processing times. Once the funds hit your account, you’re ready to trade.

3. Open an Order Ticket and Set Your Position Size

If you already know what Indian stock to buy, then you can navigate the trading dashboard to that market. If you’re still considering your options, then reports in your broker’s research section can help you build shortlists of stock picks. The platforms also provide technical analysis and fundamental analysis tools to help you unearth good investment ideas. Once decided, find your stock by running a search for its name, or filter the stock database by country or sector.

The actual act of putting on a trade involves populating some data fields and clicking or tapping ‘buy’. It really can be as simple as that, but there are some additional risk-management features worth considering using. These can help you limit your downside and enhance returns.

Source: IG

4. Set Your Stops & Limits

Online trading platforms give clients complete control of trade management. Stop-loss instructions and take-profit orders, for example, are instructions built into the system so that the platform will trade on your behalf if price reaches a certain point. You can get on with your day job but still have the security that you will bail out of a position if things do go against you.

Stop losses will automatically sell some or all of your position if price reaches a certain level. You decide what that level is and can change the terms at any time. That way, you can cut your losses on bad trades rather than risk wiping out your whole account.

Take-profit orders work in the same way but close out your position if price moves the way that you want it to. They lock in profits by selling some or part of your position and turn unrealised profits into hard cash.

An Alternative Approach to Stop Loss Use

Stop losses are often recommended for beginners, and there is certainly some benefit from ensuring that you don’t blow up your account after falling in love with a bad position. Practicing using them in a demo account is recommended, but it’s also worth considering an alternative form of risk management: position size. Buy-and-hold investors who are prepared to wait a long time for a position to come good run the risk of being stopped out if there is a flash crash. The argument goes that short-term bumps in the road ought not jeopardise your long-term confidence in a position, and trading in smaller size, and being able to ride out ‘noise’, can help you stay in a trade and protect your account.

In a similar way, take profits can bank cash, which is never a bad thing but can limit your upside. Such decisions are best taken on a case-by-case basis, and effective portfolio management is a good skill to learn. It involves having a clear strategy, including target entry and exit points, and taking the emotion out of trading.

A final order type to consider is the limit order. These allow you to state the price at which you want to enter into a position. It helps you introduce an element of control into your trading and means that you don’t rush in and buy at current market levels. If a stock is trading at R2,150 but you think that it will fall back to the R2,050 price level before heading upwards, you can build that instruction into your broker platform. There’s no guarantee that you’ll be filled at the lower price, but if that is the case, you’ll have achieved a more elegant entrance into the market.

5. Make Your Purchase

The core process of buying Indian stocks is very straightforward. The added protection offered by stop losses, take profits, and limit orders are nice-to-have features but not compulsory. The functionality of modern broker sites is designed to make things easy enough for complete beginners to be able to trade. This is borne out by the influx of newbies setting up accounts and trading their own accounts. At the end of the process, it comes down to simply clicking or tapping the button marked ‘buy’.

One tip passed down by experienced traders is to immediately double-check that you bought what you wanted to. Even the pros make ‘fat finger’ errors, and as soon as a trade is executed, the stock position you bought will be valued according to market price. As this can fluctuate wildly, it’s important to check the ‘portfolio’ section of the platform before any errors prove costly.

Summary

The portfolio section of the site where you can check your new trade is also where you’ll be able to monitor its performance over time. You’ll be able to watch the P&L (profit and loss) on the position fluctuate, and when the time is right, sell some or all of it, or alternatively even add to it by buying more. You’ll have complete control over trade management.

This doesn’t have to eat into your lifestyle, and if your purchase is a long-term investment, then you might want to take advantage of price alerts. These are messages sent from the broker that keep you up to date with recent price moves. That way, you can carry on focusing on your day job but at the same time hope to gain from your investment.

With the process of setting up a trading account being so straightforward and the Indian stock market continuing to surge higher, now could be the ideal time to buy Indian stocks. Nothing is guaranteed, but if you follow the tried-and-tested ways of choosing a broker, you will at least be doing as much as you can to ensure that your broker is the right one for you.