Pepperstone has built a reputation in the investment community for providing fast, cost-effective, and reliable trading services. It now offers three ways to copy trade with clients benefiting from the same high service standards with Pepperstone Copy Traders.

There is a vast range of copy traders to choose from, and this shortlist has been compiled to ease the selection process. It clears the way to having other more experienced traders carry out the research and portfolio management required to succeed, allowing followers to potentially make low-maintenance returns.

Table of contents

Selecting the Best Copy Trading Platform at Pepperstone

The Myfxbook, DupliTrade, and MetaTrader Signals platforms allow Pepperstone clients to copy the trading ideas of some of the best traders in the market. Having three platforms on offer enables copiers to find the best fit for their approach, and a range of other filtering tools help them identify the strategies and traders they want to follow.

It's always a good step to ensure that a trader you follow is trading with real, not virtual, cash. Their having ‘skin in the game' allows copiers to know the interests of the leading and copying trader are closely aligned. That makes the Myfxbook copy trading platform appealing as it only offers accounts from traders running a live rather than a Demo account.

The MetaTrader Signals copy trading platform offers followers a degree of security because it is so well established. The service first came into the market in 2012 and has since become the natural home of thousands of experienced traders willing to share their strategies and ideas with others.

DupliTrade completes the suite of Pepperstone copy trading services. It offers Pepperstone clients the chance to fully automate their trading by copying the trading decisions of leading traders. The AUD$5,000 minimum account balance reflects the platform's position as a premier-grade service, but those wanting to try it out before committing can do so using a Demo account.

Selecting the Best Copy Traders on Pepperstone

Whether you're booking your own trades or copying the ideas of others, the selection process starts with considering your investment aims. Your desired rate of return, investment time horizon, and personal approach to risk will help determine which trader to follow.

The traders you can follow at Pepperstone specialise in different asset groups. Some run short-term strategies, while others adopt a more patient approach. Once you find the ideal match, some time will need to be devoted to monitoring trades, but the day-to-day process of booking trades and balancing portfolios will be outsourced.

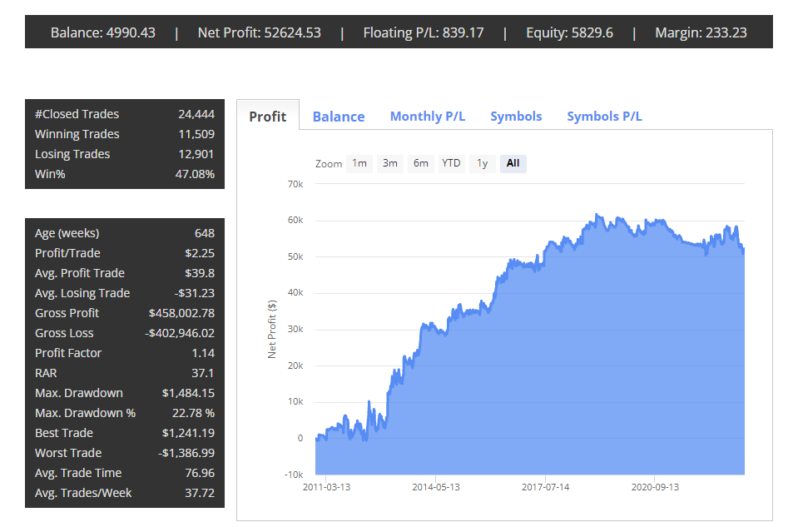

Top Pepperstone Copy Traders and Their Strategies

The transparent nature of the DupliTrade platform makes it possible to dig into granular-level data relating to the portfolio performance of potential lead traders. Although the platform's management carefully curates the list, there are plenty of traders to choose from, each with a distinctive approach to trading the markets.

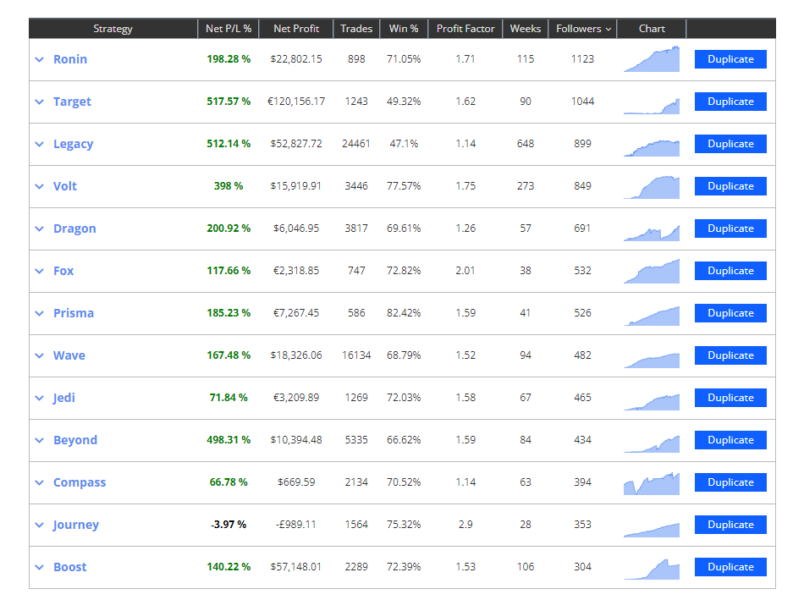

Ronin

Ronin Strategy Provider applies fundamental analysis and follows macroeconomic news developments to trade major and minor currency pairs. Risk is managed using technical analysis tools, and being a semi-automated strategy, there is some additional confidence in knowing that the strategy's operators monitor trading activity.

The Ronin strategy was first launched in January 2021 and currently has a whole-life P&L return of 195.55%. The win-loss ratio of 70.93% and the relatively modest maximum drawdown of 7.29% point to the strategy managers having the risk-management expertise to make long-term gains.

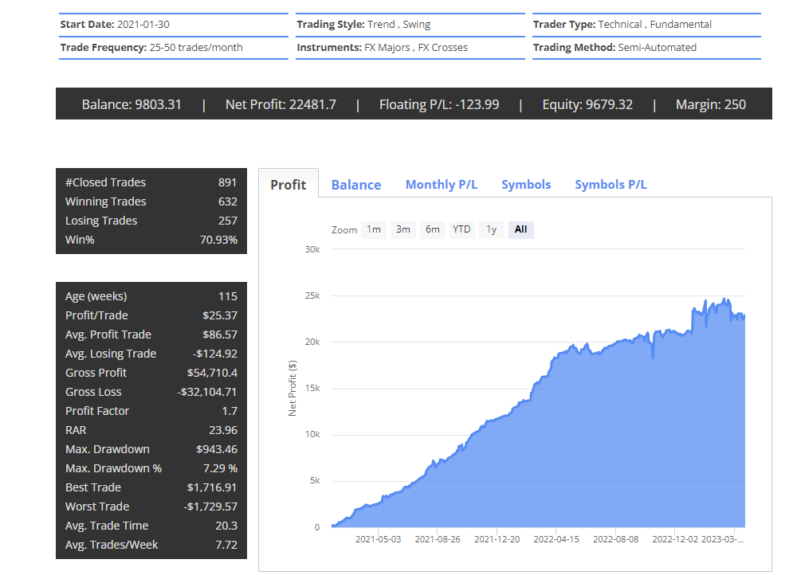

Prisma

The Prisma Strategy Provider at DupliTrade is a good fit for those with a more conservative approach to risk return. Assets traded include major and minor currency pairs, and the trading model is fully automated – though it is “constantly monitored and controlled by its operators.” It uses technical indicators such as RSI and Stochastics to identify and profit from forex market trends.

The 183.98% return since the program launched in July of 2022 is impressive enough, but a glance at the performance tables shows that returns also benefit from relatively low volatility. The maximum drawdown is only 4.82%, and the win-loss ratio of 82.33% is also impressive.

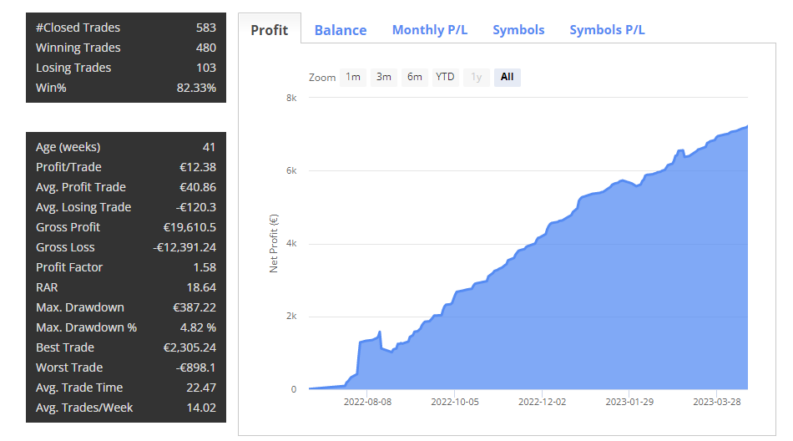

Legacy

The way that DupliTrade filters out potential traders to provide a preferred short-list makes the inclusion of a program which has been running since 2016 noteworthy. The Legacy Strategy Provider trades gold and major and minor forex pairs using robot-based algorithms designed to spot moments when markets are ‘overbought' or ‘oversold'.

Timing moments when price trends end and when they reverse is notoriously tricky, and the win-loss ratio on the Legacy strategy is only 47.08%. But thanks to careful trade management and trust being shown in the model's algorithms, the program has posted lifetime returns of 510.26%. The maximum drawdown of 22.78% is something to consider and suggests that those who copy Legacy might be in for something of a rollercoaster ride.

Recent Success Stories and Scale of Returns

Some strategies work better in certain market conditions, which means that at any one time, there will be some posting breathtaking returns. Part of the art of copy trading is being aware of when to rotate from one lead trader to another, and the chart of current top performers is an excellent place to start that research.

Target

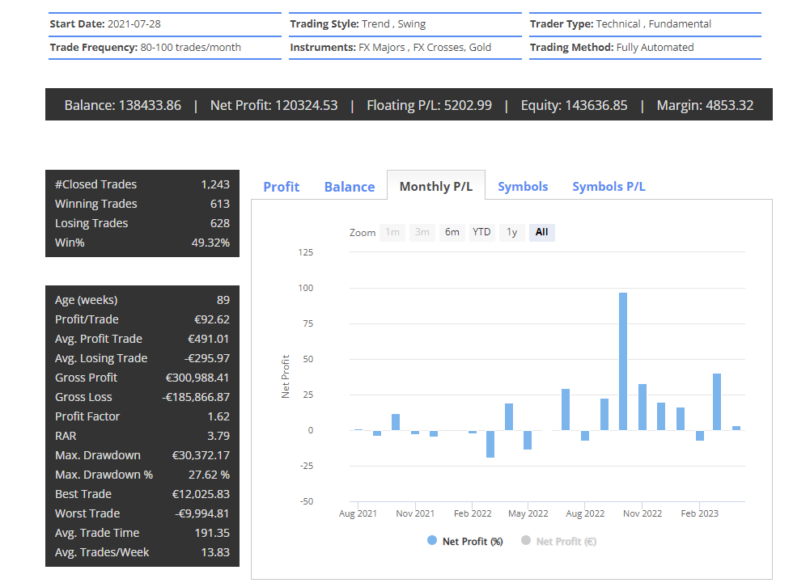

The Target Strategy Provider started trading in July 2021 and has already posted a 512.49% return. It focuses on the commodity and currency markets using AI-based technical indicators to apply trend and swing strategies. The maximum drawdown of 27.62% and peak monthly return of +97.27% in March 2022 mark this strategy as one for those with a more aggressive approach to risk return.

Volt

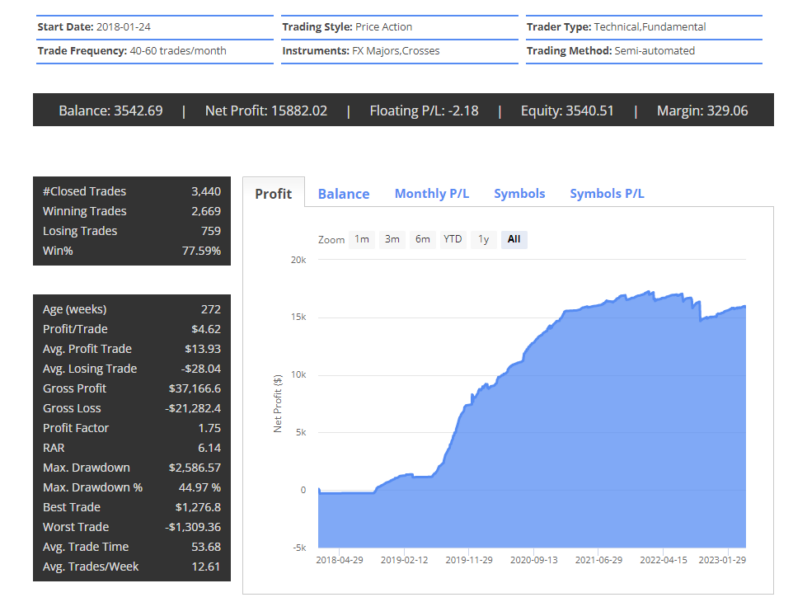

Since its inception in 2018, the Volt Strategy Provider has returned 397.11% to investors. That includes a slump in value in Q3 of 2022 when three successive down months resulted in a drawdown of 44.97%. Since then, the strategy has posted six consecutive up months, which points to current market conditions being much more favourable.

Copy Trading Best Practices

Market risk – the chance that your investment might go down in value is unavoidable whether you are trading your own account or copying the ideas of others. Investors need to be aware of some additional risks associated with copy trading to optimise returns.

While you can cut links to a trader you are copying at any time, research and due diligence are crucial to ensure the trader is worthy of managing your capital. During the time your account is set up to copy someone else, you'll be fully exposed to their trading decisions.

Looking past “performance returns” can shed more light on the likelihood a trader might be worth copying. A longer-track record of success is one thing to look out for, as is considering ‘how' they trade and their approach to risk management. That can help copiers identify if there is any divergence between what a trader states is their aim and what trades are booked.

As lead traders are already running strategies, new copiers must decide whether to copy all existing positions – to mimic the portfolio exactly or just copy new trades. The decision on whether to do this needs to be taken on a case-by-case basis as it will be influenced by the type of strategy involved, but some lead traders provide guidance on which approach they suggest new copiers take.

The summary statements and performance figures of lead trader profiles offer a good idea of what copiers can expect. However, carrying out more stringent due diligence involves considering a lead trader's win-loss ratio and maximum drawdown.

Those data points give an insight into what levels of P&L volatility can be expected and whether a lead trader holds onto losing positions until they come good – or alternatively blow the account up. Traders who adopt a more disciplined approach and accept all trades won't be profitable are a better option for those looking to avoid risking their money on an all-or-nothing strategy.

Whether you book trades yourself or use a copy trading service, diversifying your investments is a sound idea. It helps manage the risk that one position or trader could underperform and can smooth out P&L returns – that makes sticking with a strategy easier as it takes the emotion out of trading.

If you're still wondering if copy trading is for you, one way to learn more is by using a Demo account. That way, you can practise getting used to the processes involved and what it feels like to copy another trader using virtual funds.

Trader Discretion Advised

The risks associated with Social Trading include but are not limited to, automated trading execution, whereby the opening and closing of trades will occur in your account without your manual intervention. Trading foreign exchange (“forex”), commodity futures, options, contract for difference (“CFDs”) and spread betting on margin (the “investment products”) carry a high level of risk and may not be suitable for all investors. Past performance is not necessarily indicative of future results. No representation is made that any account will or is likely to achieve profits or losses similar to those shown.

Conclusion

Pepperstone's approach to copy trading has won many plaudits. Providing a choice of three different and well-regarded copy trading platforms is a particularly good fit for beginners to discover which approach suits them best. From there, it's a case of accessing the markets hassle-free and benefiting from the highly competitive T&Cs associated with the Pepperstone service.