Across the world, new markets are opening up, new instruments are being developed and new investors coming into play. It can be hard to keep up, but there is one fundamental principle — ensure the program suits your particular needs. This analysis will consider different investment opportunities and if they are for you. This article will look at CFDs vs investing, covering:

- What returns can you make investing in the financial markets?

- What should I invest in?

- How to make money using CFDs?

- Final thoughts

What returns can you make investing in the financial markets?

Traditionally, the term ‘investing’ has come with connotations of buy-and-hold. It’s certainly true that historical data points to positions held over the long-term eventually come good.

Long-term return on equities: The long-term return on stocks, as measured by the S&P 500 equity index from 1957–2018 is approximately 8%.

Long-term return on government bonds: Government bonds have returned between 5%–6%, according to investment researcher Morningstar.

Long-term return on corporate bonds: The nominal average annualised return for investment-grade corporate bonds from 1928–2019 was:

- AAA Rated Corporate Bonds: 5.7%

- BBB Rated Corporate Bonds: 7.0%

- Junk Bonds: 8.1%

Source: Investopedia

Source: Mindullyinvesting

What should I invest in?

There are a range of other asset groups to consider. Some have been in play for centuries and have tried and tested transactional procedures. There are also a range of financial instruments such as options, futures and commodities, which allow you to invest with a greater degree of sophistication.

Bonds

Over the long-term, it’s hard to buck the market. The extra risk involved with holding assets such as equities generates a greater return. In the same way, default risk on corporate bonds is higher than government bonds.

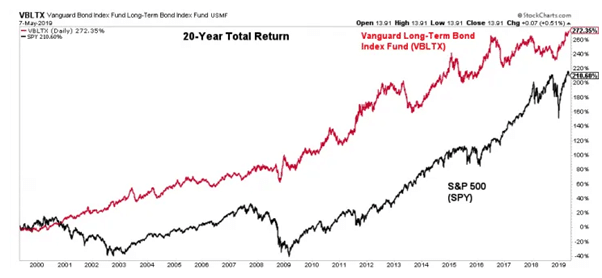

The time-window over which you run your analysis will also play a part. Over the course of 100 years, equities have outstripped bonds. Over a more recent timeframe, the opposite has been the case.

The 20-year total return of the Vanguard Long-Term Bond Index Fund (VBLTX) versus the S&P 500 Index ETF (SPY):

Source: Financial Samurai

Real estate

Real estate and currencies are popular places for people to put their money and try and make a return. You don’t have to own the key to a property to gain exposure to the sector. Real Estate Investment Trusts (REITs) in particular offer investors an opportunity to establish a diversified property portfolio.

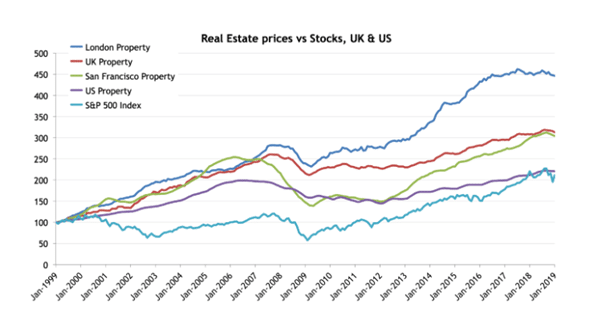

The below chart shows how such returns are still dependent on unique factors such as geographical location.

Stocks vs real estate — 20 years of price history, rebased to 100 in January 1999:

Source: Towards Data Science

Forex

Forex trading is very popular among short term traders. The characteristics of the market and the deep liquidity also attract traders using technical analysis and automated trading techniques. It can also attract investors with a longer time frame.

Family offices, funds, high net worth individuals and even retail investors can tap into forex moves. If an investment strategy involves holding a percentage of net worth in cash, then that can be done in any location. The world is literally your oyster.

In fact, forex moves can often be triggered by interest rate adjustments as ‘hot money’ moves from one country to another looking to gain the best interest rate on cash balances.

Investing in forex needs to factor in your interest rate return and potential forex moves. The two are often aligned. If you put your money in an Australian bank account and the Reserve Bank of Australia increases interest rates, then the win-win will be a higher return and relative increase in the value of AUD.

Futures and options

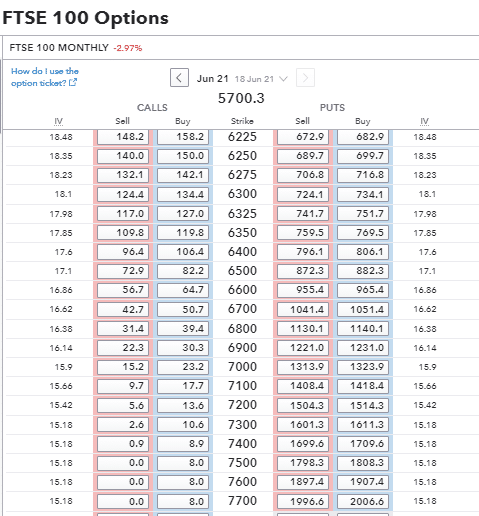

Derivative instruments such as futures options also offer exposure to the markets. They can also be used as a form of insurance.

Buying long-dated out of the money Put options in an equity index might cost you a relatively small amount in terms of your total investment portfolio. It would offer protection to the downside, as if equity markets do go into meltdown, the Puts could come into the money and compensate for losses in other areas.

Source: IG

Commodities

Some commodities are particularly well suited to buy-and-hold investment strategies. Gold, in particular, is the subject of much debate.

The trading community is torn between the convenience of holding it with a third party, such as in an ETF (Exchange Traded Fund) or in physical form.

The thinking is that if the global financial system does meltdown, then that is when gold will come into its own as the world’s currency. In this scenario, you’ll want your asset to hand, even in the form of jewellery.

If it’s held in a vault or an online account, you could be relying on others to give you access to your suddenly very valuable property.

How to make money using CFDs?

There are countless markets and instruments in which you can invest. Running along-side these markets are CFDs (Contract for Difference). There are particular features of CFDs, which make them particularly useful for short-term trading.

One measure of CFDs is their undoubted popularity. The volume of CFD trading in the forex market alone is calculated to be $5.4tn per day.

Variety: There are CFD products that cover single stock equities, bonds, stock indices, cryptocurrencies, forex and more. Being able to use one instrument, CFDs, to trade such a diversified range of markets is one of the product’s plus points.

Convenience: If you choose the right kind of broker, you’ll have all of the above markets available to trade from the same account. The priority is to ensure your broker is regulated by a tier-1 authority.

Then consider the range of markets. Some brokers such as IG offer more than 10,000 different markets.

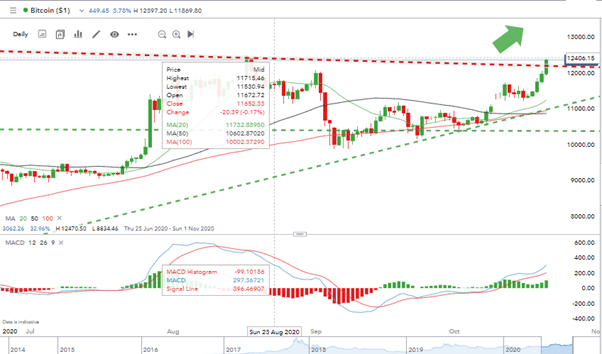

Investing in physical gold offers a unique form of ownership. By contrast, a CFD position in gold can be traded into, and out of, at the click of a button. While you are holding it, then you’ll get live pricing reports and access to research and analysis tools.

Source: IG

Selling short: If you think the price of gold is higher than it should be, any suggestion that price is about to correct downwards can be traded using CFDs.

You don’t need to own an asset to sell it. This process of ‘selling short’ is one of the attractive features of CFDs. It’s also something that makes CFDs popular with traders operating short-term strategies.

Financing costs: As CFDs are derivative products, trading them involves margin. When a broker uses your cash balance as a deposit to buy a position that is larger than your original deposit, they are effectively lending you money. This loan of funds incurs an over-night financing charge.

Investment strategies that operate over a longer-time period tend to have lower holding costs than CFDs.

Cost advantages of using CFDs: Trading in and out of positions frequently can incur certain costs. There is the bid-offer spread to consider and specialist CFD brokers tend to compete in this area.

There is more good news for traders using CFDs. Depending on your location, you might be able to avoid certain transaction taxes. UK-domiciled traders, for example, can use CFDs to avoid the 0.5% SDRT charge applied on purchases of UK-listed stocks.

Leverage: CFDs allow you to scale-up your risk-return. Profits and losses can be magnified using leverage. This is a risky approach and not advisable for the novice trader. It is worth noting as it offers something different to the standard buy-and-hold approach to investing.

Final thoughts

In truth, when considering investing CFDs, it is probably not a case or either/or. Finding a balance between long-term and short-term investment aims involves choosing the right tool for the job.

The neat features of CFDs, such as ‘short-selling’, are hard to ignore. The general view within the trading community is that CFD financing charges start to become a factor after a period of a few weeks. This makes CFDs particularly useful for short-term speculation rather than long-term investing.

Short-term speculation does come with additional risks. So that is something else to factor in.

There is another very important point to consider. The approach you take needs to fit in with your lifestyle and the time you can commit to making a return on the markets.

People who read this also viewed:

- How to start trading online (a beginner's guide)

- What is CFD Trading? Contracts for difference explained

- Dividend stocks: A guide

- Beginner’s guide to CFD trading

- How to invest in stocks in the UK

- What is counterparty risk in CFD trading?

- 12 best shares to buy as a beginner in 2020

- Beginner's guide to risk management