For decades, investors have successfully used an investment strategy you should consider investigating. It is the targeting of high-dividend stocks. Companies that pay investors a share of their profits on a regular basis provide a combination of capital growth (the share price going up) and income. With savings account interest rates as low as they are at the moment, the dividend part of the equation beats the return on cash. Plus, you can also expect to see the share price surge if you pick the right target.

YOUR CAPITAL IS AT RISK

The popularity of this approach means there is a lot of information and research available to help you find the right companies. Then it's a case of selecting a trusted broker to start investing. Institutional and retail investors are always seeking out high-yield stocks, and this review will show you how to follow the easy steps to buy the best blue-chip dividend-paying stocks in Singapore.

Seven Best Dividend Paying Stocks in Singapore

The Singapore stock market has many stocks that pay healthy dividends. As of the 31st of March 2021, the average annual dividend paid by publicly traded companies in Singapore was a very respectable 3.7%. That compares well with the 2.83% per annum average recorded by FTSE 100 index stocks in the UK.

The information about each company's yield-return is freely available because Singapore-listed companies are required to provide dividend information in their financial reports. This makes it easy to compile a list of the top 10 dividend stocks in Singapore. The first inside tip is also to factor in each firm's track record of paying dividends. The fact that a company is in the top-10 this year is no guarantee they'll be there next year. Reliability is critical – look out for names that consistently return cash to investors, like those below.

- 1. CK Hutchison Holdings

- 2. StarHub Ltd

- 3. Maple Tree North Asia Commercial Trust

- 4. ST Engineering

- 5. Singapore Exchange Ltd

- 6. Dairy Farm International Holdings Ltd

- 7. DBS Group Holdings Ltd

Related Articles

- The Best Undervalued Singapore Stocks

- The Best Singapore Stocks to Buy Now

- The Best Singapore Airline Stocks

- The Best Singapore Healthcare Stocks

1. CK Hutchison Holdings

This port operator is a prime example of a business in prime position to churn out long-term dividends. It makes its money supporting global trade and taking a cut on products that flow through its global network of 53 ports in 27 countries. The share price of Hutchison Port Holding Trust is unlikely to soar in the same way as a tech stock might, as its growth potential is capped by the fact that there aren't many potential new port sites available. On the other hand, it has a strong position in an established market, and any disruptors face high barriers to entry.

- 2020 – Reported dividend amount per share: 5.35%

- 2019 – Reported dividend amount per share: 4.27%

- 2018 – Reported dividend amount per share: 3.91%

Source: Morning Star

2. StarHub Ltd

StarHub trimmed its dividend in 2019 and 2020. In the preceding 10 years, it stood out as one of the best dividend stocks in Singapore, with an annual yield exceeding 15%. This telecoms company is relatively small and has seen its share price fall over recent years, so long-term investors can buy in at low levels and wait for a recovery.

- 2020 – Reported dividend amount per share: 3.65%

- 2019 – Reported dividend amount per share: 8.27%

- 2018 – Reported dividend amount per share: 12.31%

Source: Dividends

3. Maple Tree North Asia Commercial Trust

The price chart for Maple Tree North Asia Commercial Trust shows the shares training in a range between 63 and 1.48 since 2013. Currently in the middle of the range, the Singapore-based real estate investment trust (REIT) aims to provide consistent long-term returns from commercial property investments in China and Japan.

- 2020 – Reported dividend amount per share: 5.61%

- 2019 – Reported dividend amount per share: 7.13%

- 2018 – Reported dividend amount per share: 6.95%

Source: Dividends

4. ST Engineering

Singapore Technologies Engineering Ltd operates in the aerospace, electronics and marine sectors. Based in Singapore with a 23,000 strong workforce, the firm has a market capitalisation of S$12.4bn. While the firm's dividend might not be market-leading in gross terms, the consistency with which it makes the payments is noteworthy. If you're looking to take a buy and hold position in a high-dividend Singapore stock and want to some extent to park it to one side, then ST Engineering offers a degree of reliability that might appeal.

- 2020 – Reported dividend amount per share: 3.96%

- 2019 – Reported dividend amount per share: 3.96%

- 2018 – Reported dividend amount per share: 3.96%

- 2017 – Reported dividend amount per share: 3.96%

Source: Dividends

ST Electronics isn't a trail-blazer in terms of share price but the consistency with which it returns cash to investors is hard to beat.

5. Singapore Exchange Ltd

The firm that owns the Singapore Stock Exchange (SGX) has profited from the boom in financial services and the increasing popularity of investing. It pays a healthy dividend yield and offers share price growth – an appealing combination of risk and return.

- 2020 – Reported dividend amount per share: 2.97%

- 2019 – Reported dividend amount per share: 2.88%

- 2018 – Reported dividend amount per share: 3.12%

- 2017 – Reported dividend amount per share: 2.68%

Source: Dividends

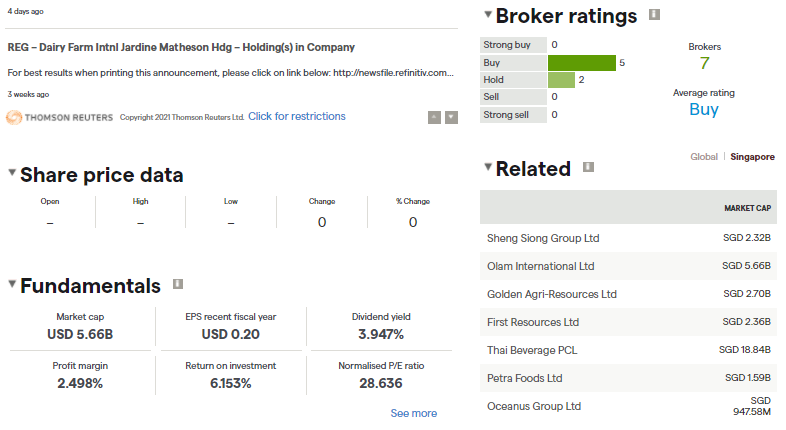

6. Dairy Farm International Holdings Ltd

Dairy Farm is a pan-Asian retailer with 10,000 outlets and 220,000 staff. The group operates under five key brands, including Cold Storage, Manning's and Maxim's. In 2020, it recorded total earnings in excess of $28bn. As dividend yield is a function of gross dividend divided by share price, buying in at the current low price levels could pay off in the long term, particularly if the retail sector bounces back after the Covid-19 pandemic.

- 2020 – Reported dividend amount per share: 4.44%

- 2019 – Reported dividend amount per share: 4.78%

- 2018 – Reported dividend amount per share: 4.78%

- 2017 – Reported dividend amount per share: 4.78%

Source: Dividends

7. DBS Group Holdings Ltd

This multinational banking and financial services corporation is headquartered in Singapore but has a global reach. It's the highest-rated banking group in Asia, which counts for a lot if you are taking on a long-term investment. It has a strong balance sheet in terms of liquidity and capital requirements and has an eye on growth. DBS is Singapore's largest lender, and its Q1 2021 financial statement shows a profit of S$2bn with fee income rising and net interest margins holding firm. The outlook also improved thanks to bad loan ratios returning to pre-crisis levels.

- 2020 – Reported dividend amount per share: 2.97%

- 2019 – Reported dividend amount per share: 2.88%

- 2018 – Reported dividend amount per share: 3.12%

- 2017 – Reported dividend amount per share: 2.68%

Source: Dividends

Why Invest in High Dividend Stocks Now?

While all investment is inherently risky, high-dividend stocks do sit at the safer end of the risk-return ratio. Firms with strong revenue streams tend to offer relatively good protection from economic slumps. If markets rally, they may underperform growth stocks, but at the same time, provide a steady income stream as a consolation. The COVID-19 pandemic and associated lockdowns highlighted how having a percentage of your portfolio in the best Singapore dividend stocks would be a good idea.

What to Know Before Investing in Singapore Dividend Stocks

It's possible to make substantial long-term returns from high dividend stocks, but there are some potential downsides to keep in mind.

Opportunity cost

By tying up cash in the more risk-averse positions, you are forsaking the chance of catching the next big growth investment. Amazon and Google (Alphabet) are examples of firms that have seen their share price increase by many multiples, but they have never paid a dividend. Instead, they reinvest spare cash back into the business. That approach marks them out as growth stocks and can result in the share price soaring far higher than it ever will with a high-yield Singapore stock.

You still don't remove all the downside risk

While high-yield stocks are largely insulated from economic downturns, they aren't immune. The unprecedented events of 2020 rocked even the most respected business models. As the global economy ground to a halt, so did international trade. CH Hutchison Holdings Ltd share price hit the lowest price levels since 2018, for example. It is also worth noting a lot of investors buy into dividend stock specifically for the income yield. If that stops being the case, there can be a rush for the door as there isn't much else to attract investors.

You still need to optimise your trade entry point.

Dividend yield depends on what price you buy in at. As the dividend paid to shareholders is paid according to the number of shares you hold, then the lower the cost of the shares, the higher your yield. If Investor A buys into a stock at a price twice that of Investor B, A's long-term dividend yield will be half of B's.

Dividend dates

Dividends are paid on specific dates and getting to grips with some of the terminologies can be helpful. This report can help you with that, but the good news is that dividends tend to be ‘priced in' to the share price. Therefore, if you sell before the dividend ex-date, you shouldn't necessarily lose out.

What Warren Buffet thinks about dividends

Firms that pay dividends have stopped reinvesting cash in exciting new growth schemes. They may not have run entirely out of ideas, but they aren't as exciting a proposition as some other firms. Any returns, as a result, are likely to be stable rather than spectacular.

The investment guru, Warren Buffet, runs strategies that invest in high-dividend companies. However, his investment firm, Berkshire Hathaway, ironically has never paid a dividend to BRK shareholders. That is because Buffet backs himself to make a better return by holding onto the cash than returning it to his investors in the form of dividends.

How to Find and Evaluate Singapore Dividend Stocks

If you're looking for dividend stocks, step one involves understanding the process used to calculate yield.

- The formula is annual dividends per share ÷ price per share.

- You simply divide how much was paid in dividends in cash terms in a given year per share by how much one share cost to buy.

The estimates applied to each of the six stocks in the text above were calculated using the most recent dividend per share divided by the share price for each company on the 27th of July 2020. If prices had been taken on another date, then the yield calculation would have been different.

With dividend investing being so popular, many brokers and research houses offer tables that use real-time prices. AskTraders has also produced research notes such as this one, which goes into the subject in greater detail.

Choosing to use a well-known and regulated broker means you're protecting yourself from scams. Also, a regulated broker allows you to make use of extensive research tools, something which weaker brokers typically don't offer.

How to Start Trading Dividend Stocks Online

1. Choose a Broker

Finding your target dividend stock is the first part of the process – the second is choosing the right broker. As you'll be depositing funds into a new brokerage account, it's good advice to start by asking, ‘how to find a safe broker?’ Any broker regulated by one of the below financial authorities is worthy of being on your shortlist:

Tier-1 Regulators

- Monetary Authority of Singapore (MAS)

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The US Securities and Exchange Commission (SEC)

- Cyprus Securities and Exchange Commission (CySEC)

Good online brokers allow you to carry out all your trading and portfolio management using desktop or handheld devices. The added convenience of being able to trade via your mobile phone appeals to many, and you can even complete the account registration process next time you have a few spare minutes.

The broker’s mobile app and desktop platform will be your personal interface with the markets, and the good news is you can try them out for free. Demo trading accounts take seconds to set up as they usually just require you to provide an email address. Once that's done, you can test the trading experience with that particular broker and practice trading using virtual funds. It's a risk-free way to test a broker's capabilities and your trading skills and is strongly recommended before investing real cash.

Best Brokers to buy Dividend Stocks:

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookIf you are ready to add some dividend stocks to your portfolio you'll need a broker that is regulated, has low fees and a user-friendly platform. Finding one can be a daunting task, which is why we've selected some of our favourites that tick all of these boxes to help you get started.

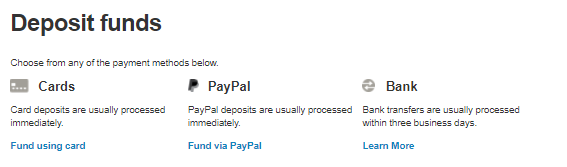

2. Open & Fund an Account

It takes minutes to set up an account with an online broker and invest in Singapore's best dividend yield stocks. Those few minutes could be time well spent as a long-term position in high-yield stocks can generate income returns for years to come.

Source: IG

The actual online registration process involves providing some personal information, verifying your email and uploading proof of identity. Most accounts are confirmed instantly, and then it's a case of wiring funds into your new account. Popular payment methods include bank transfer and debit/credit card, and payments using cards are usually credited immediately. As soon as the funds hit your account, you're ready to start trading.

3. Research Companies Using Fundamental and Technical Analysis

Successful dividend trading relies on working out the long-term prospects of a company. Good brokers offer in-depth fundamental analysis of the different stocks. It might be in the form of news reports, research notes or comment and insight from industry experts. Tapping into this free research is an excellent first step. Once you've established which of the best dividend stocks in Singapore you want to buy, you might want to consider Technical Analysis to optimise your trade entry point. This approach considers historical price data to create ‘indicators' that help traders spot short-term dips in price.

Source: IG

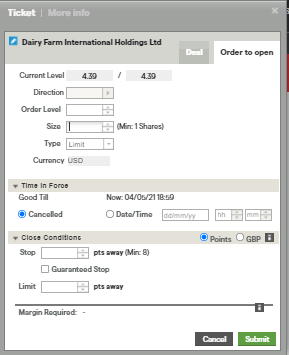

4. Open an Order Ticket & Set Your Position Size

The minimum amount of data needed to buy Singapore stocks is the quantity you want to buy. It's then a case of clicking or tapping the ‘Buy' button.

Source: IG

5. Set Your Stops & Limits

There are other order types to consider, including ‘Stop Loss' and ‘Take Profit' orders. These are instructions built into the system to automatically close out some, or all, of your position if the price reaches a certain level. Stop-losses help you bail out of a position if price is plummeting and take-profits allow you to lock in gains if price goes your way. They can be helpful tools if you are looking to set up your position and then get back to your day job.

An alternative approach is to manage risk by trading at a small volume. High-dividend stocks in Singapore are relatively secure investments, but it's worth remembering that you should only ever trade an amount of cash you can afford to lose. If that is the case, you'll take the emotion out of trading and reduce the chance of panicking during a short-term price slump. If you choose not to use stop-losses, you remove the risk of being ‘stopped out' during a momentary flash-crash, which is when the price drops suddenly and then returns to the previous ‘normal' level.

6. Select and Buy Singapore Dividend Stocks

Once you've inputted and checked your trade instruction, it's just a case of clicking ‘buy'. That will convert part of your cash pile into a stock position, and that asset will fluctuate in value according to live-market prices.

Your P&L (profit and loss) will be shown in the portfolio area of your account, and checking it is always recommended as it can confirm you bought what you intended to purchase. Even experienced investors make ‘fat finger' errors, and any mistakes are best rectified straightaway.

One important check to make is that you bought your high dividend Singapore stock outright and not in CFD format. CFDs are a popular trading tool and have some extra functionality compared to buying outright. However, they do accrue daily financing fees. They stack up over time, and if you're looking to hold your high-yield strategy position for longer than a few weeks, it is likely to be more cost-effective to avoid trading it as a CFD.

Summary

Most investment portfolios will have space for Singapore dividend stocks. They are a unique asset class that help balance out the volatile returns of more aggressive strategies. They also currently beat cash savings account returns. Beginners, in particular, might benefit from trading these top dividend stocks in Singapore and the time to act is now.

The long-term approach benefits from some thought being given to which broker you use. Some, for example, offer news alerts and research findings to keep you up to date on performance. However, choosing one that is reliable and trustworthy is the number one priority.

Dividend stocks might not be the most exciting market to invest in, but long-term data shows that they offer a more than reasonable risk-return ratio in terms of investor returns. You don't always need to have an exciting new idea or an inside tip-off to make a good return. Sometimes just following the established practice carried out by generations of previous investors can pay off handsomely.