Shares of Morgan Sindall Group PLC (LON: MGNS) soared more than 11% in spite of pre-tax profits tumbling 62% to £13.6 million. amid the pandemic and lockdown measures.

The construction behemoth posted revenue of £1.4 billion for the first six months ending June. This is 4% lower compared to a year ago to record the worst financial results since 2015.

“These results reflect the inevitable impact on our business of the COVID-19 pandemic,” John Morgan, CEO of the company, said.

“The business is having to continually adapt in this changing environment and I am extremely thankful to all our employees for their professionalism and dedication as we adjust to new ways of working safely and productively,” Morgan added.

Morgan Sindall recorded a 17% surge in revenue for the first quarter before the national lockdown measures were introduced on March 23. It prompted the closure of its construction sites, slowing down sales and increasing costs.

Still, Morgan Sindall reinstated its full-year guidance with a profit between £50 million and £60 million expected. In 2019, the construction firm earned £88.6 million. At the end of June, net cash reserves increased to £146 million.

“Our proven strategy remains the same, based on organic growth and operational improvement.”

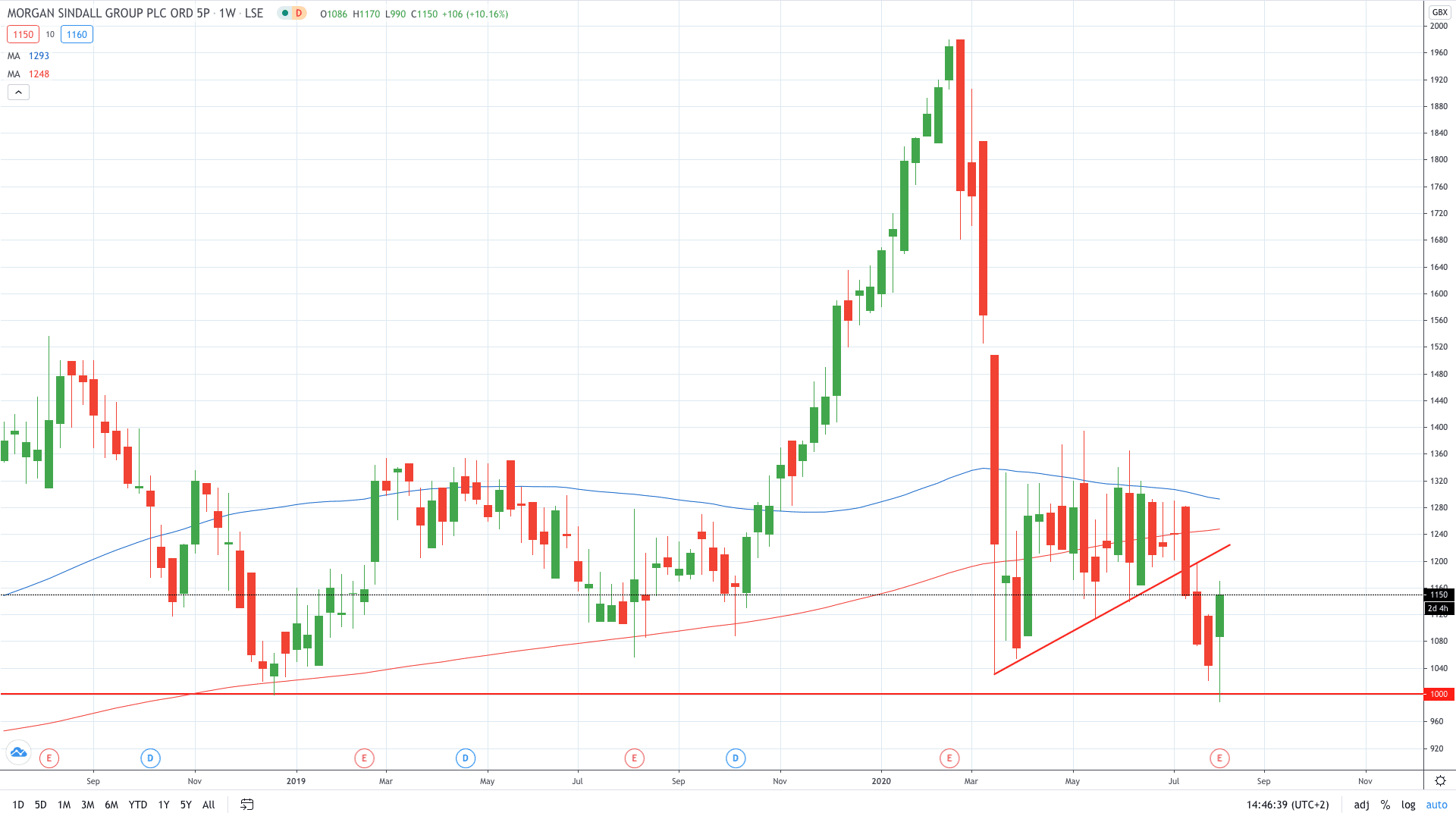

Morgan Sindall shares price jumped 12% as investors liked that the firm reinstated the full-year guidance. An improvement in the visibility signals an optimistic forecast for the rest of the year.

Earlier this week, Morgan Sindall stock price traded below 1000p for the first time since 2017.

- Trade stocks on this free demo account

- Learn stock trading strategies

- Learn from experts on risk management in trading