Amazon is a tech juggernaut. It is one of the largest and most successful companies in the world, and that success has been demonstrated in its share price over the years. Amazon has benefitted from the shift to online shopping and its success has allowed it to branch out into other sectors.

YOUR CAPITAL IS AT RISK

Given the company's growth, it's no surprise that Amazon is on the top of the of many investors shopping lists Savvy investors who had already purchased Amazon stock before the pandemic have benefitted from a meteoric increase of more than 60% since the beginner of the year. So, if you're looking to invest in Amazon, it's not too late. We'll show you how to buy Amazon shares, where to buy them and more.

Table of contents

Amazon Overview

The online retailer, streaming services provider, and cloud computing company is focused on three main segments, including its online retail business, Amazon Web Services (AWS) and its media segment, which includes Prime Video, Amazon Music, and Amazon Books.

Amazon has a long history of innovation and growth. The company was founded in 1994 by Jeff Bezos in his garage, and it has grown from a small online bookseller to a global tech giant. The company is known for its customer focus, low prices, and wide selection of products and services.

The company operates in various countries globally, although the exact number varies depending on which service you are using.

Amazon's retail platform represents its primary source of revenue. The company's online and physical stores together account for the biggest share. However, AWS currently generates a significant portion of the tech giant's operating profits. Its AWS offering also continues to grow at a rapid pace.

Alongside its other business segments, Amazon is making a move into the healthcare sector, recently rolling out its virtual health clinic service across the United States. Amazon’s scattergun approach to investing in start-ups has, to date, been a profitable one and looks set to continue. In an effort to make sure it is part of ‘the next big thing’, the firm’s subdivisions include Amazon Athena, Amazon CloudSearch, Amazon Redshift, Amazon EMR, AWS Data Pipeline, Amazon Elasticsearch Service, Amazon Kinesis, AWS Glue, Amazon Managed Streaming for Apache Kafka, Amazon QuickSight, AWS Lake Formation and more.

YOUR CAPITAL IS AT RISK

Amazon Shares: The Basics

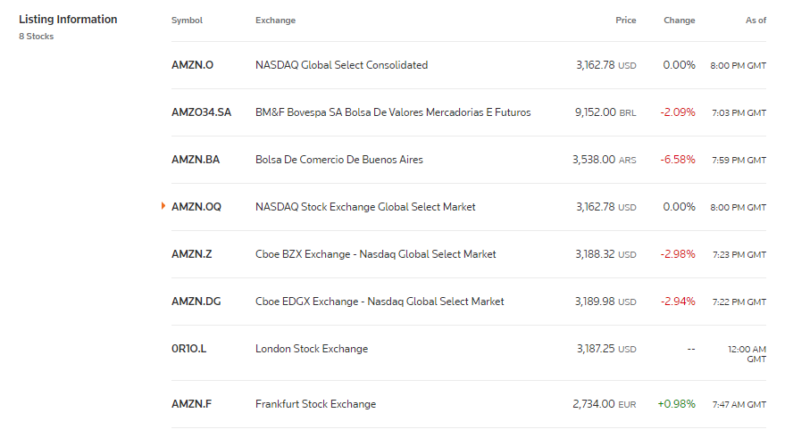

Amazon is listed on the Nasdaq under the ticker “AMZN.” The company continues to rank as one of the most valued companies in the world by market value, which stands at more than $1 trillion. However, it wasn't always valued that highly. When the stock went public on May 15, 1997, the IPO price was $18 per share, or $0.075 adjusted for stock splits. The stock can also be purchased via various other exchanges globally.

Despite its significant size and cash generation, Amazon has never declared or paid a cash dividend on its common stock. Investor gains in the growth stock have so far been generated via the company's considerable share price surge over the years.

The company's fiscal year is based on the calendar year, with the last day of the fiscal year being December 31. You can find Amazon's most recent quarterly metrics here.

Source: Reuters

YOUR CAPITAL IS AT RISK

Steps To Buy Amazon Shares

Buying shares in Amazon is incredibly easy and you don't have to be an expert to get started:

1. Research Amazon Shares

Failure to prepare is preparing to fail. Despite Amazon's recent success, there's no such thing as a ‘sure thing' in trading and investing. While Amazon is considered by many investors to be a safe-as-houses ‘blue-chip stock', it pays to do your due diligence and make your own informed decisions. Learn how to value stocks and arrive at your own conclusions.

We can see from the analysts view below that the majority feel that the stock price has a little wiggle room, and can move upwards, but this view cannot be taken as fact and is liable to change. Understanding what the analytic professionals think about a company is a good place to start and doing your own research is imperative to success.

A good place to start is learning how to value stocks in order to make informed investing decisions – something that will stand you in good stead in the future. You can see some of the important data metrics below that might give you some idea where to start.

2. Find a Broker

Finding the right broker for you is perhaps the most important part of the process. While you can buy Amazon stock with most brokers on the market today, not all brokers are created equal.

If you're ready to buy Amazon shares, you'll need to use a broker that is FCA regulated, has low trading commissions and a reliable trading platform. Finding one can be an arduous and daunting task, which is why we've hand-picked favourites that tick all of these boxes to help you get started.

3. Open & Fund an Account

Once you've compared the best brokers and selected one that is a good fit for your requirements, it's time to open an account and make your first deposit. In line with ESMA ‘Know Your Client' (KMC) regulations, you'll need to fill out a brief form to confirm your identity. When it comes to making a deposit, some brokers offer more deposit methods than others. You should always opt for a broker that offers a variety of payment methods ranging from bank transfers through to e-wallet methods such as PayPal, Neteller and Skrill.

4. Buy Amazon Shares

Once the funds hit your account, you’re ready to buy shares in Amazon. Navigate to the stocks/shares section of your broker's platform and search for ‘Amazon' or ‘AMZN'. You will then need to insert the amount you want to invest in Amazon in the order form. Bear that it's always a smart idea to set order types on your purchase orders, something that is available with many brokers. Risk-management tools such as this are a great way to protect yourself against potential losses.

Related: How to Research and Pick Stocks

YOUR CAPITAL IS AT RISK

Ways to Buy Amazon Stock

Most good brokers offer their clients the chance to buy the underlying shares. This more traditional approach to trading shares involves exchanging an amount of cash in return for a holding in Amazon stock.

Those who are looking to trade Amazon shares more actively may favour using CFDs. These instruments come with some functionality that can’t be found in buying shares outright.

Short-selling

The tech-sector is known for its volatile price moves. Understanding that dramatic prices moves can be both up or down does open the door to short selling Amazon. This involves using CFDs in Amazon to sell at one price with the intention of buying it at a lower level in the future.

Leverage

As CFDs are derivative products, you can scale up your risk-return using leverage. This involves placing a cash deposit with a broker who then allows you to take a position greater in size than your cash amount. Leverage comes with additional risks and is not recommended for novice traders.

Trading using CFDs can result in additional costs, such as overnight financing charges. These kick in when you trade on margin and can eat away at any profits you make on the price move. If you are looking to hold your position for more than 4–6 weeks, then buying outright rather than on CFD may be more economically viable.

Best Broker to Buy Amazon Shares

The intense competition between brokers feeds through to improved T&Cs for brokerage account holders. Each broker will provide users with something slightly different. As demo accounts are free to set up, it is recommended you try a few to find the best one for you.

Broker comparison tables such as the one found here are useful resources.

Finding the right broker is perhaps the most crucial part of the process. While you can buy Amazon shares with most brokers on the market today, not all brokers are created equal. For example, some may only be focused on forex or cryptocurrency trading and will not offer individual shares.

If you’re ready to buy Amazon shares, you’ll need to use an FCA-regulated broker with low trading commissions and a steadfast trading platform. Finding one can be arduous and daunting, so we’ve hand-picked favourites that tick all the boxes to help you get started.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading stocks, CFDs, forex, cryptos, and beyond. Dive in and test their capabilities with complimentary demo accounts.

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY

YOUR CAPITAL IS AT RISK

Fees When Buying Amazon Stock

While you’re watching the price of Amazon move up and down, do devote some time to monitoring other costs and fees associated with trading.

The T&Cs associated with CFDs and equities are different in nature and keeping on top of fees is an important part of being a successful trader.

| eToro | Plus 500 | Markets.com | |

|---|---|---|---|

| Inactivity Fee | Yes | Yes | Yes |

| Inactivity Fee details | $10 per month. After 12 months | $10 per month. After 3 months | $10 per month. After 3 months |

| FX Conversion | Yes – on non-base currency trades | Yes – on non-base currency trades | Yes – on non-base currency trades |

| Fund withdrawal fees | Yes – $5 | Applied on some payment methods | Yes – $5 -$100 |

| Trading commissions | Included in spread | Included in spread | Included in spread |

| Overnight Financing | Yes, on CFDs | Yes, on CFDs | Yes, on CFDs |

Final Thoughts

Amazon is a stock that is just impossible to ignore. Its size, dynamic approach and share performance have made it a favourite for many traders and long-term investors.

No one can guarantee that the Amazon share price will continue to outperform the general market. Trading it is, therefore, a decision that needs to be based on careful analysis. One nice-to-have feature is that by choosing the right broker, the process of actually buying ‘Amazon’ can be turned into one of the easier parts of the trading/investing process.