- The June month-end is approaching and is causing some analysts to predict a correction in equity prices.

- The prediction is based on historical data showing larger investors rotating out of equities into bonds and a suggestion that this time the move could be large.

- Analysis shows that large-cap tech stocks could be about to offer an opportunity to buy the dips

The equity bull run continues unabated, the Nasdaq composite equity index keeps posting record highs, and the tech-heavy index rose for the eighth straight session on Tuesday. At the close, the latter was up 0.7% on the day and an eye-watering 32% since April. The S&P 500 index is up 3.3% for June and 21% for the quarter so far.

Analysts at JP Morgan released a note stating:

“We continue to believe that we are in a strong bull market in equities and any dip would represent a buying opportunity”.

Source: The Market Ear

The same note also offered a word of caution. An unavoidable risk factor, one as inevitable as day turning into night is arriving as the markets approach the end of June.

“The equity rally has likely created a need for negative rebalancing flow, i.e. equity selling, of around $170bn on our estimates into the current month/quarter-end. While we acknowledge the risk of a small correction in equity markets over the coming two weeks as a result of this negative equity rebalancing flow”.

Source: The Market Ear

Quarter-end

The quarter-end reporting, which takes place within the next couple of weeks, will require the money managers to take a snapshot of their portfolios and to share that information with their big investors. As the really big money is in pension funds, there will not only have to be some kind of return (which keeps everyone in a job) but also a demonstration that risk management and long-term investment mandates are being met.

It's not just about the bottom line. Excessive returns can raise concerns for funds with a longer-term view. There will have to be some kind of balance to the portfolios which are due to be analysed in the first week of July.

The inevitability of the situation has led to the market rumour mill firing up – the topic in question, a rotation out of equities and into bonds. Dan Deming, managing director at KKM Financial, was speaking with CNBC when he said:

“There's a very high probability of window dressing and readjustment of positions.”

Source: CNBC

The bigger question is the scale of any potential move.

“We estimate that US corporate pensions will move about $35 billion into fixed income,” said Michael Schumacher, director of rates strategy at Wells Fargo.

Source: CNBC

JP Morgan put a higher number on US rebalancing. They estimate there will be a $65bn rebalancing flow from US defined benefit pension funds. Their global forecast being $170bn.

Goldman Sachs reportedly identified $76 billion in US pension selling of stocks.

The wide range in the forecast numbers, from $35bn to $76bn, highlights the degree of uncertainty. In terms of stock prices, this will translate as increased short-term volatility. It also opens the door to the forecasts being wrong and the sell-off in equities not materialising. The Wells Fargo forecast appears to be factoring in the possibility of a surprise to the downside. Michael Schumacher said:

“There's been more bizarre behaviour in 2020 than in the last 10 years combined.”

Source: CNBC

That being said, the forecast by Schumacher and his team would still form the most significant flow in the six years he has been tracking portfolio rebalancing.

How to trade the quarter-end

The first option for retail investors is to mimic the big guys by scaling out of risk. Combined with this is the possibility of taking a naked short on the index, and this could well have already started to happen.

The Commodity Futures Trading Commission (CFTC) that regulates the US derivatives markets has reported that as of June the 19th there was a net short position of 303,000 futures contracts for the S&P E-minis held by the non-commercial traders. The category ‘non-commercial' being a term used to refer to speculators. Their categorisation may have maverick connotations, but their bets on the market are worth noting. In early March, the same investors held a net positive position, at a high of about 55,000 contracts and caught the bottom of the market. In September 2007 that same group took a record number of short positions ahead of the market peak in October.

The debate will continue as to whether speculative stock futures investors are a contrarian call. Investors who are showing gains on long positions may be tempted to scale back on risk and crystallise at least some of their profits.

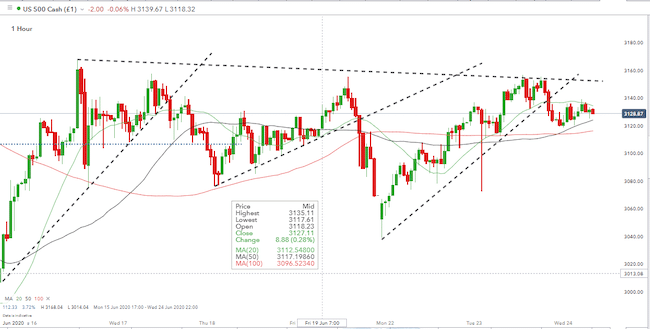

A short S&P 500 trading idea from Helping Hand was posted on January the 18th and would have offered profits. The break of the supporting trend line coming about as markets sold off as the weekend approached. There was a recovery through the first half of this week followed again, by another line break. Helping Hands own note poses the question many are asking:

“We have been going sideways for most of the week so can we finally break down?”

Source: Trading View

S&P 500 index – 1H candles – 15th – 24th June 2020

Short positions will be looking for support from the CBOE VIX index. That has yet to materialise.

Currently trading at a level above 30 means the VIX, or ‘fear index' is pricing in some uncertainty. The sub-20 prices of the first months of 2020 will now feel a distant memory to most. But there is certainly room for the VIX to tick up.

Trading volumes are also, as yet, failing to pick up.

Fundamentals rather than technical factors, drive the rotation from equities to bonds. Those who have taken short positions in the S&P index may well be factoring in that this is the quiet before the storm. Others that a second wave may be waiting for momentum to build before joining any ride down.

S&P 500 index – 1H candles – 15th – 24th June 2020

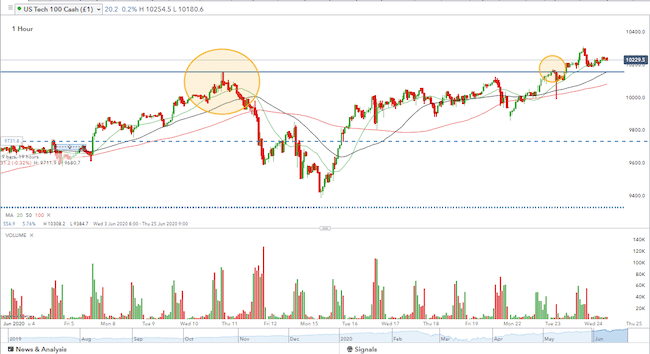

Watch the Nasdaq

A lot of attention will be on the Nasdaq. The tech-rally has been based on highly plausible arguments that everything has changed. The June the 10th all-time-high at 10161 proved a stiff resistance to price on the way up and may offer support of any correction.

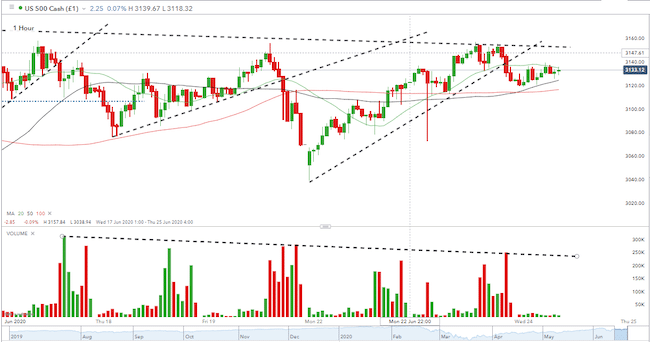

S&P 500 index – 1H candles – 15th – 24th June 2020

Below that the next support levels are the big number 10,000 level and February high of 9713.

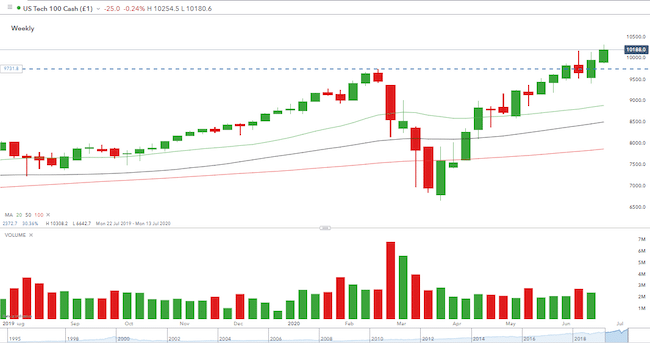

S&P 500 index – 1W candles – July 2019 – June the 24th 2020

The Nasdaq led the rally, so any correction is also likely to be led by it.

The Nasdaq index is on track for its best quarter since the end of 1999. Investors who were caught out by the dot-com bubble of that time will remember how back then there was also a case for tech-stocks valuations being based on a paradigm shift in the economy. They might also remember that after that tech-crash the Nasdaq didn't revisit its March 2020 highs for 14 years. Even small market sell-offs can gain momentum, so what is JP Morgan's short-term concern and why are they sharing it now?

Buy the dips

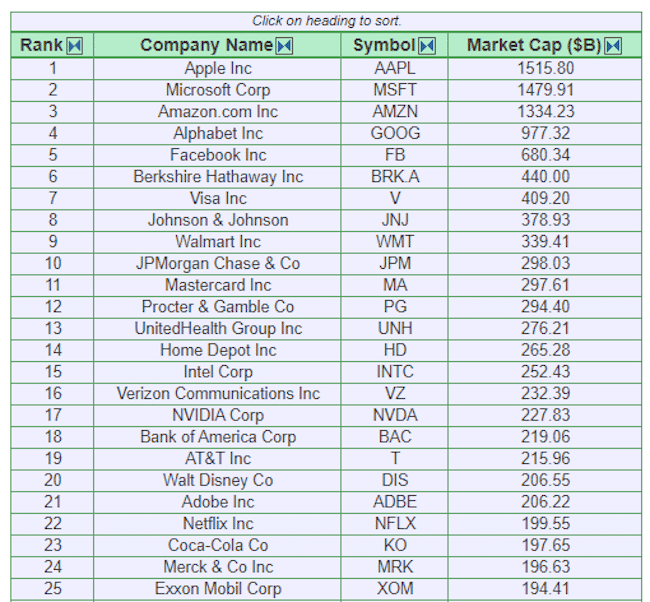

Schumacher has said that pension outflows should be highest in US large-cap stocks, followed by small caps and international stocks. Anyone buying the dips will be pleased to see that the top-25 US stocks by market cap include some of 2020's favourite names. Amazon, Netflix and Johnson & Johnson being just three names that show the capacity for entry points into e-commerce, home-streaming and health care. The changing landscape for work, school, health care, communications, and entertainment, is a long-term trend. Some will be using short-term noise as a chance to buy in.

Scaling into positions could be aided by targeting the support levels in the Nasdaq index as buying points.

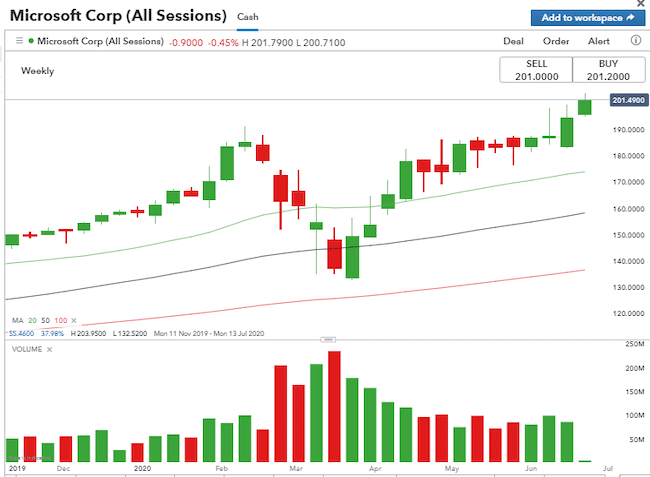

Microsoft (Nasdaq:MSFT)

The Microsoft share price has shown great strength throughout the novel coronavirus pandemic. One of the low-profile but significant developments has been the growth in cloud computing, an area where Microsoft is particularly strong. Back in April, when announcing that the firm had met earnings expectations revenue from its Azure cloud business was a stand-out feature – having grown 59% from the prior year's quarter. There appears little reason to suggest that the shift to the cloud won't continue and big players such as Microsoft have the brand recognition to imply the data will be held securely. That security of service still being a deep-seated driver for both individual and corporate users.

Microsoft – Weekly candles – Nov 2019 – June the 24th 2020

More user-facing products include Skype, the world's leading software packages, and now, Microsoft Teams. Microsoft Teams, a collaboration platform, continues to beat expectations. Teams now has 75 million users, the DAUB (Daily Active User Base) surged 70% quarter-over-quarter. The Microsoft share price is currently trading well above its weekly SMAs, and any pull-back which doesn't break those levels could signal a buying opportunity.

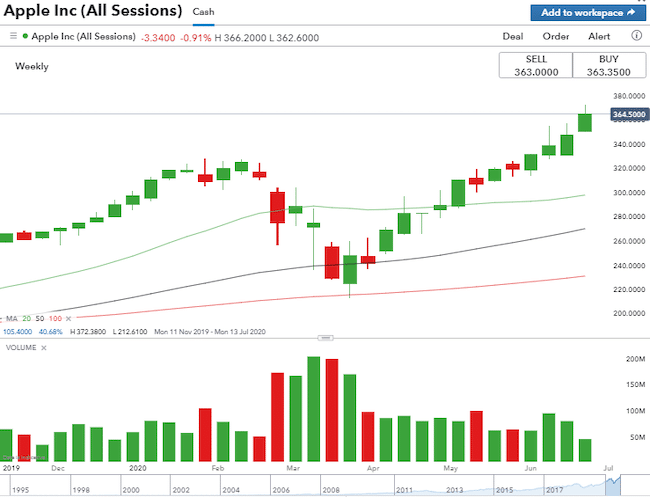

Apple (Nasdaq:AAPL)

The Apple share price surged partly due to the stampede into all tech-stocks but also as part of Wall Street's flight to quality. iPhone handset sales still make up a large part of the firm's business model. Some would say it is exposed to competition from rivals and consumer reluctance to upgrade. There is also a ‘green' argument against continually buying the next handset, and eco-issues are playing a more significant role in business decisions.

The rollout of 5G in 2020 will pick up speed as the peak Christmas buying period arrives. The desire to buy a new handset can, of course, be explained as a ‘need' if there are technical rather than aesthetic issues involved. Such mental gymnastics by consumers would do wonders for the Apple share price.

Apple – Weekly candles – Nov 2019 – June the 24th 2020

Hiccups in the production of the newest range of handsets appear to be ironed out, and the new iPhone 12 series should still debut in October, in time for the holiday shopping season. The line-up is expected to have both 4G and 5G handsets allowing Apple to capitalise on both markets.

Significantly, the decision by the firm to offer a budget handset appears well-timed. It was a particularly contentious issue due to the firm's position as a premium brand. Following the coronavirus pandemic, that decision now looks to be fully vindicated. The second-generation iPhone SE which went on sale on April the 15th retails at $399 so will allow the firm to keep hold of those in its consumer base who are suffering financially as a result of the pandemic.

The last earnings announcement was on April the 30th, and the firm's decision to not issue guidance due to the extreme nature of events could lead to extra volatility in the Apple share price as the next earnings date (August the 4th) approaches.

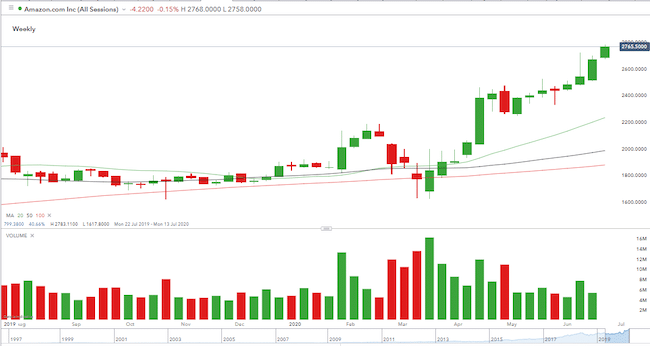

Amazon (Nasdaq:AMZN)

The Amazon share price has been one of the success stories of the first half of the year. Now the third-largest firm in the US by market cap, it keeps on posting all-time highs. Finding a way to time entry points is discussed here, and a shakeout due to June month-end could be the buying opportunity many have been waiting for. At Tuesday's close, the Amazon share price was $2,765 and Pulse2 reported this week that analysts are upgrading their price targets.

“Needham analyst Laura Martin published a report saying that Amazon should hit $3,200 in the short-term as part of a 12-month target.”

Source: Pulse2

Amazon – Weekly candles – Nov 2019 – June the 24th 2020

Trading volumes have been tapering off in all three stocks. A dip in the Microsoft, Apple or Amazon share price, accompanied with a spike in volume could signal that bigger investors are rotating out of the positions to meet their long-term requirements rather than to reflect their genuine take on the market. A chance for others to step in and buy the dips, then to wait for June month end to work its way through the system.