When investors talk about their biggest winners or even life-changing returns, they are often talking about positions they took in growth stocks. Buying into firms that have an opportunity to significantly upgrade their business models can generate significant returns.

YOUR CAPITAL IS AT RISK

Getting the timing right is obviously crucial – as they are high beta, growth stocks can also post large losses. However, with some careful planning and a considered stock selection, buying the best growth stocks in the market now could help you post those staggering returns that the stock market is known for.

Using technical and fundamental analysis, we’ll establish which are the best growth stocks to buy now and the factors to consider to make your strategy work as well as it can.

Table of contents

- What Are Growth Stocks?

- The Best Growth Stocks to Buy Now

- Perion Network Ltd (NASDAQ:PERI)

- Glencore PLC (LSE:GLEN)

- MercadoLibre (NASDAQ:MELI)

- Lloyds Banking Group PLC (LSE:LLOY)

- Tesla Motors Inc (NASDAQ:TSLA)

- Why Invest in Growth Stocks Now?

- How to Find and Research Growth Stocks

- What to Know Before Investing in Growth Stocks

- Final Thoughts

What Are Growth Stocks?

Growth stocks are companies that are experiencing or are predicted to experience higher-than-average increases in their share prices, revenue, profits or cash flow. This outperformance may be measured against their direct peer group, or the stock market as a whole.

The growth element often involves a catalyst, which could include new products, disruptive technology, a new management team, or a macro-level change in the underlying economy.

As classical equity valuation models base share prices today on revenues in the future, a relatively small uptick in forecast future income can lead to a proportionately larger increase to a share price now. As a result, growth stock investing is very much about capital appreciation, a share price rising over time.

Common metrics used when analysing growth stocks include profit margins, sales growth and P/E ratios. If a company has already been tipped as being a growth stock, then it is likely that it will already look ‘expensive’ and have a high P/E ratio, and investors are then faced with the challenge of establishing whether the good news is already priced in.

Another feature of dynamic companies with a competitive edge is that they tend to retain any profits and reinvest them in their business operations. This distinguishes growth stocks from dividend stocks, which do generate an income stream for investors, often because they don’t have exciting new projects in the pipeline.

A well-diversified portfolio has space for both dividend and growth stocks. In fact, the two can balance out returns and make it easier to hold onto positions during times of market uncertainty. The main question, of course, relates to stock selection.

The Best Growth Stocks to Buy Now

The growth stock sector includes firms with a wide variety of profiles. There are small-cap stocks as well as market giants. The thing they all have in common is that they have the potential to gain a competitive advantage over their peer group.

With the above in mind, the below growth stocks all have compelling reasons for you to buy them now:

- Perion Network Ltd (NASDAQ:PERI)

- Glencore PLC (LSE:GLEN)

- MercadoLibre (NASDAQ:MELI)

- Lloyds Banking Group PLC (LSE:LLOY)

- Tesla Motors Inc (NASDAQ:TSLA)

Perion Network Ltd (NASDAQ:PERI)

Tech firm Perion is the type of stock that many investors think of when they consider growth stocks. It’s relatively small, with a market cap of $1.16bn, and possesses a range of impressive tech products that are in considerable demand.

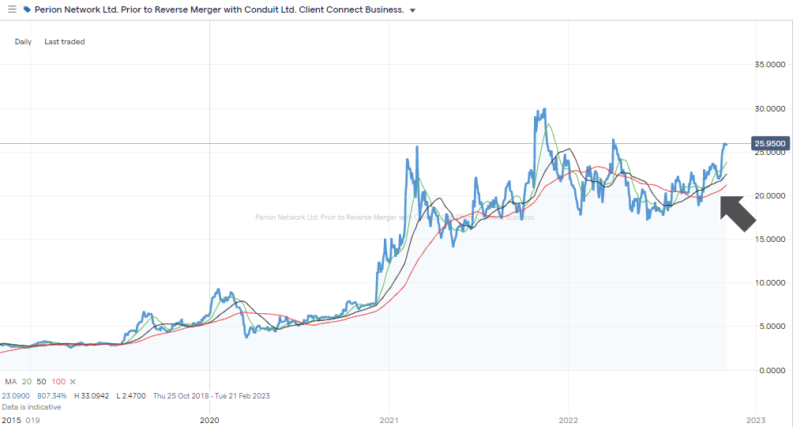

The company uses an ‘intelligent hub’ to connect publishers and advertisers in the online retail space. That finessing of the approach to e-commerce was much in demand during the COVID-19 lockdowns, and while the subsequent price fall reflects a return to normality, the PERI stock price has held up better than some other growth stocks. This doesn’t mean that it’s expensive, and the current P/E ratio of 15.21 is relatively low when compared to the average for the NASDAQ 100 index (24.86).

The firm is positioned for a new burst of upward price movement. Perion’s products are of a high enough standard to have resulted in it securing deals with firms such as Microsoft, where Perion software is being used to upgrade the Bing search engine.

With the price trading above the 20, 50 and 100 SMAs on the Daily Price Chart, the technical analysis metrics are also in line and forming a bullish pattern.

Glencore PLC (LSE:GLEN)

Growth stocks don’t always have to be small or tech-savvy to outperform the rest of the market. Sometimes, an external catalyst or shift in macro fundamentals can be enough. Glencore PLC is a well-run business with a long track record that looks set to benefit from a steep increase in global commodity prices.

The firm is one of the largest global diversified natural resource companies in the world and produces or trades in 90 different commodities. As it typically takes more than 10 years to bring a new copper mine into production, any spike in demand from industrial customers can’t be met very easily. This results in short-term commodity prices being driven higher, and the value of the assets of firms such as Glencore skyrocketing.

Commodity price inflation is already underway, with many suggesting that this trend could last long enough to take us into a commodity super-cycle. It has been triggered by a return to normal economic activity after the COVID-19 years, and another reason to buy Glencore stock relates to the shift to a lower carbon economy. The rollout of a new global infrastructure network will result in more demand for the raw materials that Glencore produces.

The GLEN share price chart shows that consistent buying pressure took the price of the stock from 115.24p in 2020 to 511.2p in November 2022. With few reasons to think that economic fundamentals will alter, it looks like a trend to back by buying any dips in price.

MercadoLibre (NASDAQ:MELI)

E-commerce giant MercadoLibre makes our list of the best growth stocks to buy due to it having a three-year sales growth CAGR (compound annual growth rate) of 63%. This forecast stems from its strong position in developing Latin American markets, where it operates a business model similar to Amazon.

The firm’s digital payment platform Mercado Pago is causing much excitement among investors. It represents a move out of the core e-commerce sector, but one that complements its bread-and-butter operations.

Originally developed to support in-house transactions, there is significant potential for MercadoLibre to leverage its brand recognition and trigger significant growth in its Pago product. The payment system has functionality that is similar to PayPal and now supports off-platform transactions, including retail and person-to-person money transfers.

Some of the growth prospects are already priced into the MELI stock price. With an eye-watering P/E ratio of 174.07, investors would do well to implement a pullback strategy in an effort to buy in at a lower price.

Lloyds Banking Group PLC (LSE:LLOY)

London-listed banker Lloyds Banking Group is trading in the middle of a 10-year-plus price channel, but a shift in economic fundamentals could be about to change that.

Before entering the price channel of 23.44p to 87.75p in 2008, the LLOY share price was trading above 300p. The immediate trigger for the share price collapse was the global financial crisis, but it was subsequent events that kept the share price suppressed.

Banks have struggled in the low interest rate environment that followed the events of 2009. Since that year, US base interest rates have been set below 1% for more than 50% of the time. That’s a tough environment for banks to operate in as their returns are dependent on the spread between savings and loans rates and those spreads get squeezed when interest rates are low.

The US Federal Reserve’s sustained program of interest rate rises in 2022 has resulted in a paradigm shift. This opens the door to Lloyds’ share price continuing its upward momentum and outperforming the rest of the market, especially as a lot of stocks struggle during periods of higher interest rates.

Tesla Motors Inc (NASDAQ:TSLA)

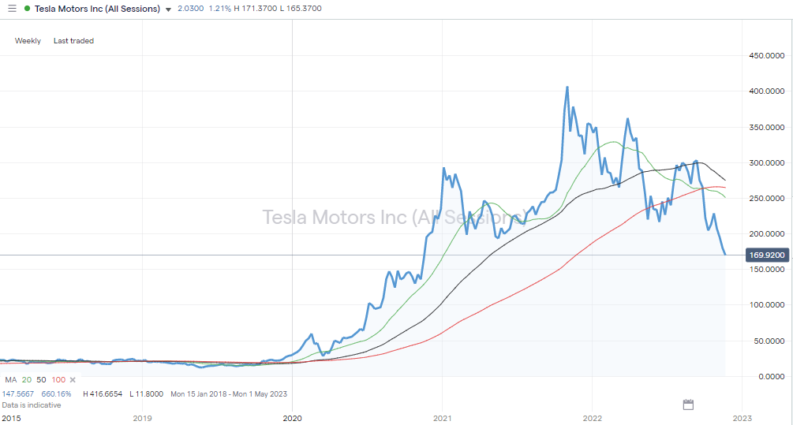

Any list of the best growth stocks to buy has for a long time included the name Tesla. The EV manufacturer has brand recognition that is off the charts and first-mover advantage in one of the most rapidly expanding markets in the world.

Tesla also forms an interesting case study for those looking to get a better understanding of the life cycle of growth stocks. Tesla’s P/E ratio peaked in December 2020 when it reached a staggering 1,396.80.

Any investor considering buying TSLA stock at that time would have been taking a major bet on the miraculous growth projections continuing – and they would have still made a capital return. The stock price rocketed from $234.95 to $353.33 in the space of 12 months.

Tesla’s P/E ratio has since dropped back to 55.67. This is not only more in line with the rest of the market, but also some way below the 13-year median of 335.31. With a three-year sales growth CAGR of 40%, the stock looks set to continue its upward trajectory once the market-wide shift away from risk reverses.

Why Invest in Growth Stocks Now?

Growth stocks are particularly sensitive to market shakedowns. Moments when the financial markets move away from risk can leave growth stock firms exposed to the risk of the financing they require drying up, and other challenges arising for the new projects they are trying to get off the ground.

The loss of appetite for growth stocks in 2022 largely stemmed from the threat of inflation, which is considered likely to erode the future value of expected earnings. If inflation is brought back in line with long-term averages, then it’s easy to imagine current stock prices to be ideal opportunities to have bought a dip.

It’s also likely that the COVID-based supply-side constraints will ease and this will open up opportunities for growth stock companies. They are the sector of the financial markets where the management team haven’t yet run out of ideas. And for long-term investors, this can result in significant returns.

How to Find and Research Growth Stocks

Growth stocks have over the years generated life-changing returns for some investors, so unsurprisingly there is a lot of interest in the sector. Identifying the next big thing does require some work to be done upfront, but analysing the market can pay off. It’s also easy to find free research and analysis on firms, and if you have intimate knowledge of a product or firm, then that shouldn’t be underrated.

The features that growth stock investors look for in a firm include the following.

SCALABILITY

The greater ability of firms to benefit from scalability, the greater the chance that their share price will outperform the market. Identifying new markets is only part of the process for a growth stock firm. Ideally, each unit of additional revenue should be associated with a marginally smaller increase in costs.

Tech firms such as Perion Network that develop a great new product and attract more customers have a cost base that doesn’t increase at the same pace as the revenue that the new customers bring in. This is great for the firm’s bottom line and the Perion share price.

BARRIERS TO ENTRY

Being able to fend off new entrants also helps to protect profit margins and maximise returns. Examples of barriers to entry include Tesla’s intense brand loyalty, which has taken years to develop and works effectively against challengers trying to eat into its market share.

Other barriers to entry include technical copyrights and patents such as those held by pharmaceutical firms.

CATALYSTS

The financial markets are full of traders holding ‘good’ positions they believe in, but who are not making any money. Catalysts are needed and can take many forms, including a change of opinion on the sector (Lloyds Banking Group) or external factors making a product more attractive (Glencore). Identifying and reacting to catalysts is an essential part of growth stock investing.

LONG-TERM ECONOMIC PROSPECTS

If you’re bullish about long-term economic prospects, such as continued economic development in Africa and the gentrification of China’s middle classes, then growth stocks are a way to tap into those stories.

THE EASE OF BUY-AND-HOLD

It’s also possible to use growth stocks as a relative hands-off way to gain exposure to the financial markets. Once the required research has been carried out, and the right broker is chosen, the next step can be to be patient.

Keeping up with events using news alerts systems offered by brokers is an option, but a small-scale investment in a diversified portfolio of growth stocks shouldn’t get in the way of your day job.

A GOOD TIME TO ROTATE EXPOSURE TO DIFFERENT SECTORS

The high-beta element of growth stocks explains how they fall in price by a greater extent than the general market offers a chance to rotate into them during times of market weakness. If your portfolio has been overweight defensive stocks during the stock market rout of 2022, then it probably held up relatively well in the sell-off.

Rotating into growth stocks at the bottom of the market would lock in that relative outperformance, and if markets rebound, then growth stocks would be expected to outperform defensives on the way back up: win-win.

What to Know Before Investing in Growth Stocks

It’s possible to make substantial profits from growth stocks, but there are risks. The sector also has some distinguishing characteristics that investors need to be aware of.

THE WORKLOAD IS FRONT-LOADED

It pays to invest time in the early part of the process. This involves carrying out due diligence on the target firms and the broker you propose to use.

The GameStop trade that inspired the meme stock craze came down to one man’s intensive research of one firm. It’s not necessary to invest quite as much time as Keith Gill did in researching GameStop, but this article explains the many processes he went through to find the right stock to buy and post a 1,550% gain.

NO DIVIDENDS?

Growth stock firms might not pay dividends, so investors must factor in that they will potentially be sacrificing near-term income streams in the hope of making long-term capital gains.

BUY GROWTH STOCKS OUTRIGHT

One important point to keep in mind is that your selected broker might offer both CFD trading and a share dealing service, which means that care must be taken to book trades in the right type of instrument. CFDs have many advantages over stocks, including the option to use leverage or sell short. They also avoid stamp duty (SDRT), but one downside is that they incur daily financing costs. These can rack up if you hold a position for any length of time, and most investors looking to hold a position for more than a few weeks opt to buy them outright in share format rather than as a CFD.

IN IT FOR THE LONG-HAUL

Holding periods of growth stocks are typically medium to long term in nature as the strategy coming good relies on new growth markets being exploited as planned. Growth stocks may also be loss-making in the short-term and reliant on borrowing from banks willing to back ‘the next big thing’.

PARADIGM SHIFT

Things change, particularly if a stock is expected to come good over years rather than weeks. What looks like a great stock now might not be one in five years, as exemplified by Blockbuster, Polaroid, Borders and Compaq, which were all once stock market sweethearts, and all eventually filed for bankruptcy.

This risk can’t be avoided, but it can be mitigated by investing in a basket of names in the hope that returns from the winners are greater than the losses from the losers.

Final Thoughts

Whether you’re just starting trading or have been investing in the markets for some time, these brokers are an ideal way to gain exposure to the growth stock sector. They have been operating for many years and the platforms offer a combination of user-friendly functionality and powerful behind-the-scenes software tools. In addition, the list only includes trusted brokers that are fully regulated, so they offer a safe route into the markets.

Fierce competition between brokers has driven costs down and improved service levels. Some brokers specialise in offering high-grade research, while others have 24/7 customer support. Trying some out in Demo account form can help you find the best fit and get your trading off to the best possible start.

Past performance is not a guide to future returns, but the eye-watering returns from some names in the growth stock sector mean that it remains a popular market for investors. If things turn out as planned, then you’ll have found a low-maintenance way of making market-beating returns.

As with all trading, timing is everything, and the higher-than-average price volatility seen in the markets in 2022 makes now the time to consider getting involved.