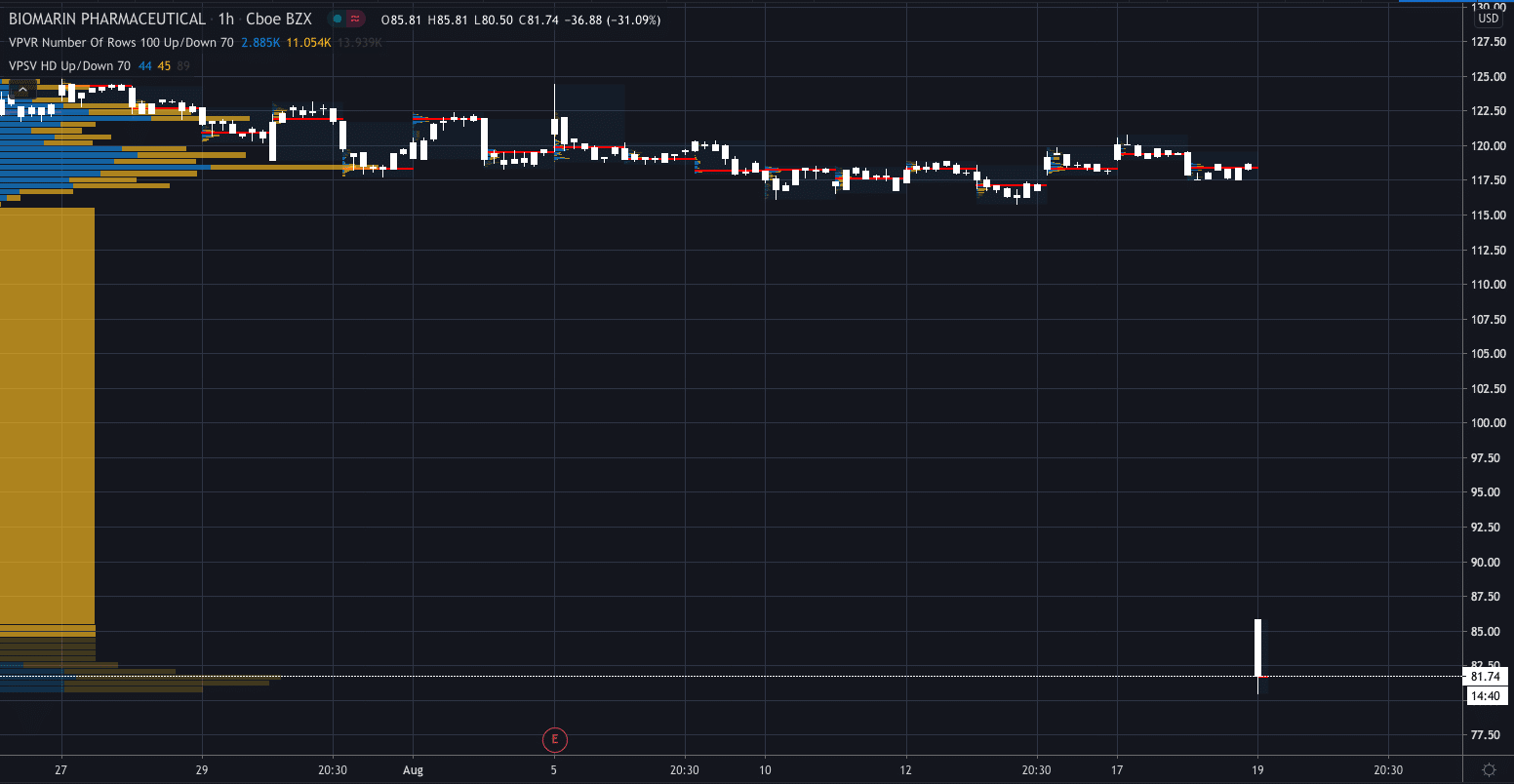

The US Food and Drug Administration (FDA) has sent a Complete Response Letter (CRL) to BioMarin Pharmaceutical Inc (NASDAQ:BMRN) sending its stock price plunging over 30%.

Its share price has fallen to $81.56, a drop of 31.20% since the news was released.

The FDA declined to approve BioMarin's gene therapy for hemophilia A, a bleeding disorder, stating that it is not ready in its current form and that they need two-year data on the treatment, according to the company.

It was expected that the drug would be approved after it had shown in trials to reduce the bleeding rate of patients which decreased the need for treatment.

BioMarin had previously agreed with the FDA on the extent of data needed, but the request was changed.

“We are surprised and disappointed that the FDA introduced new expectations for the first time in the Complete Response Letter. We are confident in valoctocogene roxaparvovec gene therapy and its potential to redefine the treatment paradigm for people with hemophilia A,” said Jean-Jacques Beinaime, Chairman and Chief Executive of BioMarin.

The company said the gene therapy could be priced in a range of $1 million to $3 million, although that was debated. However, it is one of several gene therapy treatments that could cost more than $1 million.

BioMarin said they remain committed to the treatment and plan to meet with the FDA in the coming weeks to work out the next steps towards approval…

“We remain committed to the hemophilia community and to leading the way to the first-ever gene therapy in hemophilia A,” said Bienaimé.