Energy stocks have had a very volatile year, with geopolitical uncertainty in the Middle East causing wild swings in prices, before stabilisation. Despite the pullback, the moves have largely been to the upside thanks to various factors creating a tailwind for the sector. Trading with the trend is always a good idea, but by using technical and fundamental analysis techniques, we have identified some the best energy shares to buy for the long-term.

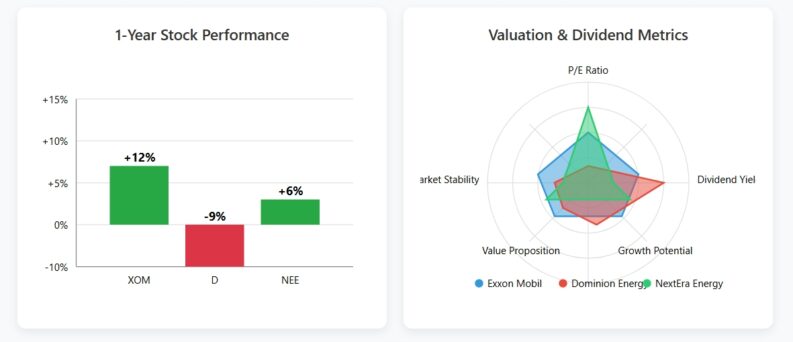

The energy sector, a cornerstone of the global economy, continues to evolve at a rapid pace, presenting both opportunities and challenges for investors. As of July 2025, three major U.S. energy stocks in Exxon Mobil (NYSE:XOM), Dominion Energy (NYSE:D), and NextEra Energy (NYSE:NEE), offer distinct investment profiles.

Exxon Mobil: Traditional Energy Giant with Strategic Expansion

Exxon Mobil, the behemoth of the oil and gas industry, currently trades around $112 per share. Its one-year return drop of 5% reflects the challenges, despite continued demand for traditional energy sources and the company’s strategic positioning within the market.

With a market capitalization of around $430 billion, Exxon Mobil’s sheer size provides stability, and its dividend yield of approximately 3.2% makes it attractive to income-seeking investors. The company’s P/E ratio, hovering around 12x, suggests a reasonable valuation relative to its earnings. In 2024, Exxon Mobil generated roughly $350 billion in revenue, underscoring its dominant market presence.

A significant event influencing Exxon Mobil’s trajectory is the acquisition of Pioneer Natural Resources in October 2023. This $59.5 billion deal significantly expanded Exxon’s presence in the Permian Basin, solidifying its commitment to fossil fuels even amidst the growing push for renewable energy. However, Exxon Mobil faces potential headwinds from proposed cuts to clean energy funding by the U.S. Department of Energy. These cuts, potentially totaling nearly $10 billion, could jeopardize Exxon Mobil’s involvement in high-profile collaborations related to hydrogen and carbon capture technologies.

Despite this, analysts remain cautiously optimistic, with a median price target near $118 and Piper Sandler reiterating an “Overweight” rating.

Dominion Energy: Stable Utility with Growth Initiatives

Dominion Energy, a major regulated utility focused on electric and natural gas distribution, presents a contrasting picture. Its current stock price is around $57.17 per share, with a one-year return of approximately 10%. This underperformance reflects challenges from regulatory hurdles and strategic asset sales.

Despite these headwinds, Dominion Energy boasts a substantial dividend yield of approximately 5.6%, making it a compelling option for income-focused investors. The company’s market capitalization stands at approximately $42 billion, and its P/E ratio is around 15x. In 2024, Dominion Energy generated roughly $13.5 billion in revenue.

A significant recent development is Dominion Energy’s collaboration with Amazon to explore the advancement of Small Modular Reactor (SMR) nuclear development in Virginia. This partnership aims to address the growing electricity demand, especially from data centers, a key area of focus for Dominion. The company has connected approximately 450 data centers and is enhancing its infrastructure to meet the growing demand from this segment. This strategic focus on data centers positions Dominion to benefit from the expanding market.

While the stock has faced recent pressures, analysts maintain a median price target near $52, suggesting a potential rebound based on its stable utility earnings and future growth initiatives.

NextEra Energy: Clean Energy Leader with Premium Valuation

NextEra Energy, the largest U.S. utility by market capitalization and a global leader in renewable energy, trades around $75 per share. Its one-year return of approximately +5% reflects its strong growth in wind and solar assets.

With a market capitalization of around $150 billion, NextEra Energy commands a premium valuation, reflected in its higher P/E ratio of approximately 27x. The company’s dividend yield is around 3%, with the firm generated roughly $28 billion in revenue through the last year.

Analysts remain optimistic, with a median price target near $80.

YOUR CAPITAL IS AT RISK

Comparative Analysis

The three companies offer distinct investment profiles:

Exxon Mobil provides exposure to oil prices and cyclicality, with a strong record of returning capital to shareholders. However, it faces increasing pressure to transition to cleaner energy sources.

Dominion Energy offers stable utility earnings and a high dividend yield but has faced headwinds from regulatory challenges and strategic asset sales.

NextEra Energy is a preferred choice for those seeking exposure to clean energy growth trends, albeit at a higher valuation.

The potential cuts to clean energy funding represent a headwind for all three companies, but particularly for NextEra Energy, which has heavily invested in renewable energy projects. Conversely, Exxon Mobil’s acquisition of Pioneer Natural Resources reinforces its commitment to fossil fuels, potentially insulating it from the immediate impact of these cuts but also exposing it to long-term risks associated with the transition to cleaner energy.

Dominion Energy’s collaboration with Amazon on SMRs represents a strategic move to diversify its energy portfolio and capitalize on the growing demand for electricity from data centers. This initiative could provide a significant growth opportunity for the company in the coming years.

Ultimately, the best investment choice depends on individual risk tolerance and investment goals. Investors seeking stability and income may find Dominion Energy attractive, while those seeking growth potential and exposure to clean energy may prefer NextEra Energy. Exxon Mobil offers a balance of stability and exposure to the traditional energy market, but investors should be aware of the long-term risks associated with fossil fuels. Careful consideration of these factors, along with ongoing monitoring of industry developments, is crucial for making informed investment decisions in the dynamic energy sector. The analyst optimism for NextEra and Exxon also suggest possible upsides to the stocks.

Things to Know About Energy Shares

New Opportunities

Not too many years ago, picking the best energy stock involved filtering a relatively small pool of long-established oil and gas multinational firms such as BP, ExxonMobil, Chevron, and Royal Dutch. The switch to low-carbon energy use has resulted in stock picking metrics needing to change. One requirement is to be able to evaluate the capability of the big players toward the new way of doing things. There are also new, smaller energy firms focused on renewables to consider.

Growth Stocks or Defensives?

The change in the profile of the firms making up the energy sector means picking a top energy stock doesn’t, by default, mean you’re buying a relatively secure firm that pays an impressive dividend. Some still do, but the sector now contains exciting growth stocks as well.

The Role of Governments

The shift to greener energy is being driven and, to a large extent, financed by public spending. While the commitment towards achieving a carbon-free economy is nailed on, some of the funding can be expected to be tapered back as and when green energy firms become self-financing.

Commodity Markets

Buying into energy stocks allows exposure to two asset classes, equities and commodities. The price of your stock position will be determined by the market mood towards stocks and the price of oil, gas, and coal, which trade on commodity exchanges. These two price drivers can work in the same direction or against each other.

Energy Stocks are Easy to Buy

The critical role energy firms play in the global economy means good broker platforms offer markets in the companies. Opening and funding an account with an online broker takes moments and buying energy stocks requires little more than entering the number of shares you want to purchase and clicking ‘Confirm Order.

From that point on, your energy stock position will fluctuate in value according to live market prices until the time comes to reverse the process, sell your position, and crystalise your profit or loss. One crucial check to make is to ensure your broker is legit. Head to this list of trusted brokers to find a shortlist of firms that the AskTraders team has reviewed to ensure they are reliable, offer competitive T&Cs and provide the support needed to help you make the best of your trading decisions.

Practise Using a Demo Account First

Setting up a Demo account takes moments and often requires providing little more than an email address. Using one will allow you to test-drive the platforms of different brokers to find a good fit for your style of trading. The funds provided are virtual, which means practising buying and selling shares is risk-free and an opportunity to learn valuable lessons before upgrading to a live account.

Final Thoughts

Recent price moves in energy stocks point towards a growing upward momentum. Bull markets can run for years and offer the opportunity to make significant returns and picking the best long-term energy stocks can optimise your returns. Navigate to one of these trusted brokers to ensure you get off to the best possible start and benefit from the peace of mind that comes from knowing you’re set up with a good broker.